Exchange traded funds

Post on: 12 Июль, 2015 No Comment

Posts tagged exchange traded funds

ETF Slam Dunk: Mixing Jordan & Rodman

Players in the same game may use different strategies in the hunt for success. Take five-time NBA champ Dennis “The Worm” Rodman vs. Hall of Famer and fourteen-time All-Star Michael Jordan. Rodman’s bad-boy antics, tattoos, and loud hair colors more closely resemble the characteristics of a brash trader or quick-trigger hedge fund manager, which explains why Rodman played for five different NBA teams. Jordan on the other-hand was less impulsive, and like a long-term investor, held a longer term horizon with respect to team loyalty – he spent 13 seasons with one team (Chicago Bulls), excluding a brief, half-hearted return to the Washington Wizards. Despite their differences, they shared one common goal…the ambition to win.

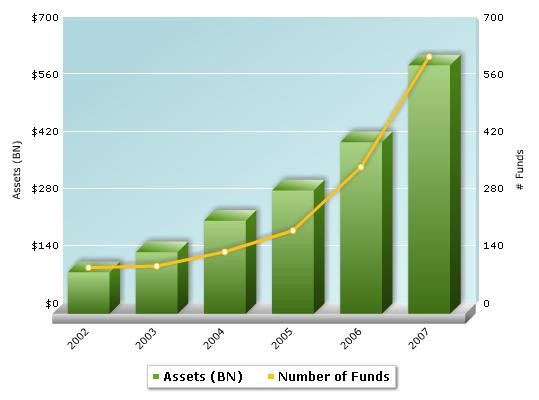

In the investment world, traders and long-term investors in many cases could be even more different than Rodman and Jordan…just think Jim Cramer and Warren Buffett. But when it comes to the exploding trend of Exchange Traded Funds (ETFs) expansion, traders and investors of all types share the common appreciation for lower costs (management fees and trading commissions). Beyond the lower costs, ETFs also offer a wide and growing range of liquid exposures, regardless of whether a trader wants to hold the ETF for five hours or an investor wants to own it for five years. The benefits of low cost and liquidity, relative to traditional actively managed mutual funds, are two key reasons why this market has blossomed to $822 billion in size and is still strengthening at a healthy clip.

Source: SPDR

The flight to bonds and out of equities has been well documented (see chart below), but underneath the surface is a migrating investor trend out of active managers, and into lower cost vehicles for equity exposure (ETFs and Index Funds). The poster child beneficiary of this movement is the Vanguard Group (based in Valley Forge, Pennsylvania), which manages $1.4 trillion in fund assets, including $112 billion in ETFs (Bloomberg). Equity heavy fund management companies like Janus Capital Group Inc. (JNS) and T. Rowe Price Group Inc. (TROW) have felt the brunt of the pain from the disinterested investing public.

Source: Iacono Research

The migration away from expensive actively managed funds has created a cut-throat dog-fight for ETF market share. Competition has gotten so bad that discount brokerage firms like Fidelity Investments ($1.25 trillion in mutual fund assets) and Charles Schwab Corp. (SCHW) have begun offering free ETF trading. Just two days ago Schwab also purchased Windward Investment Management, Inc. (

$3.9 billion in assets under management), for $150 million in stock and cash.

At the end of the day, money goes where it is treated best. Irrespective of differences between long-term investors and short-term traders, the lower costs and improved liquidity associated with ETFs have shifted money away from more costly, actively traded mutual funds. At my firm, Sidoxia Capital Management . I choose to use a diversified hybrid approach via my Fusion investment products (Conservative, Moderate, and Aggressive). Fusion integrates low-cost, tax-efficient investment vehicles and strategies, including fixed income securities (including funds & ETFs), individual stocks, and equity ETFs. Regardless of the differing preferences of hair colors and tattoos, my bet is that Dennis Rodman and Michael Jordan could agree on the importance of two things…winning games and using ETFs.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in JNS, TROW, SCHW or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.