Five Myths About Asset Allocation

Post on: 6 Апрель, 2015 No Comment

In recent years there have been a lot of inflated claims made about the benefits of asset allocation. During the last bear market investors discovered just how inflated. Asset allocation (really just a fancy name for diversification) isn’t a panacea. It won’t protect you in a bear market, and there is no “optimal” asset allocation, no matter what the computer-model promoters say.

Nevertheless, setting a sensible asset allocation is, like controlling investment costs, a key part of smart long-term investing. Neither effort is going to insulate you from a market crash. But over time both disciplines improve your odds of achieving reasonable returns. So it’s time to separate the asset allocation myth from the reality.

Myth 1: Asset allocation protects you from the bear.

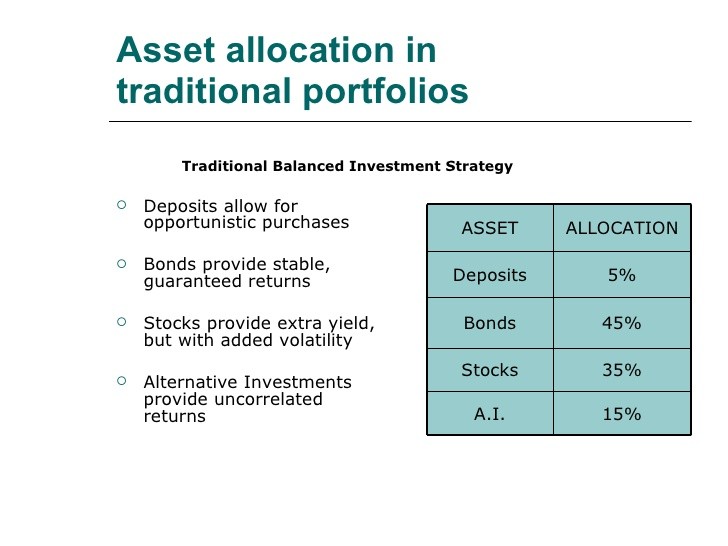

Asset allocation is all about identifying fundamentally different asset classes (stocks, bonds, real estate investment trusts), deciding how much of each you want to own and selecting investments that represent these asset classes for your portfolio. I prefer to represent asset classes with index funds and ETFs because they’re low cost, they are tax efficient and they track the asset classes closely. But you could make the same allocations with actively managed funds.

The goals of asset allocation should be twofold: to set a long-term risk and return expectation for your portfolio and to reduce the probability of a large loss along the way. It is no surprise that the more risk you decide to take, the higher return you might expect. But asset allocation is also sold as a way to diversify risk. The notion is that each asset class in a portfolio carries different risks, which helps reduce the total long-term risk in a portfolio and smoothes out short-term swings.

Here’s the key: Asset allocation reduces the probability of a large loss in a down market, but it doesn’t prevent a loss. In an economic downturn your portfolio will go down according to the amount of total risk you hold. There’s no getting around it.

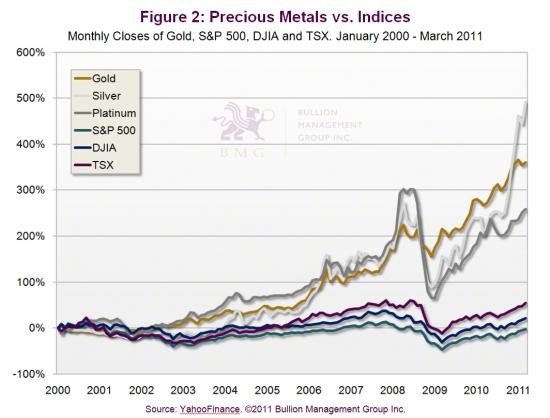

As for different assets carrying independent risks, that’s only true up to a point. These independent risks can be overwhelmed by a larger global economic risk that causes all risky investments to go down together. That’s what happened in 1987, 1994, 1998, 2001, 2008 and this year. The Greek debt crisis sent U.S. stocks, foreign stocks and corporate bonds all down together.

Wall Street, fixated on selling investment products, doesn’t do a good job of revealing this reality. Investors piled into commodities and hedge funds during 2007 and early 2008 because they were told that these investments weren’t correlated with stocks and would protect them in a bear market. But these risky assets fell right along with everything else in 2008 and early 2009, leaving some investors shocked. They shouldn’t have been.

Myth 2: Tactical allocation is best in volatile markets.

There are two different schools of asset allocation. The first follows a “strategic” approach calling for investments to be allocated according to your long-term needs and held at a fixed percentage regardless of market conditions. The portfolio is rebalanced annually to put the investments back at their strategic target mix. In contrast, the “tactical” asset allocation school shifts asset-class weights based on near-term predictions of returns. A tactical asset allocation may last from a few days to a few years.

Tactical asset allocation is the biggest con game on Wall Street. People want to believe that somewhere, somehow, someone can tell them where to put cash now, and they’ll pay good money for that advice. Billions are wasted every year on tactical allocation advice that doesn’t work. To be blunt, tactical allocation is just a form of market timing, which for average investors is a losing game.

Morningstar tracks investors’ tactical decisions by analyzing the flow of cash into and out of mutual fund classes. The table shows the difference in performance between mutual fund categories and investors’ weighted returns in those categories–accounting for when they moved in and out. Investor returns are consistently lower, reflecting the folly of tactical allocation decisions.

A strategic asset allocation is a smarter solution because there’s no loss from market guessing. Simply select fundamentally different investments for your portfolio, allocate using fixed targets and rebalance back to those targets every year regardless of what you or anyone else thinks. This method has delivered very respectable returns over the past decade.