European funds for cautious and adventurous investors

Post on: 27 Март, 2015 No Comment

This site uses cookies. Some of the cookies are essential for parts of the site to operate and have already been set. You may delete and block all cookies from this site, but if you do, parts of the site may not work. To find out more about cookies on the website and how to delete cookies, see our Privacy and Cookie Policy.

European funds for cautious and adventurous investors

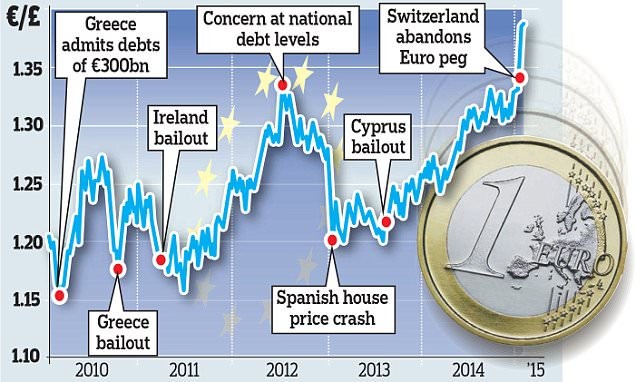

Mario Draghi disappointed the markets last week after dashing hopes that the European Central Bank (ECB) will embark on quantitative easing (QE) this year, after admitting that the board of the institution is split on how best to stimulate the ailing eurozone economy.

At the central banks monthly monetary policy meeting on Thursday, the president said there were major decisions where there was no unanimity following the ECBs decision to keep interest rates at record lows and undertake asset purchases of private sector bonds.

The ECB is widely expected to roll out a full QE programme, which would involve buying government bonds, at some point although this is opposed by Germany, which argues that it is beyond the central banks remit. However, Draghi said last week that it would be illegal for the ECB to not attempt to control inflation.

He supported hope that the bank will launch full-blown QE in the coming months, saying: The governing council remains unanimous in its commitment to using additional unconventional instruments within its mandate. This would imply altering early next year the size, pace and composition of our measure.

Fears that the eurozone is a risk of deflation and another recession have damaged investor sentiment towards the region, although the fact this has pushed its stock market to low valuations mean some have returned to hunt for bargains.

Tom Jemmett, fund analyst at Brewin Dolphin, said: Indications of a possible announcement of QE coupled with the dispersion in valuations between its developed country counterparts are both credible reasons for this return, however investors should be reminded the region is not without risk.

Given that there are strong bull and bear cases to be made for European equities, Jemmett highlights two funds — one for cautious investors and one for aggressive investors.

For the cautious Europe investor

Jemmett said: For investors wishing to take a fresh look at the sector, but in a more risk constrained framework, we recommend the Threadneedle European Select fund.

The 2.1bn fund has been managed by FE Alpha Manager David Dudding since July 2008 and achieved first-decile returns of 99.23 per cent, more than double the gains of the average fund in the IMA Europe ex UK sector and its FTSE World Europe ex UK benchmark.

Performance of fund vs sector and index over manager tenure

Jemmett said: Dudding adopts a strong focus on companies that can generate a superior return on capital invested over the long term. This will lead the manager to invest in defensive quality companies and away from the more cyclical sectors like the peripheral banks, however the relative valuation premium should reflect this.

Our data shows the five FE Crown-rated fund has a good track record in protecting its investors capital. In the down year of 2011 it lost just 5.41 per cent compared with a fall of 14.71 per cent in the benchmark and an average drop of 15.57 per cent in its peer group.

FE Analytics also shows Threadneedle European Select has 5.41 per cent maximum drawdown — which shows the losses an investor would have faced if they bought and sold at the worst time — over Duddings tenure, which is around one-third that of the sector and benchmark. Meanwhile, its annualised volatility of 9.44 per cent is about four percentage points lower than the sector and index.

The fund is also found on the FE Research teams Select 100, where it is highlighted for its long-term approach and concentrated portfolio. The team adds that Duddings preferred quality growth companies have gone out of fashion in recent years but maintains confidence that his approach can outperform over an economic cycle.

Threadneedle European Select has an ongoing charges figure of 1.06 per cent.

For the aggressive Europe investor

Of course, not all investors will want to adopt a cautious stance on Europe if they believe a turnaround is in sight. For these, Jemmett said: For investors comfortable taking on cyclical risk, we recommend the Neptune European Opportunities fund.

FE Alpha Manager Rob Burnett has managed this 630.2m fund since May 2005 and has significantly outperformed the sector and its MSCI Europe ex UK benchmark since with a 153.81 per cent gain.

Performance of fund vs sector and index over manager tenure

Jemmett said: The fund is highly geared into a domestic recovery in peripheral Europe, with a large overweight to Italian banks so should stand to gain from accommodative ECB policy. The fund will have significant sector bets so risk on an absolute, as well as relative, basis will be high.

Neptune European Opportunities has 29.6 per cent of its portfolio in financials, which would be expected to perform well if an economic recovery can take hold, with another 15.4 per cent in telecommunications and 12.8 per cent in utilities. Its largest positions are in Vodafone, France Telecom and Enel.

Burnetts aggressive positioning has not paid off in recent years, as investors have avoided European equities because of huge macroeconomic headwinds, leaving it in the IMA Europe ex UK sectors fourth quartile over one, three and five years.

However, fund pickers regard the manager and his process highly, with it being one of the most common picks given for investors with an optimistic outlook on Europe.

Square Mile, which gives it a A rating, said: This is an ambitious fund that at times can take aggressive positions. When these positions come good, returns can be impressive for holders of the fund; conversely the potential for return shortfall is significant.

Neptune European Opportunities has ongoing charges of 0.82 per cent.