Fed s Balance Sheet Data

Post on: 16 Март, 2015 No Comment

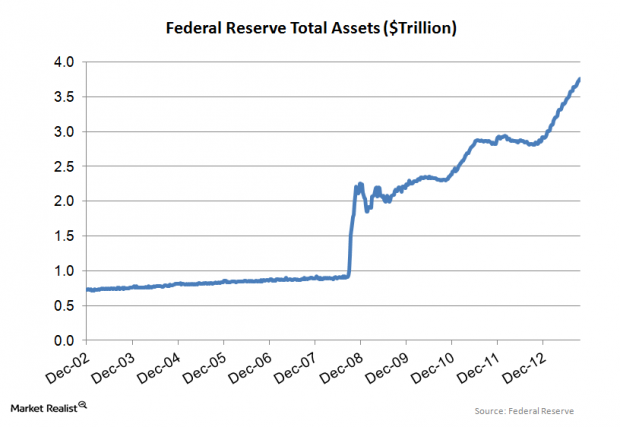

An Incredible Record of Monetary History

The 100 Year Federal Reserve Data Set is a comprehensive record of Federal Reserve balance sheet data spanning the past 100 years. It’s a rare and untapped research asset that can help you produce superior investment returns.

The Power of Monetary Analysis:

We believe that monetary analysis is the single highest value activity that you can do to improve investment returns.

The reason for this is twofold. Firstly, money is all pervasive in an economy. It touches each an every transaction and exerts an influence on all prices. Secondly, money is a subject that few understand in depth and therefore it’s rarely properly reflected in global asset prices. Humphrey B. Neill put it well in his book, The Art of Contrary thinking :

. because monetary problems are not comprehended by the public or by the average businessman, “money management” will continually cross up public opinions concerning economic trends.

Monetary manipulation is a crafty and tricky tool within a system of bootstrap economics. If you make it a point to become posted on some of the more common practices of monetary management you will occasionally be able to discern trends that are opposite to those commonly discussed in public pronouncements and business stories.

This data set is the crown jewels of monetary data sets. It spans a century full of interesting market events where the US Dollar rose to become the world’s reserve currency. The data set is weekly* and starts in April 1915 (just two years after the founding of the Federal Reserve).

How we got the data:

Compiling this data set took enormous man hours, patience and diligence.

Although the data is freely available at the St Louis Fed. it’s in a very unwieldy form. Here’s why:

- Each month of data is in a separate pdf report (the Federal Reserve bulletin report for that month). So for a century of data that means there’s 1,200 reports to open!

- The reports are old documents and they are often imperfectly scanned (the copy and paste functionality on your computer will rarely work correctly because of this).

- The reports span a long period of time and the layout and structure is inconsistent.

The above reasons make collection via automated computer processes virtually impossible, leaving manual collection as the only practical solution. We ended up poring through thousands of Federal Reserve bulletin reports, diligently checking and copying figures, to put this data set together.

Estimated costs of compiling this data set:

Let’s say that you have a junior analyst or intern at your firm and you would like them to put this data set together. Here’s what your costs might look like:

Junior Analyst cost per hour: $17

Let’s assume your analyst earns $35,000 per annum. Then that’s $17 per hour (assuming a 260 work year and an 8 hour work day).

Number of reports to extract data from: 840

There are 100 years of data in the data set. The last 30 years of data can be found in a manageable format online so that leaves 70 years of data to extract.

This implies there are 70 years * 12 months = 840 Federal Reserve bulletin reports that need to be opened, understood and harvested for data.

Time per report: 10 minutes

We measured ourselves when getting this data and, once we had got up to speed, it took us 10 minutes per report to extract the relevant data (data checking and thinking about layout not included).

That means it would cost 840 * 10 minutes = 8,400 minutes, or 140 hours of work to collect the data.