Fed 2015 Stress Test Results 31 Out Of 31 Pass Mission Accomplished

Post on: 14 Апрель, 2015 No Comment

Four months ago, in another failed attempt to boost confidence in the Eurozone and stimulate lending (failed because three months later the ECB finally launched its own QE), the ECB conducted its latest stress test, which as we explicitly pointed out was an utter joke as even its worst-case scenario did not simulate a deflationary scenario. Two months later Europe was in outright deflation.

It was initially unclear just how comparably laughable the Feds own stress test assumptions were, but refuting rumors that Deutsche and Santander would fail the Feds stress test (perhaps because former FDIC head and current Santander head Sheila Bair wasnt too happy about her bank being one of the failed ones), moments ago the Fed released the results of the 2015 Fed stress test, and. it seems there was no need to provide a sacrificial lamb as with stocks at record highs. In fact everything is awesome!

- FED STRESS TEST SHOWS ALL 31 BANKS EXCEED MINIMUM REQUIREMENTS

As we have previously explained, of course, the results are completely meaningless, as the Fed neither then, nor now, has any methodology for how to calculate capital in case of the same kind of counterparty failure chain as happened during Lehman, and when no amount of capital would have been sufficient to preserve the financial sector. Like we said: theatrical spectacle. But at least everyones confidence has been boosted. So Buy stawks, and build your paper wealth!

So to summarize the history of US bank failure:

- 2013 Fails — Citi, SunTRust, MetLife

- 2014 Fails — Zions

- 2015 Fails — None, nada, zip.

US Financial stocks have been considerably more exuberant ahead of this report than financial credit.

We will see how they react to these results. Some more details from the WSJ :

. all 31 of the biggest U.S. banks had enough capital to continue lending during a hypothetical economic shock where corporate debt markets deteriorate, unemployment hits 10% and housing and stock prices plunge. The exams are designed to ensure large banks can withstand severe losses during times of market turmoil without a taxpayer bailout.

It was the first time since the tests began in 2009 that all banks maintained capital levels above what the Fed views as a minimum allowance. The banks will need to maintain those minimum capital levels to pass the second round of stress tests on Wednesday, which will determine whether a firm can return money to shareholders. Two banks, Goldman Sachs Group Inc. and Zions Bancorp. had certain capital ratios that came close to the Feds minimum, which could limit shareholder payouts.

The overall results buttress regulators view that the financial system is safer than before the Great Recession, in large part because of loss-absorbing capital built up for the annual stress test exercise. The Fed said the 31 banks aggregate Tier 1 common capital ratio, which shows high-quality capital as a percentage of risk-weighted assets, dropped as low as 8.2% under the stressful scenario, well above the 5.5% level measured in early 2009 and the 5% level the Fed considers a minimum allowance.

The bottom line: bank shareholders can recoup some more capital from their perfectly solvent banks. As a reminder, it was almost exactly 6 years ago when discussing just what the prerogatives of the Fed were when it proposed enacting a non-QE plan of saving the financial system:

irst, the lack of details will create some uncertainty and concern, particularly because theres not a great deal said about the problem children, the BAC and Citi. Secondly, I think the markets will be disappointed in the following sense: As I will describe, this is a real truth-telling kind of plan. Its fundamentalist. Its not about giving the banks a break. Its not about using accounting principles to give them backdoor capital. Its very much market-oriented and tough love. And I think we all will like that. I like that. But the banks shareholders arent going to be thrilled about it.

Back then, the bank shareholders made it quite clear that they want QE, and they got QE. They have been thrilled ever since.

* * *

A reminder of what last years stress test scenarios looked like. in the baseline stress test scenario, the Dow Jones plunges to 11.4K in Q3 2014, and then somehow surges back to all time highs by Q4 2016! Does the Fed understand the word Stress?

And here is this years oh so stressful scenarios. wonderfully mean-reverting and no contagion and Dow 20,000.

The Feds description of the Severely Adverse stress test:

The severely adverse scenario for the United States is characterized by a deep and prolonged recession in which the unemployment rate increases by 4 percentage points from its level in the third quarter of 2014, peaking at 10 percent in the middle of 2016. By the end of 2015, the level of real GDP is approximately 4.5 percent lower than its level in the third quarter of 2014 ; it begins to recover thereafter. Despite this decline in real activity, higher oil prices cause the annualized rate of change in the Consumer Price Index (CPI) to reach 4.3 percent in the near term, before subsequently falling back.

