Five Alternative Investments To Protect Your Wealth From Inflation

Post on: 11 Май, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

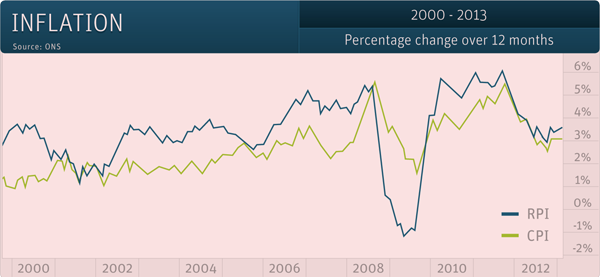

I have been writing about my expectations of high inflation in coming years as governments the world over gently renege their overwhelming debts by lowering the value of money.

To myself and many others, it seems inevitable that inflation will be used to rebase the economies of the developed world. It has happened before, and it will happen again.

However, there is no point in believing this only to leave much of your wealth in cash or other instruments vulnerable to inflation, such as bonds. Investing away from cash is crucial.

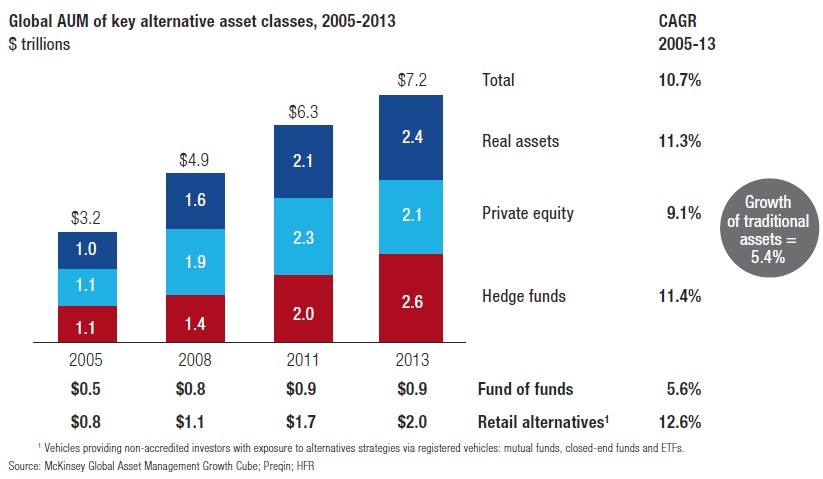

Equities are an option but so-called ‘alternative investments’ are a better way of achieving diversification. Alternative investments have a bad reputation however, and for good reason. Time and again companies offering alternative investments are nothing but fly-by-night fraudsters trying to skin the unwary.

However, good alternative investments do not need to be supplied by providers, they can simply be bought by conscientious investors.

The first on any list of alternative investments will always be gold, the ‘granddaddy’ of alternative investments. The key is to own it in coin. It is ideal for the small investor as they can buy gold in the form of small coins like the 10th ounce Canadian Maple. The small size gives liquidity and the ability for even a modest saver to put some away.

Gold is great in inflation and countries in inflation trouble will try and get their hands on it, so gold you can put in a sock is a great fall back rather than the ‘paper gold’ of ETFs like SPDR Gold Shares (GLD) or iShares Gold (IAU), futures, equities and certificates. Right now, Turkey is looking to grab its citizens’ gold in return for ‘gold certificates.’ It’s not only Turks that would be advised to keep a horde of small gold coins to protect themselves from the return of the 1,000,000 lira/dollar bill.

2. Numismatic coins

Collectible coins are already going off the dial around the world. Rich people like rare, high-value items they aren’t making more of. Collectible coins are one of those things. They are also very beautiful–the developing nations are rediscovering their histories and buying it back. As the numismatic advisor to a prestigious coin investment fund I’m in a ring-side seat watching the lid come off coin prices. Inflation is already driving this market, and in a way it always has.

Just like coins, collectible stamps boom in times of inflation. They are effectively a form of flight capital. A notebook could easily contain millions in the rarest stamp, something that the world’s rich very much like the idea of. Stamps have been inflation hedges for generations and after a lull when times were good and inflation was controlled, the market remained in the doldrums.