Explain Balance Sheet Define Assets Liabilities and Net Worth

Post on: 30 Май, 2015 No Comment

Balance Sheet

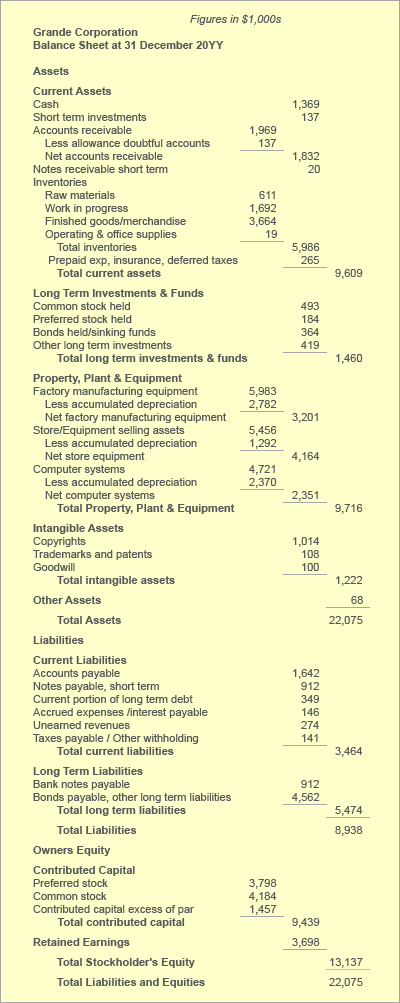

A balance sheet shows the assets, liabilities, and net worth of an individual or entity at a given point in time. In other words, it is a snapshot or statement of financial position on a specific date.

Components of Balance Sheet

Define Assets

Assets are items that are owned and have value. Assets would include cash, investments, money that is owed to the person or entity (accounts receivable), inventory of items for sale, supplies, pre-paid expenses, land, land improvements (buildings), equipment, etc.

Define Liabilities

Liabilities are obligations or items that are owed to others. Liabilities are the accounting opposite of assets. Liabilities would include accounts payable, accrued interest and principle on bonds issued, accrued interest and principal on mortgages outstanding, etc.

Define Net Worth Calculation

Assets Liabilities = Net Worth

Net worth is the total assets minus total liabilities of an individual or entity. Net worth may also be referred to as book value or owner’s (stockholders) equity. In other words, net worth is the accounting value of an individual or entity if all assets were sold and liabilities were paid in full on a specific date.

Explain Balance Sheet

The balance sheet is a summary of assets, liabilities, and net worth (book value) at a specific point in time.

Why is the Balance Sheet Important?

The purpose of company financial statements is to evaluate the financial position (balance sheet), profitability (income statement), and cash flow (cash flow statement) of an entity. The balance sheet is the foundation of the entity.

Whether an investor is looking for dividends. value. quality, or companies with sustainable competitive advantages. the foundation of each strategy is finding companies with a sound balance sheet. This is because the financial position of the entity affects everything it does and is able to achieve.

An entity with liquidity, low debts, and sufficient working capital has a higher probability of being successful. It can fund future needs (i.e. capital investments) to grow the company or overcome unexpected challenges. It also affects whether and how much of the cash flows can be returned to shareholders in dividends or stock buybacks.

Do you have a favorite financial statement? Which one is it?