Exchange rates Inside the Bitcoin economy

Post on: 16 Март, 2015 No Comment

Inside the Bitcoin economy

Add this article to your reading list by clicking this button

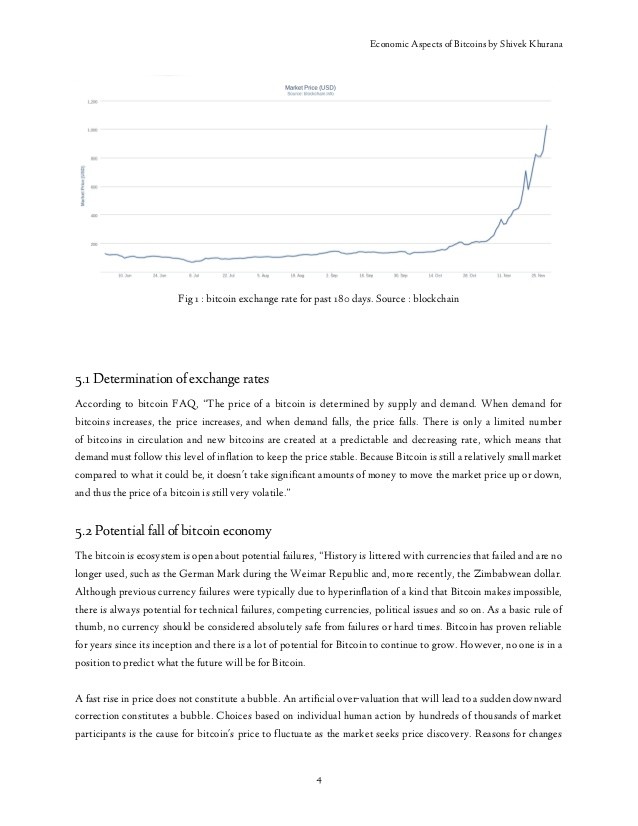

BITCOIN. a cryptocurrency that has all the financial world talking, has had a crazy few days. Bitcoins have always been volatile, but over the past week the currency went on a tear, rising to close to $300 dollars, before plunging, losing some 60% of their value in the space of a few hours. Felix Salmon considers the carnage and writes:

Bitcoin is clearly not an effective store of wealth — just look at how quickly that wealth can be evaporated. Neither is it a useful payments mechanism, given how fast its value can fluctuate. Currently, it can take an hour for a bitcoin transaction to clear, which means that the value of the transaction when it clears can be radically different from its value at inception. Bitcoin only works for payments if you can be reasonably sure that its value will remain reasonably steady for at least the next hour or so.

I’m going to play the pedant and note that this isn’t quite right. The dollar is one of history’s most successful currencies, I think it’s fair to say, and yet it, like virtually every floating currency, is prone to wild volatility. In the late 1990s, the trade-weighted dollar soared nearly 50%. It then turned on a dime, dropping 30%. Then, in a matter of weeks in late 2008 it jumped nearly 20%. Once again, that’s the trade-weighted dollar, not an individual currency pair (which can be much more crazily volatile).

Now over long time horizons those swings can have substantial macroeconomic impacts. But on a scale of weeks or months or even a year or two the average American has almost no idea that such movements are occurring nor does he care. And that’s because America is a massive economy, in which trade is a relatively small share of GDP, in which everyone is paid in dollars and in which everything is priced in dollars. Foreign exchange volatility matters only to the extent that the exchanges you care about have a foreign component.

Now in Bitcoinia (as we might call the Bitcoin economy) that means volatility currently matters very much. Almost every good one can purchase with Bitcoins is actually priced in dollars and sold at a Bitcoin price reflecting the prevailing exchange rate. So there is almost no Bitcoin frame of reference independent of the Bitcoin-dollar exchange rate. Bitcoinia mostly lacks internal supply chains, in which contracts for intermediate goods are denominated and settled in Bitcoins. People aren’t taking home Bitcoin paycheques. To put things simply: every good in Bitcoinia is an import and every job must be offshored. In that kind of economy, exchange-rate volatility matters a very great deal indeed.

But just because that’s how Bitcoinia operates now doesn’t mean that’s how it will operate always and forever. The more purchasing power there is in Bitcoinia, the greater the incentive there is to cater to Bitcoinian demand. The more transactions there are in Bitcoinia, the more entrepreneurs will want to hedge their exposure to foreign exchange volatility by paying suppliers or employees in the same currency they’re accepting as payment. And Bitcoin wage payments reinforce the demand for goods and services that can be purchased with Bitcoins. The greater the ability one has to buy and sell what one needs exclusively within Bitcoinia, the less foreign-exchange volatility matters.

Whether Bitcoinia actually attains that critical mass is very much an open question, and I certainly have my doubts. In early days volatility does matter a great deal, and huge swings against other currencies may kill the Bitcoin economy in its cradle. One might recommend a bit of macroeconomic management to create enough to stability to allow the critical mass to build, but centralised management is very much what Bitcoin is not about. Sceptical as Bitcoinistas may be of the value of central banking, it has developed as it has for a very, very good reason. And if the Bitcoin economy manages to come up with a completely decentralised way to stabilise itself without that top-down maintenance, well, that would be something very interesting indeed. More probable: either Bitcoinia will remain a small, fringe economy thanks to inherent instability, or a stabilising financial structure will somehow grow within it. And then one day we just might see a Bitcoinian J.P. Morgan gathering Bitcoinia’s financial eminences into a virtual office to cooperate in an effort to stave on looming financial panic.

Previous

Monetary policy: The mystery of stable prices

Next

Cypriot blues: Getting worse