Fidelity Stock market continues to rally but there are risks

Post on: 21 Апрель, 2015 No Comment

Share This Story

The equity market could continue to gain strength, but there are risks, according to a new report from Fidelity.

According to Can the Sweet Spot for Stocks Continue, four important factors have played into the recent stock market rally: economic momentum, monetary stimulus, technical conditions and investor sentiment.

The U.S. stock market has been on a tear since the end of last year, said Jurrien Timmer, co-portfolio manager of Fidelity Global Strategies Fund and director of Global Macro for Fidelitys Global Asset Allocation division. The rally has been impressive, with the Dow up about 1,000 points so far this year — and back above its all-time closing high of 14,164.53 set on Oct. 9, 2007. The S&P 500 Index is about 25 points shy of its all-time closing high of 1,565.15.

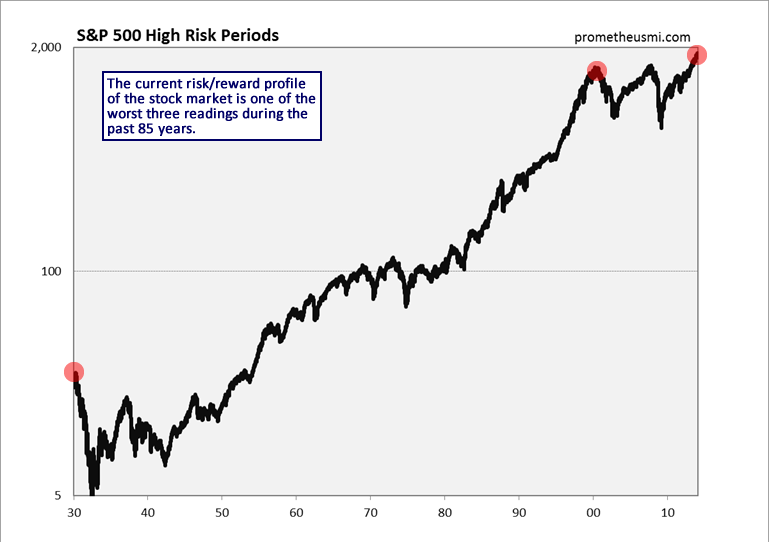

While I believe the U.S. equity market could continue to gain strength, there are risks on the horizon, including Chinas overheating credit boom, rising gasoline prices, technical divergences, and spread product liquidity, said Timmer.

While some of the markets recent momentum is the result of a better economy, as well as reduced fiscal cliff fears, the market has been on a sugar high delivered by the Feds latest round of quantitative easing and now also by the prospect of an important regime shift at the Bank of Japan, he said. This has raised the valuation of equity prices relative to the underlying economic fundamentals. Thats fine as long as the momentum keeps going, but it creates the risk that when the music finally stops, the market could be exposed to downside risk.

Technical conditions refer to the markets technical condition, including breadth and momentum. Both have been very strong and this has created an important pillar to support stocks.

Investor sentiment also has turned positive, leading Fidelity to wonder whether they will finally start to rotate their investment out of bonds and back into equities, which they have been avoiding since the market stock market peaked in October 2007.

All in all, I see a stock market that could well continue to gain strength in the coming weeks, but there are enough risks on the horizon to warrant maintaining a balanced portfolio, said Timmer. That means having enough equities to participate in the rally, while also having enough bonds to provide diversification.

Fidelity Investments is one of the worlds largest providers of financial services, with assets under administration of $4 trillion, including managed assets of $1.7 trillion, as of Jan. 31, 2013.