FDI a key concept in Economics and Management

Post on: 5 Апрель, 2015 No Comment

When a firm controls (or have a strong say in) another firm located abroad, e.g. by owing more than 10% of its equity, the former is said parent enterprise (or investor) and the latter foreign affiliate.

Foreign Direct Investment (FDI) is the financial investment giving rise and sustaining over time the investor’s significant degree of influence on the management of the affiliate.

The initial investment can be the purchase of an existing firm (by acquisition or by merger, the so-called M&A) as well as the foundation of a new legal entity who usually — but not necessarily — makes a green-field real investment (e.g. building a factory) in the foreign country [1 ].

In a broader definition, FDI consists of the acquisition or creation of assets (e.g. firm equity, land, houses, oil-drilling rigs. ) undertaken by foreigners. If in these enterprises they are not alone but act together with local firms and/or governments, one talks of joint ventures.

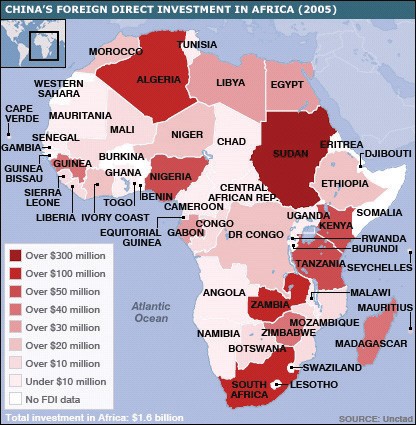

A country outflows of FDI means that it is exporting money to buy or build foreign productive capacity, whose ownership will remain in the first country’s hands.

For a country, attracting an inflow of FDI strengthen the connection to world trade networks and finance its development path. However, unilateral massive FDI to a country can make it dependent on the external pressure that foreign owners might exert on it.

Since it is through FDI that a firm becomes a multinational, one could say that the it’s the FDI process that generates MNC (multinational companies). The reverse is also true: firms that are already multinational generate the majority of FDI flows.

Composition

FDI has three components:

- equity capital ;

- reinvested earnings. the investor’s share of earning not distributed as dividends by affiliates, in proportion to its share in the equity (say for instance 50% in a certain joint venture);

- intra-company loans. when the investor borrows funds to the affiliate, usually without the intention of asking the money back.

To better understand their defining characteristics, you should consider that FDI are flows of capital that share the following features:

- they are long-term (in contrast to portfolio investment in bonds and in short-term speculation in shares);

- they give rise to a property right on the asset built or bought (in contrast to foreign aid ).

However, FDI is quite heterogeneous and one should distinguish several kinds, e.g. by looking at the following factors:

a. whether the activity in the host country is just an intermediate phase in a longer production chain or it gives rise to a finished good;

b. the production phase performed in the host country (design, manufacture, distribution);

b. where the outcome of the process in the host coutry will be sold (there or abroad).

The classical FDI is a manufacture plant using foreign technology and management techniques to exploit low-cost local resources, with sales made to the present clients of the investor (thus, usually involving exports ). However, market-oriented FDI as well as FDI in other sectors (e.g. tourism resorts, banks, transport. ) are important phenomena as well.

In micro-economics terms, routines allow firms to judge whether to look for FDI occasions, which country to target, which contracts and clauses to establish with foreign counterparts.

Determinants

At investor’s level, a firm can decide to make a foreign investment because of many factors, including:

1. upstream integration. by purchasing a provider, whose input will now be sold cheaper (or exclusively) to it or be differentiated along particular features;

2. horizontal integration. by purchasing a firm making the same product, to expand its production, reduce costs. improving logistics;

3. downstream integration. by purchasing a firm using or distributing its products, to get higher value added along the chain and to aggressively push distribution;

4. diversification. by purchasing a firm doing somewhat different activities than the purchaser, to seize new opportunities.

A firm already exporting to a market can decide to make a FDI and build there a productive unit to reduce the transport cost and avoid tariff barriers.

In another vein, FDI is the chosen vehicle used by a foreign firm having a monopolistic advantage vis-a-vis other firms in the market. Host country conditions are such that the application of the advantage enables the generation of economic profits. higher than the expected profit to be gained from selling or licensing the advantage to other firms.

Access to a privileged network of input-output relationships as well as of knowledge providers is an important objective of many FDI initiatives.

Note that strictly financial consideration are important as well, since a current positive cash-flow is conducive to look for investment opportunites.

Together with rational reasons, the specific country chosen can often be forecast by an external observer in terms of imitation , being the same as the target country of other FDI.

At country level, outflows of FDI are high when:

- firms have sound financial conditions but consider that other countries have more favourable investment conditions ;

- the exchange rate is high in an historical perspective (e.g. after a re-valuation) so foreign firms are cheap and exports are braked — in this case FDI substitutes exports;

- the trade balance is positive, with exports higher then imports. since capital flows usually compensate the commercial flows;

Inflow of Foreign Direct Investments increases with the attractiveness of the country, due to the following factors in different proportions depending on the industry and the country:

1. large GDP and market potential;

2.1. advanced know-how ;

3.1. low labour cost and wages ;

3.3. lower environmental protection;

4. high tariff protection ;

5.1. favourable l aws and public incentives ;

5.2. intentional and professional territorial marketing.

In particular, the establishment and the skills of an Investment Promotion Agency. actively looking for investors in industries and activities for which the country has a competitive advantage and a strong need, can make the difference, both in quantity, quality and positive effects of FDI.

On a sub-national level, FDI usually concentrates in the richest part of the country. where wages are higher, also because there the investor can find a better infrastructure and easier logistical accessibility from abroad. This empirical evidence weakens the relationships between FDI and low wages.

