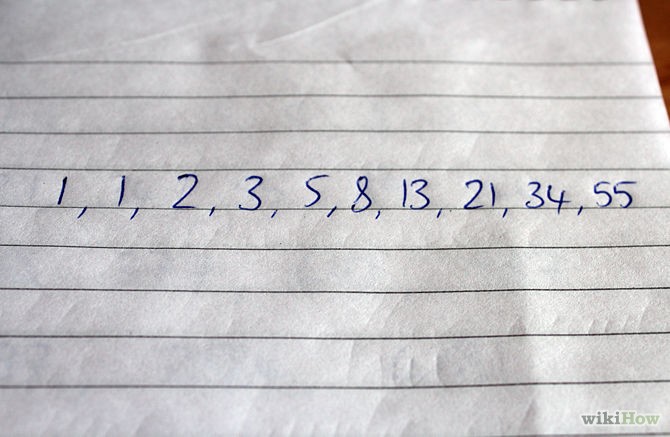

Fibonacci numbers Articles Page 1

Post on: 16 Март, 2015 No Comment

By: David S Adams | — When e-mini trading, the Ambush trade can be a power tool in your arsenal of trading. Its a Fibonacci trade, which certainly is not my favorite, but has a surprising level of success. This trade set-up, which occurs frequently, take some time and practice to recognize, but learning it can put valuable ticks on the positive side of your trading ledger.

A quick note on trades utilizing Fibonacci number is in order here. I have no belief that Fib numbers hold any particular value in e-m.

By: Mark miller | — Before deciding to invest in a particular security, the prospective investor has to understand the risks, an investment advisor or financial planner can provide you with more information to determine your risk-tolerance level. Some investors rely on complex stochastics, smoothing techniques, linear weighted moving averages, Fibonacci numbers, these techniques are advanced and experts feel they cannot make a rational decision using these advanced financial techniques. Some of these techniques adv.

By: Noble DraKoln | — If you have been trading for more than two weeks, you probably know about candlesticks. They are one of the most innovative tools in enlightening a trader on day-to-day momentum. They are excellent for intraday trading and, more importantly, for entry and exit signals.

The other four toolssupport/resistance, Fibonacci retracements, ATR, and MAscan give you set numbers to target candlestick charts to seal the deal.

As I suggested in the macro technical analysis, y.

By: Noble DraKoln | — While support, resistance, and Fibonacci are used as both entry and exit triggers, average true range (ATR) tends to be a one-trick pony. Once you have entered a trade, you are able to use ATR as a stop-loss indicator or as a way to place your protective short or long.

ATR is a volatility indicator that smooths out gaps and erratic market behavior to give us the absolute highs and lows of the market. Knowing this range is very important. Under money management strategies, knowing th.

By: Noble DraKoln | — We utilize Fibonacci retracements in the exact same way that we use horizontal support and resistance. The key difference is that our entries and exits are based on the market penetrating any of the five Fibonacci ratios: 0, 38%, 50%, 62%, and 100%.

This is identical to how we utilize the support and resistance levels. The only difference is that these numbers may not necessarily be at key points of support or sideways activity. Utilizing the Fibonacci numbers will give you a littl.