EuroDollar Basis Swap Cost at 2008 Crisis Levels MarketBeat

Post on: 27 Апрель, 2015 No Comment

By Anusha Shrivastava and Vincent Cignarella

AP

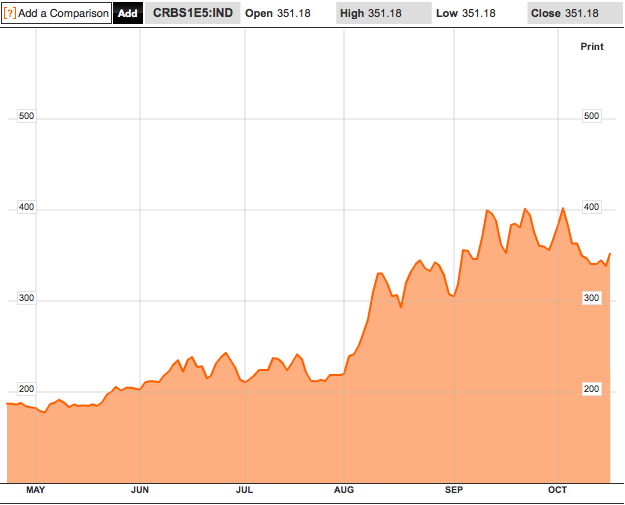

Elevated concerns about the fate of the euro zone sent a widely tracked measure of European funding costs to levels not seen since the 2008 financial crisis.

The three-month euro-dollar cross currency basis swap traded as wide as minus 126 basis points on Wednesday, its peak since December 2008.

This shows it is exceedingly more expensive to swap euros into scarce dollars for European financial institutions. Its elevated costs reflect investor concern that the European Central Bank is not buying enough bonds to bring down yields to stabilize European debt markets. Italian bond yields are hovering in the 7% range, a euro-era high. Yields on French bonds have also risen by 50 basis points in the last week.

People are looking at (the swap) and talking about it, said Todd McDonald, head of foreign exchange trading at Standard Chartered in New York. Conviction and volumes are both low. People are trying to avoid trading it.

However, some have no choice but to use the swap market or lean on the ECB for funds. Many avoid taking the latter route because it might damage the reputation of the borrower.

The swap has widened despite the European Central Banks efforts to ease the situation by establishing a window for banks and others to exchange the common currency for greenbacks.

After the ECBs announcement of this facility in September, the three month euro dollar cross currency basis swap was at minus 76.5 basis points, but has widened back out since then.

The direction (of the swap) is more important than the level because it will translate into what the market is doing in other risky assets, said Adrian Miller, senior vice president of global markets strategy at Miller Tabak Roberts Securities in New York. As these indices push lower, it signifies the markets anxiety level remains elevated.

Still, the ECB facility should prevent the indicator from reaching the minus 215 basis swap level seen in October 2008, by providing a last-ditch alternative for dollar-starved banks, analysts said.

Here We Go Again: Fitch Note on Bank Euro Exposure Slamming Stocks Next

Citi Economist Warns of Imminent Spanish, Italian Default