In macroeconomic terms, net inflow of FDI often occurs when the country has a trade deficit.

Impact on other variables

A. Financial variables

The equity capital component of FDI generates an increase in total equity of the foreign economy. Note that the latter is not equal to total assets in the aggregated balance sheet.

As an inflow of capital it is, FDI changes the balance of payments . Other things equal, if not sterilized, FDI increases the official reserves of foreign currency.

B. External trade and industrial variables

A particularly strong FDI concentrated in a short period of time (e.g. a purchase of a newly privatized big state company) can lead to a re-valuation of the currency exchange rate.

If significant flows of FDI are aimed to real investments (e.g. building a factory), then total investment will rise, other things equal.

Usually, in this case, the foreigners will import machines as well as raw and intermediate inputs for the production process (from their country or their providers’ one). For both reasons, imports will rise after a FDI inflow.

If the good produced in the host country is sold there, consumption composition will change, possibly with a loss in market shares of local producers and of foreing producers based abroad. in the latter case, FDI is crowding out imports. If the product is new for the host country, it fills a gap and increases the variety of available goods, thus opening the path to higher productivity for industrial users and higher satisfaction for consumers. For instance, a FDI in an electricity generation plant will allow more firms to operate in the region and wider availability of energy for inhabitants.

If, instead, the production is exported, FDI boosts exports of the host country, providing it with foreign currency.

If FDI is targeted to green-field investment, employment will rise, possibly involving a Keynesian multiplier of income and consumption. If FDI is targeted to an acquisition of a large inefficient firm, the priority of profits will possibly lead, in the short run, to waves of dismissals and a rise of unemployment.

Wages are usually higher in foreign affiliates than in local firms, sometimes with the crowding out of the latter on the labour market (i.e. they do not find any more workers at the previous level of wage and they are not profitable at the new level, because of their lagging productivity ).

C. Knowledge and entrepreneurial variables

Usually, foreign firms have higher productivity than local ones, since the foreing ownership prompts managers to use non-locally available knowledge, both incorporated and not-incorporated in machines, which often constitute an innovation.

The local workforce is put into contact with that knowledge and, more in general, with the foreigners’ mentality.

All this might generate knowledge spillovers to workers, as well as to local providers (e.g. forced to adopt ISO certification or specific methods of production) and to local competitors (who could imitate the foreign firm).

Thus, a mid-term effect of FDI can be the mushrooming of new businesses in the same industry by competitors and past key workers. In parallel, the presence of a big foreign investor can re-orient the education & training courses offered in the region, giving rise to a pool of specialized skills, which in turn become a competitive advantage for the investor as well as an incentive for other international firm to locate there.

D. Political variables

Far-sighted politicians can use FDI for their country to catch up with world standards in certain industries, prompting a fast development of the economy, by attracting and selecting the investors.

However, large and concentrated FDI can exert external pressure to obtain a preferential treatment against the local firms, giving rise to political attrition between the two groups. The external pressure can take the form of funds for electoral expenses of certain parties or of corruption of bureacrats and politicians, the more so the money at stake is huge in comparision with the typical wage of the officer.

Foreign-owned managers risk to exhibit a radical ignorance of law, since the law is written in a not-known language and they have no experience with it. In this case, the management behaves as it wants, leaving to lawyers and bribery the task to make the activity compliant with regulation.

FDI in non-democratic countries can exploit the lack of free trade unions and active citizens to carry out activities banned in democratic countries. However, FDI is a window to the world, thus in a longer time perspective, it’s conducive to openness, sometimes to the same development of democracy.

E. Caveat

All this can be the effect of FDI provided they are big with respect to the host economy. By contrast, for most countries and for most of their history, FDI stocks and flows are quite small and their (positive or negative) effects simply do not influence the aggregate, which is rather determined by other factors.

Long-term trends

During the relatively stable UK-dominated world system of 19th century, globalization boosted FDI from the core to the semi-periphery and to colonies. The subsequent conflict between core countries exploded in two global wars, with international trade collapse, protectionism, nationalization of foreing affiliates and FDI crise.

The US-dominated world system of the second half of 20th century showed a strong trend of increasing FDI.

However, this overall general tendency is structurally unstable: nervous short-run flames of FDI reach a short list of target countries, with abrupt crashes (as with the East Asia boom and crise in the last decade of the century).

Debt crises are a dramatic end of FDI flames (as in Argentina, Russia, Brazil during the same period), in interaction with external aid, currency crises, bank crashes and political turm-oil.

Behaviour during the business cycle

Being pro-cyclical and lagged. inflows of FDI usually arrive late after robust signs of recovery and growth. The international press helps to tune the sentiment of international investors, providing a kind of early signal of FDI inflows in case of good coverage.

Outflows of FDI can arise especially in two subsequent periods:

a. at the end of the business cycle when very liquid firms try to extend their assets abroad;

b. during recession, when the interest rate is low but no investment opportunity are evident in the domestic economy.

Industry life cycle

FDI comprehends cross-border Mergers & Acquisition, thus they retain some of their hectic movements, with accelerated boost and severe crashes.

Looking instead to the industrial side, FDI can be framed in the product life cycle as an emerging feature of the moment when, after a dominant design has put a temporary end to product innovation. a new phase of cost control is leading to movements in the production preferred location, by transferring active factories from core countries to semi-peripheries where production costs are lower. This movement goes together with semi-periphery firms imitating the core countries’ innovators.

In the perspective of a competition among countries to attract foreign investors, a low-wage, low-tax country attracts investments from abroad thanks to a relatively acceptable dotation of infrastructure and technical expertise, until other even-lower-wage & tax country substitute it. This contributes to a geographical earthquake-like movement of FDI from a centre to its neighbours and to further peripheries.