Expense Ratio Are You Paying Too Much

Post on: 28 Июнь, 2015 No Comment

A Lower Expense Ratio Means More For You

What is an expense ratio?

When you buy stocks and bonds directly there is a transaction charge when you buy or sell them, but there are no ongoing fees to own the investments. When you buy a mutual fund. the fund is buying and selling the underlying investments for you, and they charge an ongoing fee to do this. This fee is called an expense ratio.

- Expense ratios are expressed as follows:

Expense ratios are not deducted from your account or investment. Instead they are deducted from the total assets of the mutual fund before you get your share.

This means if the investments owned by the fund delivered a gross return of 10%, and the fund has an internal expense ratio of 1%, your return, net of fees, is 9%.

The article Mutual Fund Management Fees and Chocolate Chip Cookie Dough provides additional details on how expense ratios work in a fun way that is easy-to-understand.

What is an average expense ratio?

According to Morningstar, in 2011 the average large-cap fund with assets greater than $5 million has an expense ratio of 1.45% and an equivalent small-cap fund has annual expenses of 1.61%.

Funds that own small companies and international investments will have higher expense ratios than funds that own large U.S. companies. This is because it takes more expertise and research to research and trade in smaller stocks and overseas investments.

When comparing expense ratios, it is important to make sure you are comparing funds that own similar types of investments. It would not be fair to compare the expense ratio on an emerging markets fund to that of a U.S large cap fund. It would be fair to compare the expense ratio of one emerging markets fund to that of another emerging markets fund.

Where can I find my mutual fund’s expense ratio?

There are several ways you can find out the expense ratio of any mutual fund :

- You can search for information on the fund by its ticker symbol (a series of five letters). For example, Vanguard’s 500 Index Investor fund has a ticker symbol of VFINX. When I type that into the internet, the first item that showed up was Google Finance. When you glance through the information provided you’ll see a section called key statistics, where it shows the expense ratio is .17%

- You can always look up a fund’s expense ratio in the fund’s prospectus. This is mailed to you each year, although in some cases now it may be delivered to you electronically. You can download a fund’s prospectus from the mutual fund company’s website. Look in the table of contents for a section called “Fees and Expenses”, and it will tell you the expense ratio of your fund.

Why are expense ratios important?

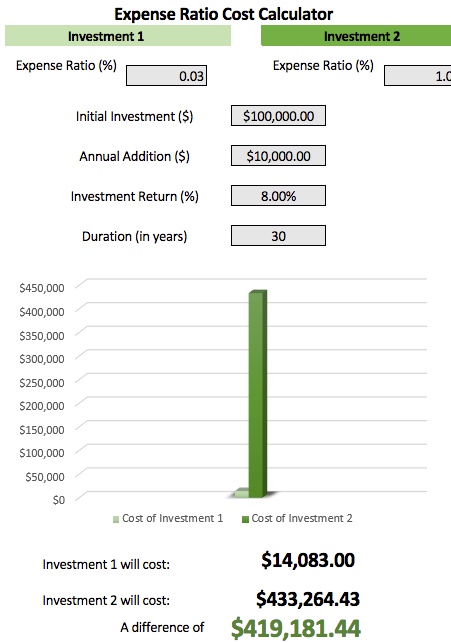

Expense ratios have the effect of reducing the return on your investment. You have to look at investment returns net of fees and taxes to make a good comparison.

Most mutual fund follow either an active investment philosophy or a passive investment philosophy. Active funds spend money on research and trading trying to pick the best set of investments, and because of the extra work involved, they have higher expenses. Passive funds own a pre-determined selection of investments and have much lower expenses. Studies show that net of fees and taxes, passive funds (also called index funds ) outperform active funds more often than not.

iShares is a fund company that offers low cost passive funds called exchange traded funds. They have an online tool which they call their Total Performance Challenge SM. You can put in the ticker symbol of any fund and compare it to their version. It will compare the returns, expense ratios, risk, and after-tax returns of the two funds.

Unknowingly, many investors pay too much for their investments. Paying attention to investment fees can increase your net return over time. For example, if you could find similar quality investments with expense ratios that were about .50% less than what you currently pay, on $100,000 that saves $500 a year. Over ten years, that adds up to $5,000 of savings.