Fed s New Tools Also Work by Adjusting Rates Real Time Economics

Post on: 6 Август, 2015 No Comment

QE3

The Federal Reserve has been able to reduce borrowing costs for consumers and businesses in recent years using unconventional policy tools forward guidance and large-scale asset purchases in much the same way it did before the financial crisis by adjusting a key interest rate, according to new research from the central bank.

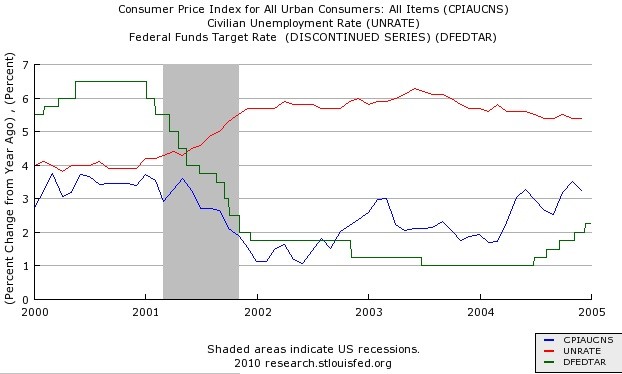

The Fed traditionally used the federal funds rate, an interest rate for overnight lending between banks, as its primary tool for influencing the economy by easing or tightening lending. But faced with a financial crisis and deepening recession, it lowered the rate in December 2008 to nearly zero, where it’s remained ever since.

That prompted the Fed to look for other, less conventional ways to lower the cost of borrowing and help revive the economy, such as making explicit statements about how long they expect to keep rates low (forward guidance) and buying bonds (quantitative easing).

Do those tools work? In a new working paper (“Monetary Policy and Real Borrowing Costs at the Zero Lower Bound”) from the Fed, three economists examined two-year Treasury yields on days the central bank announced policy changes and related effects on 10-year Treasury yields, a benchmark for mortgage rates and other loans, as well as corporate bonds and mortgage-backed securities.

Their conclusion: “unconventional policy through a combination of forward guidance and asset purchases is very effective in influencing longer-term interest rates,” and “the effects of both types of monetary policy actions are transmitted fully to real business borrowing costs.”

The two types of policy work in different ways, they wrote, but “we find no meaningful difference in the efficacy of conventional and unconventional policy measures, as measured by the impact of monetary policy on real borrowing costs.”

The paper was written by Simon Gilchrist of Boston University and two researchers from the Federal Reserve Board in Washington, David Lopez-Salido and Egon Zakrajsek. Mr. Gilchrist, a former staff economist at the Fed, co-authored two articles in the 1990s on the “financial accelerator ” with now-Fed Chairman Ben Bernanke .

Follow @WSJecon for economic news and analysis

Follow @WSJCentralBanks for central banking news and analysis

Get WSJ economic analysis delivered to your inbox: