Explanation of Current Federal Reserve Policy

Post on: 5 Август, 2015 No Comment

The basics of the fed funds rate, quantitative easing, and why rates are so low

Panoramic Images / Getty Images

The Fed’s Current Policy – Updated November 2014

The Federal Reserve fulfills a wide range of functions in the U.S. economy, but the aspect of its role that receives the most attention is its control of monetary policy. The Fed’s current policy is outlined below, with links to provide more detail on each aspect of its policy. This article will be updated with each major policy shift.

The Federal Reserve sets the federal funds rate – or “fed funds rate,” as it is typically called. This is the rate at which banks with balances held at the Federal Reserve borrow from one another overnight basis to meet their required reserves. The Federal Open Market Committee (FOMC) – the rate-setting committee within the Federal Reserve, chaired by Janet Yellen — sets the federal funds “target rate ” – which is its desired overnight borrowing rate. By buying bonds to inject money into the financial system and selling bonds to take money out of the system (a process known as “open market operations ”) the Fed influences the rate at which banks borrow and lend from another.

The Fed’s current policy is to maintain a target rate between 0.0% and 0.25%, a level that it has targeted since December, 2008. Nobody can say for sure when the Fed will raise rates — not even the Fed itself, since its policy is dependant on incoming data — but the most likely scenario is that the first rate hike will occur in the second half of 2015. While the Fed intends to normalize policy (i.e. bring rates up from their near-zero levels over time), it intends to do so gradually in order to avoid disrupting the markets. In addition, it wants to prevent deflation by making sure that the inflation rate stays at a healthy level.

The reason the Fed has maintained this ultra-low rate policy is to stimulate the economy in the wake of the 2008 financial crisis. Unemployment soared and the economy contracted following the crisis, forcing the Fed to take dramatic steps to prevent a deeper recession. The U.S. economy recovered from its post-crisis downturn long ago, but growth remains sluggish with no threat of inflation. Since growth would likely contract if the Fed raised rates to more normalized levels, it has maintained a low-rate policy that will likely have been in place for seven years or more (2008-2015) before the Fed finally changes its approach.

Once the Fed begins to raise interest rates. how far might it go? Estimates vary widely, but the current consensus is that short-term rates could stand anywhere between 2% and 4% by the end of this decade. While that may seem like a small difference, it’s actually quite large — and it could make all the difference for future bond market performance. To see which outcome is more likely, see my article, Are Bonds a Good Investment? Bill Gross May Have the Answer .

The Fed also sets the discount rate. the rate at which banks can borrow directly from the Fed via its “discount window .” Since January 2003, there are three types of credit that depositary institutions can acquire at the Fed’s discount window: primary credit, secondary credit, and seasonal credit. Each type of credit has its own interest rate. The rate on seasonal credit is typically lower than the rate on primary credit, while secondary credit is higher. Current rates are: 0.75% for primary credit, 1.25% for secondary credit, and 0.20% for seasonal credit.

Stimulus Programs

In addition to cutting rates to ultra-low levels, the Fed has provided additional stimulus to the economy through the programs known as Operation Twist and quantitative easing .

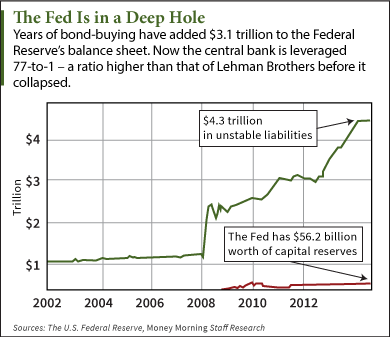

Quantitative easing (QE), the more important of the two, involves the Fed buying fixed-income securities on the open market in order to bring down long-term interest rates. The Fed has enacted three different rounds of QE since the 2008 financial crisis. In the most recent iteration, it purchased $85 billion of fixed-income securities per month — $40 billion of mortgage-backed securities and $45 billion of U.S. Treasuries — through the end of 2013. Beginning in January 2014, the Fed began to taper the policy in increments of $10 billion. The Fed wrapped up the third round of QE in October 2014.

The Fed also employed a program known as Operation Twist. which is no longer in effect. This program involved the Fed purchasing longer-term bonds while selling the shorter-term issues it already owned. This process enabled the Fed to bring down the yields on longer-term debt without adding any new cash to the money supply. (Keep in mind, prices and yields move in opposite directions .) Operation Twist began in September, 2011 and ended in December, 2012.