Filing Tax Form 1099INT Interest Income TurboTax Tax Tips & Videos

Post on: 6 Июль, 2015 No Comment

Updated for Tax Year 2014

OVERVIEW

If you receive a 1099-INT, the tax form that reports most payments of interest income, you may not have to pay income tax on the interest it reports. However, you may still need to report it on your return.

The Internal Revenue Service requires most payments of interest income to be reported on tax form 1099-INT by the person or entity that makes the payments. This is most commonly a bank, other financial institution or government agency. If you receive a 1099-INT, you may not have to pay income tax on the interest it reports, but you may still need to report it on your return.

1099-INT filing requirements

When you file your taxes, you dont need to attach copies of the 1099-INT forms you receive, but you do need to report the information from the forms on your tax return. Thats because each bank, financial institution or other entity that pays you at least $10 of interest during the year must prepare a 1099-INT, send you a copy by January 31 and file it with the IRS. The IRS uses the information on the 1099-INT to ensure you report the correct amount of interest income on your tax return.

Taxation of interest

When you receive a 1099-INT, youll need to understand what each box of the form is reporting, so that you can report your interest on the appropriate lines of your tax return:

- Box 1 of the 1099-INT reports all taxable interest you receive, such as your earnings from a savings account.

- Box 2 reports interest penalties youre charged for withdrawing money from an account before the maturity date.

- Box 3 reports interest earned on U.S. savings bonds or Treasury notes, bills or bonds. However, some of this may be tax-exempt.

- Box 4 reports any federal tax withheld on your interest income by the payer.

- Box 8 relates to interest-bearing investments you hold with state and local governments, such as municipal bonds.

Reporting 1099-INT information

All amounts reported in box 1 must be reported on the taxable interest line of your tax return and are taxed in the same way as the other income you report on the return. For the penalty amounts reported in box 2, you may be able to take a deduction in the adjusted gross income section of your return. And although the tax-exempt interest reported in box 8 of the 1099-INT isnt taxable, you still must report it on the tax-exempt interest line of your tax return for informational purposes.

It is also important to report all federal tax withheld from box 4 in the payments section of your return. Doing so will either reduce the amount of tax youll need to pay with your return or will increase your refund.

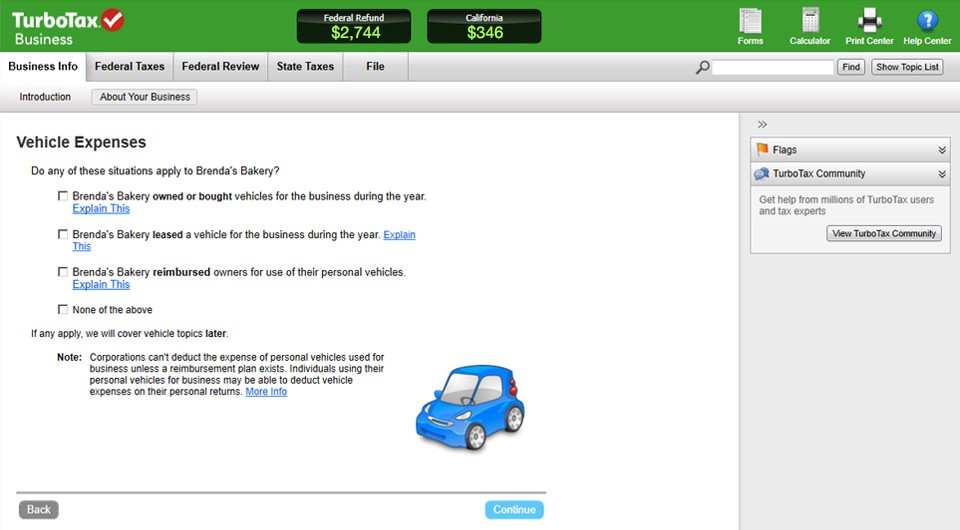

When you use TurboTax to prepare your taxes, youll just need to answer some simple questions about your income and 1099-INT forms. Well fill in all the right tax forms for you.

Schedule B implications

You must prepare a Schedule B with the name of each payer and the amount of interest received when the combined total of taxable interest reported on all 1099-INTs exceeds $1,500.

If box 3 of your 1099-INT includes interest from U.S. savings bonds that were issued after 1989, you may be eligible to exclude those amounts from tax if you use the proceeds to pay qualified higher education expenses. In order to do so, youll need to report the excludable amount on Schedule B and prepare Form 8815. If you receive interest income as a nominee (i.e. you receive interest that actually belongs to someone else), you must still report the income on Schedule B, but you then subtract it out as a Nominee Distribution. In this case, you will also need to report the interest belonging to the other party on a Form 1099-INT issued to them and reported to the IRS.