In response to this economic contractionand despite the higher near-term path of CPI inflation short-term interest rates remain near zero through 2017; long-term Treasury yields drop to 1 percent in the fourth quarter of 2014 and then edge up slowly over the remainder of the scenario period. Consistent with these developments, asset prices contract sharply in the scenario. Driven by an assumed decline in U.S. corporate credit quality, spreads on investment-grade corporate bonds jump from about 170 basis points to 500 basis points at their peak.

Equity prices fall approximately 60 percent from the third quarter of 2014 through the fourth quarter of 2015, and equity market volatility increases sharply. House prices decline approximately 25 percent during the scenario period relative to their level in the third quarter of 2014.

The international component of the severely adverse scenario features severe recessions in the euro area, the United Kingdom, and Japan, and below-trend growth in developing Asia. For economies that are heavily dependent on imported oilincluding developing Asia, Japan, and the euro areathis economic weakness is exacerbated by the rise in oil prices featured in this scenario. Reflecting flight-to-safety capital flows associated with the scenarios global recession, the U.S. dollar is assumed to appreciate strongly against the euro and the currencies of developing Asia and to appreciate more modestly against the pound sterling. The dollar is assumed to depreciate modestly against the yen, also reflecting flight-tosafety capital flows.

This years severely adverse scenario is similar to the 2014 severely adverse scenario. However, corporate credit quality is assumed to worsen even more than would be expected in a severe recession, resulting in a greater widening in corporate bond spreads, decline in equity prices, and increase in equity market volatility than in the 2014 severely adverse scenario.

The fun part: The Feds severely adverse scenario assumes the USD appreciates strongly against the euro and the currencies of developing Asia — so like. right now?

As for the just Adverse scenario, it involves the Dow Jonies cratering back 15,000 and BBB debt yielding an unheard of 6%!

Here is Deustche Bank looking crazy.

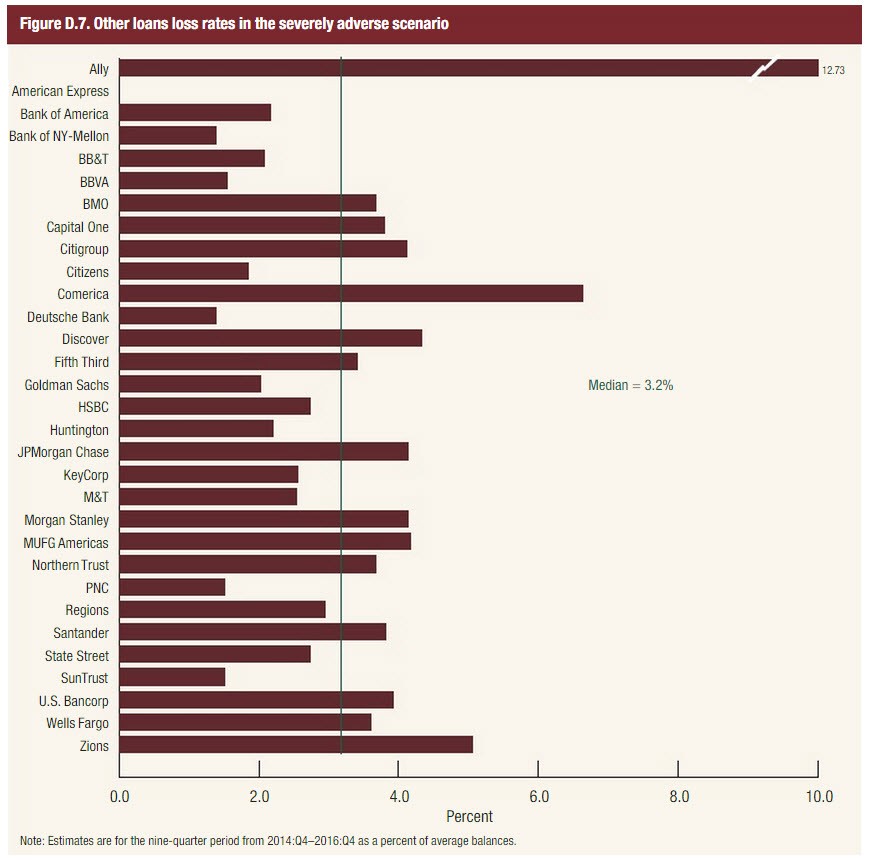

Spot the subprime auto lender.