February 23 2015 Why Is Global Tactical Asset Allocation Not Popular

Post on: 16 Июль, 2015 No Comment

Why Is Global Tactical Asset Allocation Not Popular?

We regularly receive many questions from our users. Some of them are very pointed and concerned about our core methodology. The following question came from a user a couple of weeks ago:

I have a couple general questions for you about the thought/strategy (and results) behind one of the advanced portfolios, namely [P Goldman Sachs Global Tactical Include Emerging Market Diversified Bonds] using mutual funds, not the ETF one.

You may not know the answer, but I thought Id ask and these are not urgent questions, Im just curious as to your thoughts on it.

Why isnt this strategy, the GS GTAA one mentioned above, known and followed all over the place by investment advisors, retail and institutional investors at large (outside of myplaniq), and so on? Or maybe it is. But Im guilty of having read many (too many) investment newsletters, books, and articles over the years and yet I never heard of this strategy anywhere else except through your site. It seems so simple (in terms of algorithms) and steady (in terms of decent results with small drawdown). Its in contrast to the Mebane Faber type of TAA; Id heard about the Farber type approach before, but that approachs sharpe ratios arent nearly as good as the GS GTAA one on your site.

Basically, the GS GTAA results seem almost too good, compared to everything elseyet the results are easy enough to track, at least through your site, and plain to see. Also, as it uses regular mutual funds (with once-a-day prices) and a monthly rebalance frequency, I have more confidence in backtest results for this strategy, since there is less a chance of losing out due to intraday pricing fluctuation or other friction if you did it for real over the years.

Given the results of this are so strong (in terms of annual return, sharpe ratio, and draw down), and yet are realistic Im just wondering why it is not a more widely known/talked about/followed approach. Its one of those things that I wish Id heard about, and started doing, years ago.

Thanks in advance for your thoughts on this, if you have time.

The portfolio the user referred to is P Goldman Sachs Global Tactical Include Emerging Market Diversified Bonds. Since we received the email, we have pondered how to best answer this question. Recent market actions and the portfolio behavior might provide a good reason to answer the question.

To put it under context, the portfolio was doing very well at the time when the question was asked. It had 5-6% YTD (Year To Date) return. However, recent US stock strength and the weakness in REITs and long term bonds have dented its performance. Tts ETF cousin is even worse: as of today, it had only 0.3% YTD return, compared with 2.8% of S&P 500 (VFINX)

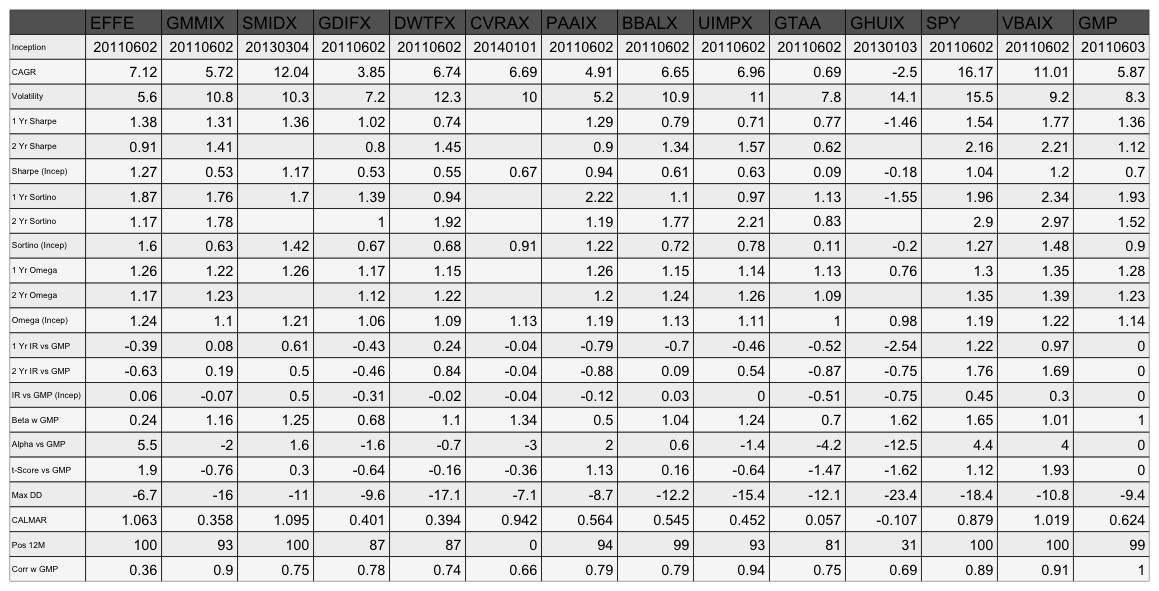

Portfolio Performance Comparison (as of 2/23/2015):