Five banks fail Fed stress test The Deal Pipeline (SAMPLE CONTENT NEED AN ID )

Post on: 16 Март, 2015 No Comment

by Ronald Orol In Washington | Published March 27, 2014 at 8:17 AM

Five banks failed final Federal Reserve stress tests put in place after the 2008 financial crisis made it imperative that financial institutions hold enough in reserve to weather economic downturns.

Citigroup Inc. HSBC North America Holdings Inc. RBS Citizens Financial Group Inc. Santander Holdings USA Inc. and Zions Bancorp failed final Federal Reserve stress tests, based on results released Wednesday.

In addition to those, Bank of America Corp. and Goldman, Sachs & Co. had to submit less ambitious capital distribution proposals last week in order to pass.

The first four in the Fed list failed the tests, designed to assess whether a bank’s capital reserves are adequate to withstand another crisis like the credit crunch of 2008, because they had so-called qualitative deficiencies such as problems with their internal controls or issues with projections made by internal company-run exams.

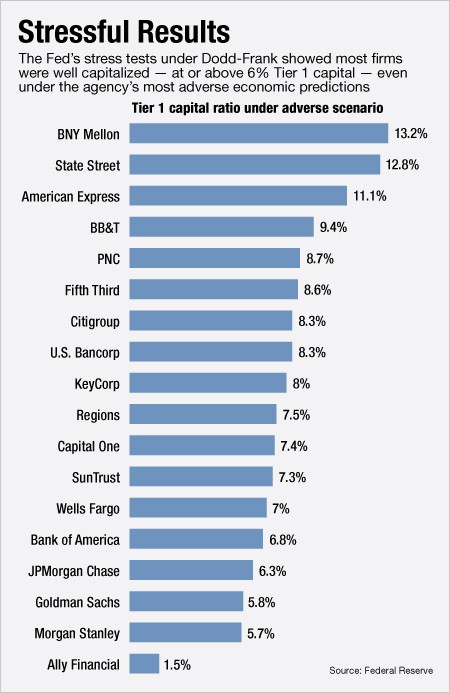

Meanwhile, Zions failed, as expected, on quantitative grounds because it had a Tier 1 common ratio of 4.4%, below a 5% minimum required by the Fed. The other 25 big banks that underwent the tests passed, but some came close to failing on quantitative grounds.

Bank of America and Goldman Sachs would have failed on quantitative grounds had they not resubmitted less ambitious capital distribution plans last week. Bank of America originally had a leverage ratio of 3.9%, below a 4% minimum. After resubmitting a less ambitious proposal it received a passing 4.1% ratio. Goldman Sachs ratio went up from a failing 3.9% to a 4.2% pass after resubmitting plans.

A Fed official noted that there were relatively small variances between the failing and passing levels, indicating that the banks likely did not have to resubmit significantly reduced distribution plans. Goldman CEO Lloyd Blankfein said Wednesday in a statement that the bank’s capital plan provides flexibility to manage its resources dynamically and return excess capital to our shareholders.

The banks and the Fed considered a hypothetical nine-quarter severely adverse economic scenario with an unemployment rate hitting roughly 11.25% in mid-2015 — the rate was 6.7% as of last month. The financial institutions were also evaluated as to how their capital buffers would withstand real GDP declining by almost 5% and equity indices falling by nearly 50%.

The results differ from initial stress test results released last week because, unlike last week, these tests take into account proposals each institution had submitted to the Fed for their dividend and stock buybacks over the next 12 months.

Other banks came close to being below the minimum threshold last week including Morgan Stanley, at 6.1%, Bank of America Corp. at 6% and JPMorgan Chase & Co. at 6.3%.

The banks that failed the test are not allowed to implement their requested plans to hike their capital distributions in the U.S. However. the three foreign banks that were rejected — HSBC, RBS Citizens and Santander — only are limited in what the U.S. unit of the bank can send to its parent.

Nevertheless, all five must resubmit their plans to the Fed following substantial remediation of the issues that led to the objections.

Yet Citigroup and Zions, at a minimum, could continue to distribute capital at the same level as they did last year. Citigroup, for example, can maintain its $1.2 billion common stock repurchase plan and its penny a share dividend from last year and regulatory observers expect it will be approved for a modest increase.

Citigroup said its rejected request was for a $6.4 billion common stock repurchase program through the first quarter of 2015 and an increase of its stock dividend to 5 cents.

Most banks will ultimately be permitted to increase their distribution plans from last year, a senior Fed official said. He added that the Fed’s expectations from the banks has been increasing annually since the central bank first began conducting the tests in 2009. That means banks needed to improve in areas identified in previous years as needing work as well as in new areas of emphasis, he added.

The Fed’s board voted 4 to 0 to approve the qualitative objections. However, one Fed governor, Sarah Bloom Raskin, abstained from the vote.

The Fed said that Citigroup has deficiencies in its ability to project revenue and losses under a stressful scenario for material parts of the firm’s global operations. The Fed also said Citigroup had deficiencies in its ability to develop scenarios for its internal stress testing that adequately reflect and stress its full range of business activities and exposures. Citi CEO Michael Corbat said in a statement that he was deeply disappointed by the Fed’s decision, adding that the bank will continue to work with the central bank to understand its concerns.

The Fed also rejected on qualitative grounds capital plans for three banks that were required to conduct the stress tests, known as the Comprehensive Capital Analysis and Review, for the first time: The U.S. units of HSBC, RBS Citizens and Santander. The Fed said it objected to the capital plans from HSBC and RBS Citizens because of inadequate governance and weak internal controls around their capital planning processes.

It seemed to have the biggest issues with Santander Holdings USA’s proposal. It objected to Santander’s capital plan due to widespread and significant deficiencies across the bank’s capital planning processes. The central bank included a laundry list of concerns including issues with the firm’s governance, internal controls, risk identification and risk management, as well as concerns about the firm’s management information systems, and assumptions and analysis that support its capital planning processes.

The stress test failure report wasn’t all bad news for the big banks. The Fed noted that the average Tier 1 common equity ratio for the 30 banks has more than doubled from 5.5% in the first quarter of 2009 to 11.6% in the fourth quarter of 2013 and, as a result, the Fed has approved significant increases in dividends and stock buybacks for most firms.

In February, Zions said it planned to resubmit its capital distribution plans to the Fed as a result of its sale of a portion of its collateralized debt obligation portfolio. Zions said that under the Fed’s severe adverse scenarios the CDO securities would have contributed disproportionately to hypothetical projected losses.

Bank of America announced Wednesday that it intends to increase its quarterly common stock dividend to $0.05 per share, beginning in the second quarter of 2014. It also has a new $4 billion common stock repurchase program.