Finding Your Investment Sweet Spot Volatility Returns and the Efficient Frontier

Post on: 11 Май, 2015 No Comment

Finding your investment sweet spot involves consideration of multiple factors.

Investors need to carefully consider the effects of volatility when constructing the appropriate investment plan. In an investing context, historical volatility refers to variation of the price of a financial asset over time, which is commonly measured by standard deviation. There are numerous sources of risk, and volatility can be used to measure the sum total of risks associated with a financial asset.

Investment portfolios commonly consist of multiple asset classes, including equities, fixed income (bonds), hard assets and “alternative” investments. Understanding the inter-relationships of various asset classes and their historical volatility as well as the correlation of returns for those asset classes is useful in constructing the optimal investment portfolio. It should be noted that historical volatility and asset class correlations can differ materially from future volatility and asset correlations, due to the ever-changing confluence of economic and other forces that influence investor behavior.

Most investors are aware of the adage, “higher risk, higher reward.” In effect, taking more risk implies the ability to accept higher volatility of returns over the investment time horizon. The right amount of volatility in a portfolio depends on the investor’s unique circumstances. If an investor is dependent on the returns from the portfolio to partially or fully pay for living expenses, then he or she is more likely to prefer a portfolio with lower volatility for more consistent returns.

Conversely, if investors have a longer time horizon and is currently not dependent on returns from the portfolio, they will likely be more able to accept increased volatility in their investment returns. However, a critical difference exists between having the ability to accept more volatility and the willingness to accept more volatility. Some investors are not comfortable seeing their investment returns vary considerably, regardless of whether they have more ability to take risk. In such cases, the willingness to accept volatility will outweigh one’s ability to accept higher volatility.

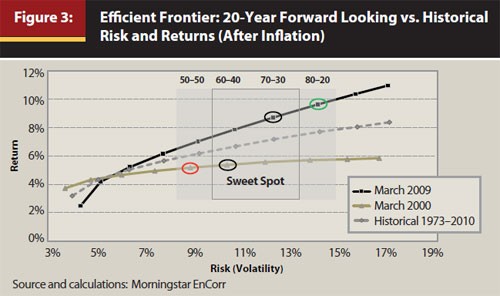

The efficient frontier  can be represented graphically to convey historical data illustrating the relative risks and returns associated with various investment asset mixes.

A skilled investment advisor can create a profile for most clients in about an hour and help them find their sweet spot on the “efficient frontier” just the right mix of risk and return to help them meet their objectives.

For more information, please contact Charles B. (C. J.) Carter  at First Bank and Trust Company.

First Bank & Trust Company. one of the top community banks in the United States, is a diversified financial services firm with office locations in southwest Virginia serving Blacksburg, Christiansburg and surrounding areas northeast Tennessee, and the New River Valley and Shenandoah Valley of Virginia. Financial objectives are addressed by offering free checking products for personal and business accounts, and assessing lending solutions managed by mortgage, agricultural and commercial lending divisions. Comprehensive financial solutions are available through trust and brokerage service representatives. For businesses, First Bank & Trust specializes in business services. including online banking  and online billpay. andbusiness loans .

First Bank & Trust Company is a client  of Handshake Media, Incorporated. the parent company of Handshake 2.0.