Fixed Income Best Bond Funds in 2014

Post on: 19 Июнь, 2015 No Comment

Investing in Bonds in a Rising Interest Rate Environment

You can opt-out at any time.

Now that the Federal Reserve has begun tapering its Quantitative Easing (QE) program, interest rates will continue to creep up in 2014 as they did in 2013. In translation, the Fed is gradually unwinding its stimulus as the economy moves from life support to stable condition. But bond prices move in the opposite direction as interest rates, which makes investing in bond mutual funds and ETFs a challenge, to say the least.

One way to invest in bond funds during rising interest rates is to use short-term bond funds. Generally speaking, bonds with longer maturities fall further in price than those with shorter maturities. So by using bond mutual funds with shorter average maturities, you can minimize the negative effect of falling prices. In this case, investors can consider a good short-term bond fund, such as PIMCO Low Duration D (PLDDX). PIMCO manager Bill Gross had a difficult time navigating the interest rate environment in 2013 but his portfolios may be ready to improve in 2014.

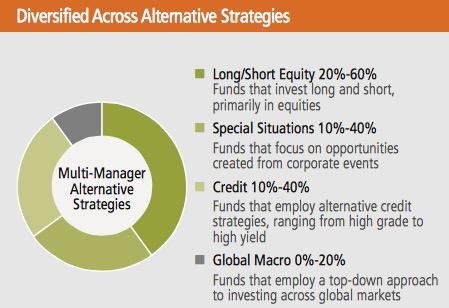

Another way to manage uncertainty in rising interest rate environments is to use a well-diversified and well-managed bond mutual fund. One such fund is Loomis Sayles Bond (LSBRX). Manager Dan Fuss. has been has 55 years of experience in the investment industry and has been with Loomis,Sayles & Company since 1976. Fixed income can be more complex and difficult to manage than stock portfolios. So a skilled and experienced manager is a must for bond fund investing.

If bond funds are expected to fall in value in 2014, as they did in 2013, wouldn’t it be wise to simply sell your bonds funds and shift the fixed income portion of your portfolio into cash? This is a challenging question but the answer is relatively simple if you are a long-term investor. If you look back to 2013, you can see that stocks had their best year in 15 years, whereas bonds had one of their worst. But isn’t this how diversification is supposed to work? One asset does extremely well and another asset performs somewhat poorly. That’s called a good balance, not a bad allocation! Also, if you are dollar-cost averaging into bond funds, you are buying shares as they fall in price. So when the prices begin to rise again, your average share price is lower and thus you benefit more when they bounce back.

By the way, LSBRX had a gain of 5.52% in 2013, whereas the bond market, as measured by the Barclay’s Aggregate Bond Index declined by -2.02%. Bottom line: If you want to minimize risk first and maximize returns second, which is a wise investment philosophy, you will not completely abandon your long-term outlook but simply remain diversified.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.