Flight to Quality Implication on Financial Markets Investing

Post on: 8 Июнь, 2015 No Comment

Aug 30, 2014

Few days ago, a friend of mine asked me if I would choose to invest in either treasury bills or bonds if I had $500,000 to invest in the financial markets. I paused for a moment and my response was that it depends. Ordinarily, I am a long-haul type of businessman; however, that strategy might not hold true if the prevailing economic conditions do not align with my investment strategy. That got me thinking. I decided to conduct a few research and found out the main factor that influence the choice of where to invest in the financial markets: Flight to quality. Further, it is also imperative to understand the nature of different financial markets before deciding where to put money. All these factors contribute to where investors put their money in a free market economy in order to earn returns on their investments.

Free market economy encourages property rights of different economic units. As a result, those economic units are motivated to make investments in real (productive) assets so as to garner wealth for themselves. Making investments in productive assets requires that financial instruments be used to lay claims on those assets. Therefore, the participation of savers (SSUs) and producers (DSUs) in the financial markets depends on their motivations for investments, the duration of their investments, and their tolerance for risk. Economic units are motivated either to make investments in capital projects or to adjust their liquidity positions; hence, the availability of different financial markets that cater to their needs. Financial markets are broadly divided into money markets and capital markets. The capital market is also further subdivided into bond markets and equity markets. The main difference between money markets and capital markets is that while money markets are wholesale markets where financial institutions and businesses adjust their liquidity by borrowing or lending for short periods of time, capital markets are where business firms obtain funds for long-term investment projects and where individuals finance the purchases of long-term assets.

The most important economic function of the money market is to provide an efficient means for economic units to conduct liquidity management when their cash expenditures and receipts are not perfectly synchronized (Kidwell, Blackwell, Whidbee, & Sias, 2012, p.237). Thus, money market instruments are financial instruments that are being used in the money markets for liquidity management by economic units. Money market instruments have low default risk, have low price risk due to their short term-to-maturity, have high liquidity due to their high marketability, and are sold in large denominations so that the cost of transaction is low. Money market instruments are of two types: discount instruments and add-on instruments. Discount instruments are money market instruments that are sold at a discount to par value and pay at par value at maturity. Examples include Treasury bills, short-term federal agency debt, commercial paper, and bankers acceptance. Add-on instruments are money market instruments that are sold at par value and pay par value plus interest at maturity. Examples include negotiable certificates of deposits, federal funds, and repurchase agreements.

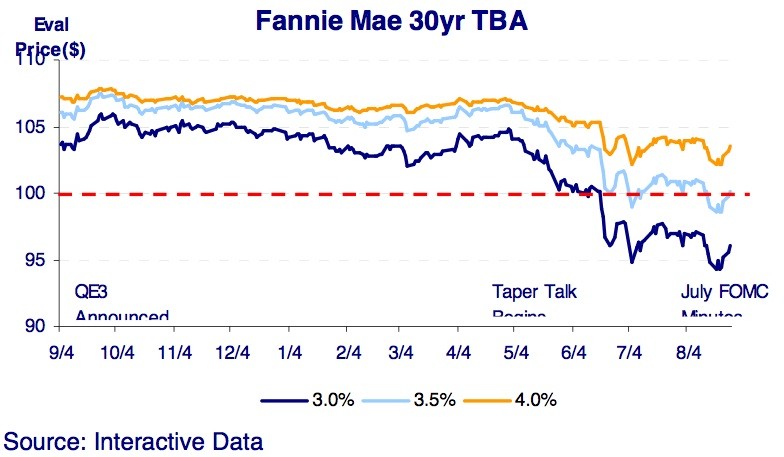

Bond market instruments are long-term financial instruments that are used mainly for capital investments. Bond market instruments usually have long-term maturity, high default risk, and low denominations which increase their transaction cost. However, unlike most money market instruments, bond market instruments pay coupon payments in addition to principal at maturity. Many economic units, essentially businesses, often issue bond debt for capital expenditures by matching their expected assets life with the maturity of the debt. The decision to issue bond is a function of many factors such as the philosophy of debt issuer towards capital structure, willingness to bear risk, and the receptivity of lenders to the securities being offered. Bond market instruments include Treasury notes and bonds, federal agency debt, municipal bonds, and corporate bonds. Municipal bonds can be distinguished from other types of bonds by the fact that coupon interest payments are exempt from U.S. federal income tax. As a result, high-income-tax-bracket investors find municipal bonds very attractive.

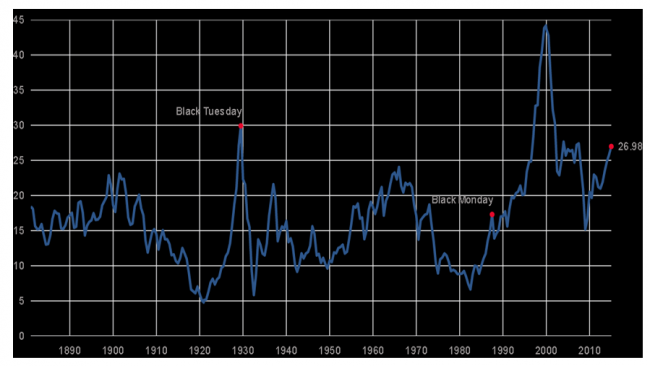

The prevalence of so many types of money market instruments and bonds gives investors ample opportunities to spread their risks and earn premiums, thereby boosting their confidence in the financial markets. Therefore, it is very important for investors to deploy a good portfolio adjustments strategy in order to avail themselves enough flight to quality options. However, any tactical portfolio adjustments that investors wish to take in response to changed market conditions take place in a market where the laws of supply and demand govern, and tactical response must be developed with that in mind (Marsh & Pfleiderer, 2013, p.56). In sum, there are myriad of options of financial securities to choose from whenever an investment decision is to be made. Investors should endeavor to take accounts of their costs and benefits before taking the plunge.