Facebook s Upcoming Inclusion In The S&P 500 What You Should Know Facebook (NASDAQ FB)

Post on: 16 Март, 2015 No Comment

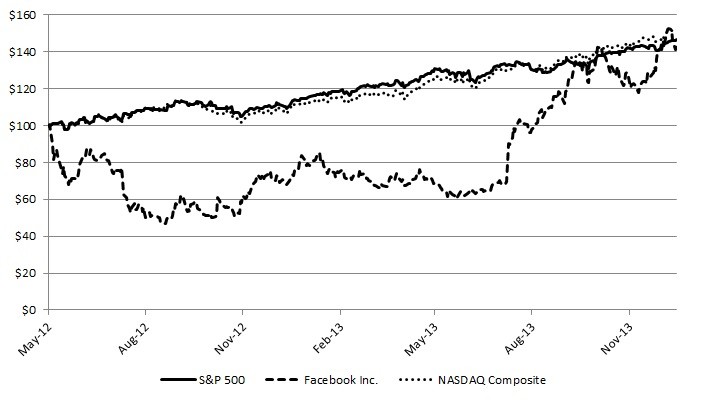

Facebook (NASDAQ:FB ) closed at an all time high yesterday of $54.86. The stock is up 11% over the last 4 trading days. YTD it is up 100%. Three announcements have been made regarding FB over the past 4 days:

- Introduction of Instagram Direct

- Introduction of video ads (non-prompted) to begin 12/19/13

- Inclusion in the S&P 500 at the close of trading on 12/20/13

The first two announcements mentioned, Instagram Direct and video ads, have been chronicled on this website. Both are significant, and the case can be made for significant future benefits from these endeavors. However, a large degree of uncertainty surrounds the execution and potential success of both as they relate to the future performance of FB’s stock price.

There is no uncertainty regarding the very near-term effect that the S&P 500 inclusion will have on FB’s stock price. I am convinced that most of the gain over the last 4 days (11%) is due to this announcement. I also think that by 12/20/13 more new highs will be made in FB. Over the long term, I believe FB’s stock price will be affected positively by inclusion in this widely-followed and mimicked index. I will discuss both.

Facebook will be added to the S&P 500 on the close of business, Friday December 20, 2013. This addition had been anticipated, although the timing had been quite uncertain. S&P, not unexpectedly, chose this year-end addition with a seven day lag, in order to minimize as much as possible the impact on FB’s stock price. FB stock is up 11% in the four trading days since the announcement.

All investors, long, short, or anticipating establishing a position in FB, should understand the enormous demand/supply imbalance that has been created by this inclusion. I will simply, yet methodically, provide the most conservative estimate of the demand for FB over the very near term. I can not provide the supply side, but will make a strong case that it will not match the demand.

First, we must establish the total assets linked to the S&P 500 at the current time. As of December 31,2011, S&P’s last published survey, $1.61 trillion (T) were linked to the S&P 500. The closing settlement of the S&P 500 on 12/30/11 was 1257.6. The close on Friday, December 13th was 1775.32. This represents a 41.1% increase over the two year period. We need to grow the linked assets by this increase. Now, there are $2.27 T linked ( 1.61 x 1.41) This represents the most conservative estimate. It assumes no organic growth (inflows) or closet indexers.

Next, we need a proxy to establish FB’s weighting within the S&P 500. FB’s market cap was $131 billion (B) on 12/13/13/. Visa (NYSE:V ) had a market cap of $ 132 B on Friday and represents .66% of the total market cap of the S&P 500. Therefore, FB’s market capitalization within the S&P 500 will be .66% (.0066x) of $2.27T or $14.99B.

$14.99B / $53.3(price of FB stock) will equal the number of FB shares to buy by index funds. The number is an astonishing 281 million shares to buy. This represents 11.2% of the shares outstanding and 15% of the float. The average volume in FB stock over the past 30 days has been 64.4 million shares.

Most index funds will not risk meaningful tracking error with significant pre/post buying of FB stock. This is particularly relevant with today’s FOMC release and potential market volatility. I estimate that more than 50% of the buying will take place over the last two days.

With FB trading at all time high, all investors are profitable. It is difficult to make the case for sizable year-end selling. Additionally, large institutional owners such as Fidelity (largest with 4.7% ownership as of 09/30/13) are not likely to sell sizable stakes and lose tracking to the S&P 500.

Zuckerberg could satisfy the entire add. I do not believe that will be his intention. Sandberg owns 11.1 million shares. Again I do not believe she will sell her entire stake. I have no knowledge. and these are my assumptions.

There are significant implications for the long term with FB’s inclusion in the S&P 500. All funds that are benchmarked to the S&P 500 will be potential investors in FB. This universe far exceeds the indexed assets I mentioned above ($2.27T). FB will be in the top 20 weightings within the 500. It will no longer be acceptable to ignore FB. Portfolio managers will be confronted with greater tracking risk if FB is not considered as an investment.

In summary, FB’s inclusion in the S&P 500 is quite a significant event. It has implications for both the short and long term performance of FB stock.

Disclosure: I am long FB. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Since you’ve shown interest in FB, you may also be interested in