Fidelity Freedom Funds Review Avoid High Cost Target Date Retirement Funds

Post on: 19 Июль, 2015 No Comment

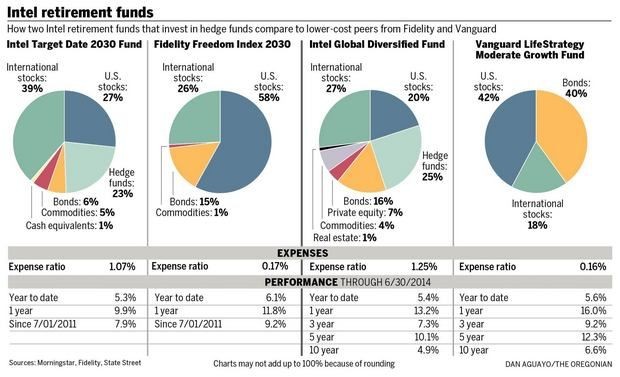

Updated and revised. Fidelity Investments does a lot of things well, but their Fidelity Freedom series of target-date retirement funds is not one of them. Ive been warning people about these funds since 2006, although recently theyve been getting some heat due to their overall underperformance. Assets in the Freedom funds have been dropping, while the assets in Vanguards Target Retirement funds have been increasing quickly. Heres why the underperformance is not about the glide path, but about the structure and fees.

This post is a bit long, so heres a roadmap of what Im going to try and show:

(1) The goal of owning actively-managed mutual funds is to beat their passive benchmark. Pick the winners and not the losers. The problem is that Fidelity Freedom funds hold so many different funds with overlapping holdings, that in the end they basically own everything. Its exceedingly difficult for them to accomplish such outperformance. Thus, over time their performance before fees is likely to simply match that of their benchmark.

(2) Due to their higher expenses, this means that their net performance after fees (what investors actually get) will be very likely to underperform the their benchmark. Over long periods of time, the amount of underperformance will closely match the amount of management fees charged.

(3) This expected underperformance is confirmed by looking at their historical performance over the past 3, 5, and 10 years.

(4) Instead, investors should look for low-cost index funds to replicate the benchmark give the best chance of higher performance. Options are explored.

Fidelity Freedom Holdings

Here are some sample Fidelity Freedom funds and their respective ticker symbols:

Fidelity Freedom 2030 Fund (FFFEX )

Fidelity Freedom 2035 Fund (FFTHX)

Fidelity Freedom 2040 Fund (FFFFX)

Fidelity Freedom 2045 Fund (FFFGX)

Fidelity Freedom 2050 Fund (FFFHX)

If you look at the fund prospectus for any of these, youll see that every fund holds a little bit over 25 different mutual funds listed below. With so many funds that cover all the asset classes and so many different advisors, in the end the holdings will tend to mimic that of an index fund. There is no focused bet that would create a winning strategy. Too many cooks in the kitchen.

Perhaps they want to seem diversified. However, for example the 2030 fund only holds 0.36% of assets in the Fidelity Series Intrinsic Opportunities Fund, 0.58% in the Fidelity Series Real Estate Income Fund 0.58%. Whats the point?

US Equity Funds

Fidelity Growth Company Fund

Fidelity Series All-Sector Equity Fund

Fidelity Series Large Cap Value Fund

Fidelity Blue Chip Growth Fund

Fidelity Series Stock Selector Large Cap Value Fund

Fidelity Series Equity-Income Fund

Fidelity Series Opportunistic Insights Fund

Fidelity Series Small Cap Opportunities Fund

Fidelity Series Investment Grade Bond Fund

Fidelity Series High Income Fund

Fidelity Series Floating Rate High Income Fund

Fidelity Series Emerging Markets Debt Fund

Proper Benchmark

Even though Fidelity lists them for you, dont make the mistake of comparing the returns of these funds to the S&P 500. Each one holds a mix of US stocks, international stocks, and bonds. Fidelity properly provides custom benchmarks like the Fidelity Freedom 2040 Composite Index which use well-recognized indexes to match the overall asset allocation.

Fidelity Freedom 2040 Composite Index is a hypothetical combination of the following unmanaged indices: the Dow Jones U.S. Total Stock Market Index, the MSCI EAFE Index (Europe, Australasia, Far East), and the Barclays U.S. Aggregate Bond Index. The index weightings are adjusted monthly to reflect the fund’s changing asset allocations.

Performance

If the theory that the funds end up simply tracking their benchmark is correct, then over the long run the funds will simply lag by the amount of their annual expense ratios, which are 0.71% and 0.75% respectively (slightly lower than a few years ago). Over the short term, there will be more noise and the Freedom funds may beat or lag the benchmark.

Here are the actual historical performance numbers of the Fidelity 2030 and 2040 funds (as of 1/31/2013). I added in the annual difference in red.

Do you see any alpha or benefit from Fidelitys attempts at active-management? The Freedom funds have lagged their benchmarks consistently by more than their expense ratio.

Conclusion and Alternatives

As the time period lengthens, the amount that the Freedom funds lag their benchmark seems to converge toward their historical average expense ratio of about 0.80%. I would expect similar results for other target-dated funds that simply include a mishmash of the fund family’s existing funds. Fidelity Freedom funds are like the mystery soup or meatloaf that cafeterias serve at the end of the week, where they just put in all the unsold leftovers before they spoil. Dont buy them.

In 2009, Fidelity quietly announced the introduction of their Fidelity Freedom Index Funds, which primarily hold just three low-cost index funds a US fund, an international fund, and a US bond fund. Annual expense ratios are around 0.20%. However, apparently Fidelity hates them because you cant find any information about them on their website, and they continue to be unavailable for purchase by retail investors. Instead, they are only available inside select workplace retirement plans. If you only have a choice between the regular Fidelity Freedom and the Freedom Index series of funds, definitely choose the Index ones.

Otherwise, if you are stuck inside a 401(k) or similar plan with limited investment choices, do the best you can using whatever lowest-cost options are available. If you have Fidelity Spartan index funds available, create a portfolio out of those. In my case, I used to cobble together a portfolio of an in-house S&P 500 index fund, the Vanguard Total International index fund, and an institutional share class of the PIMCO Total Return fund with a relatively low expense ratio. If you can roll over your assets into an IRA and still want a simple all-in-one fund, I recommend to my own family the Vanguard Target Retirement series of funds.