Expense Ratio The Mutual Fund Stat You Can t Afford to Ignore

Post on: 28 Июнь, 2015 No Comment

About

Alamy One of the great selling points of mutual funds is that they’re fire-and-forget investment vehicles. You make your contributions, and then check in on your fund’s performance every once in a while, secure in the knowledge you’re diversified across a wide range of stocks, bonds or both.

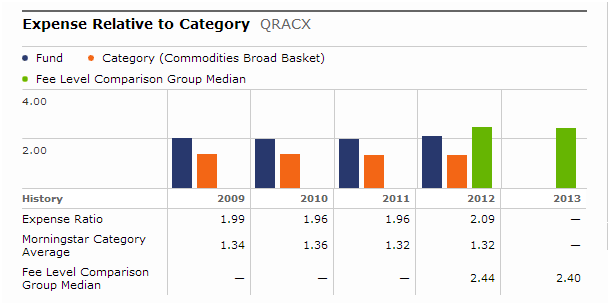

The flip side of fire-and-forget is that most mutual-fund investors probably don’t look too closely at the critical details of their investments, like their fund expenses. These fees eat into returns and can add up to significant amounts. Happily, there’s an easy way to compare these parasitic costs across different funds.

Your Friend, the Expense Ratio

As with any other kind of enterprise, a mutual fund needs money to operate. Costs can include administrative fees, taxes, marketing fees, legal expenses and securities transaction fees. But a mutual fund’s biggest operating cost is typically the investment advisory fee — the money paid to the fund’s investment manager.

All of these costs have to be paid by someone, and that someone is you, one of the fund’s many investors. The lower the operating costs, the better your returns. And the easiest way to compare operating costs across funds is with the expense ratio.

The expense ratio is arrived at by dividing the fund’s operating costs by its average assets, and it is expressed as a percentage. For example, the expense ratio of my Vanguard 500 Index Fund Admiral Class (VTSAX ) is 0.05 percent. This means only 0.05 percent a year of the fund’s total assets are paid to those who run it. A lower expense ratio leads to a better long-term performance.

The Numbers Don’t Lie

Last year, Financial Analysts Journal published a paper by William F. Sharpe titled The Arithmetic of Investment Expenses . Sharpe is professor emeritus of finance at Stanford University and the 1990 Nobel Prize in Economics. In the study, he compared two investments: one made in a fund with high operating costs and the other in a fund with low operating costs. The low-cost fund was a Vanguard Total Stock Market Index Fund Admiral Shares, and had an expense ratio of 0.06 percent a year. The high-cost fund had an expense ratio of 1.12 percent a year, which Sharpe said is the average for such funds.

The differences were startling. Over a period of 10 years, the fees on an investment of $10,000 were only $153 with the low-cost Vanguard fund, compared to $2,720 for the high-cost fund. But far more important were the effects high operating costs have on fund returns over the long run. Again over a 10-year period, an investor in the low-cost fund ends up with 11.25 percent more wealth than an investor in the high-cost fund — all because of higher operating costs.

A person saving for retirement who chooses low-cost investments, Sharpe says, could have a standard of living throughout retirement more than 20 percent higher than that of a comparable investor in high-cost investments.

The funds being compared were index funds designed to simply track a benchmark. My Vanguard fund, for instance, mimics the S&P 500 (^GPSC ). While there is almost certainly a human looking after things at my fund, that person isn’t moving stocks in and out of it at his or her personal discretion. Not only would I have to pay extra for that, but I would also have to bear the costs such moves would generate.

Say It With Me Now: Expense Ratios

In his paper, Sharpe quotes a director of fund research at Morningstar (MORN ), which provides mutual-fund analysis and data: If there’s anything in the whole world of mutual funds that you can take to the bank, it’s that expense ratios help you make a better decision. They are still the most dependable predictor of performance.

Any investment house worthy of your money should be proud of its low-cost, high-return fund offerings. However you monitor your mutual fund’s performance, the expense ratio should be easy to find. And if it isn’t, you may want to ask yourself — and the company offering the fund — why.

Your daily habits and routines are the reason you got into this mess, writes Trent Hamm, founder of TheSimpleDollar.com. Spend some time thinking about how you spend money each day, each week and each month. Do you really need your daily latte? Can you bring your lunch to work instead of buying it four times a week? Ask yourself: What can I change without sacrificing my lifestyle too much?

Remove all credit cards from your wallet and leave them at home when you go shopping, advises WiseBread contributor Sabah Karimi. Even if you earn cash back or other rewards with credit card purchases, stop spending with your credit cards until you have your finances under control, she writes.