Everything You Need to Know About Investing in Junk Bonds

Post on: 15 Июнь, 2015 No Comment

When many investors hear the term “junk bond,” they immediately associate them with Michael Milken, Ivan Boesky, and other notorious “junk bond kings” of the 1980s. However nefarious or unappealing the name may sound, you should not let it fool you, because if you own a bond fund, these seemingly unworthy investments may already be in your portfolio.

What Is a Junk Bond?

Technically speaking, a junk bond is identical to a regular bond. Junk bonds are simply IOUs issued from organizations or corporations that tell you how much it will pay you back, the date you will be paid back, and the interest you will receive for the borrowed money. The amount it owes you is known as the principal. The date you will be paid is called the maturity date. Finally, the interest a corporation or organization pays you is called a coupon.

The only thing that differentiates junk bonds from regular bonds is the credit quality of the organization issuing the bond. Every bond is characterized according to the issuer’s credit quality. Therefore, all bonds fall into one of the two following categories:

• Investment Grade – These types of bonds are issued to investors by borrowers deemed medium-to-low risk. Most investment grade debt ranges from BBB to AAA. Investment grade bonds do not provide huge returns, but investors benefit from reduced risk of default.

• Junk Bonds – These bonds provide investors with higher yields because borrowers have little to no borrowing options. However, they also have less desirable credit ratings of BB to Ba or less, increasing the risk exposure of investors .

A bond rating is essentially an organization’s credit rating report card. Blue-chip firms that are safer investments typically have a high bond rating. Conversely, risky organizations have a lower rating. Bonds are rated by Moody’s and Standard & Poor’s, which are the two leading credit and bond rating agencies.

Junk bonds may be advantageous to investors due to their high yields, but they also carry above average risk that the organization will default on the bond. In fact, junk bonds have an average yield of four to six percent more than the current yield for U.S. Treasuries, simply because of the added risk.

All junk bonds fall into one of the two following categories:

• Fallen Angel – This type of junk bond was an investment grade bond at one time, but it has fallen to junk bond status due to the diminished credit quality of the issuing organization.

• Rising Star – Rather than suffering from a falling bond rating, a rising star is a bond that has seen its rating increase as a result of an organization’s improved credit quality. However, many rising stars are still considered junk bonds; they are simply on their way to becoming investment grade.

What Type of Investor Should Purchase Junk Bonds?

Before you decide to invest heavily in junk bonds, there are a few things you must take into consideration. Obviously, you must take into account the fact that junk bonds are a high risk investment. With junk bonds, you risk never receiving your money back. Also, junk bond investments require a high-level of analytical skills and advanced knowledge in the field of specialized credit. Simply put, directly investing in junk bonds is mainly an activity for wealthy or extremely motivated individuals. Furthermore, this specialized market is primarily dominated by large institutional investors.

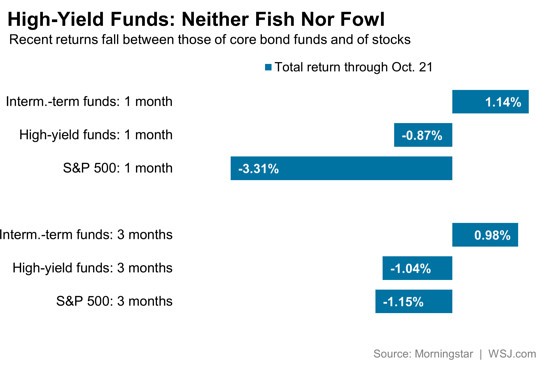

However, you do not necessarily need to be rich to invest in junk bonds. A number of individual investors choose to participate in junk bonds through the use of high-yield bond funds. In addition to allowing you to benefit from professionals who do nothing else but research junk bonds, high-yield bond funds also allow you to reduce your risk exposure through investment diversification across a number of asset types.

It’s important to note, however, that you should seriously consider how long you can tie up your cash before making the commitment to invest in a junk bond fund. With many junk bond funds, you are not allowed to cash out for one year or longer.

There are also times when the risk to reward ratio simply doesn’t make sense. You can determine if the risk is justifiable by examining the spread between U.S. Treasuries and junk bond yields. As mentioned earlier, junk bonds have an average yield of four to six percent above U.S. Treasuries. If you notice that junk bonds have a yield spread below four percent, then it wouldn’t be wise to invest in them at the time. It’s also a good idea to examine the junk bond default rate. This can easily be checked by viewing the Moody’s website .

As a final consideration, you should know that junk bonds follow boom and bust cycles. For instance, in the early 1990s, a number of bond fund investors were earning an impressive 30 percent annual return, but a sea of defaults can result in negative returns in no time at all.