Eurobonds (Business) Definition Online Encyclopedia

Post on: 14 Август, 2015 No Comment

EUROBONDS — Bonds that are marketed internationally.

EUROCLEAR — The Euroclear group is the world’s largest settlement system for domestic and international.

EUROCREDIT MARKET — Comprises banks that accept deposits and provide loans in large denominations and i.

Eurobonds :

Bonds issued in Europe outside the confines of any national capital market. A Eurobond may or may not be denominated in the currency of the issuer. Canadian dollars deposited in a London bank are EURO Canadian dollars, German marks deposited there are EURO marks.

Eurobonds. bonds sold in a country other than the one in whose currency the bond is denominated. These are also known as foreign pay issues.

Eurobonds Bonds that are marketed internationally.

Eurodollar Market A banking market in U.S. dollars outside the U.S.

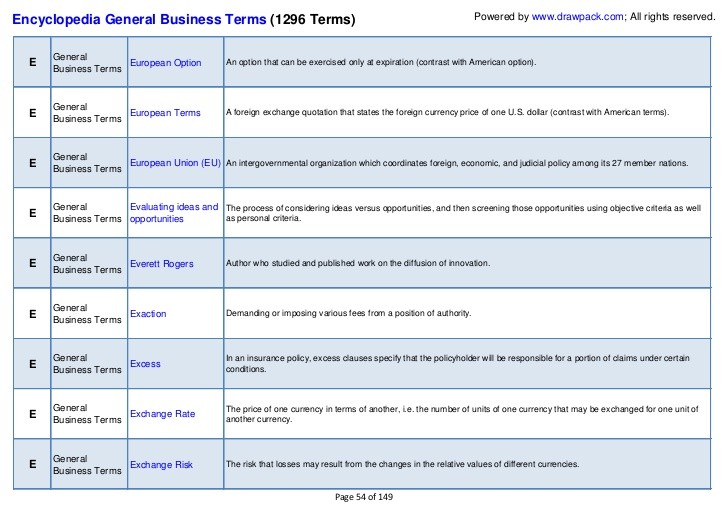

Exercise Price The price at which a call option or put may be exercised. Also called strike price.

Eurobonds. Bonds issued in any currency and are commonly listed in Luxembourg.

Eurodollar. U.S. dollar denominated deposits in banks outside of the U.S.

Eurobonds are interest — bearing securities issued in the Eurobond market. The Eurobond market constitutes with the foreign bond market the international bond market.

Eurobonds are unique and complex instruments of relatively recent origin. They debuted in 1963, but didn't gain international significance until the early 1980s. Since then, they have become a large and active component of international finance.

Eurobonds that pay coupon interest in one currency but pay the principal in a different currency.

SEARCH.

Eurobonds are issued by large borrowers such as governments and other public bodies or major multinational companies

See Also: Online share dealing service Stockmarket Centre.

Eurobonds denominated in ECUs.

Franзais: Obligations en ECU

Espaсol: ECU bonds

Eurobonds denominated in U.S.dollars.

Eurobonds denominated in U.S.dollars. Eurodollar certificate of deposit

A certificate of deposit paying interest and principal in dollars, but issued by a bank outside the United States, usually in Europe.

Euroequity issues.

Equity-linked Eurobonds — A Eurobond with a convertibility option or warrant attached.

Ethnocentrism — The belief that one ethnic group or culture is inherently more superior.

CEDEL A centralized clearing system for eurobonds .

Certainty equivalent An amount that would be accepted in lieu of a chance at a possible higher, but

uncertain, amount.

Certificate of deposit (CD) Also called a time deposit. this is a certificate issued by a bank or thrift that.

Equity-linked Eurobonds A Eurobond including a convertibility option or warrant.

CEDELA centralized clearing system for Eurobonds. CeilingThe highest price, interest rate, or other numerical factor allowable in a financial transaction. Centillion A unit of quantity equal to 10303 (1 followed by 303 zeros).

Eurobonds may take the form of loans, debentures or convertible debentures. and maybe designated in any currency.

EURODOLLARS — Dollars originally deposited in US banks that are acquired by persons resident outside the United States and held abroad, mainly in Europe.

Eurobonds may be issued in a single currency, in multicurrency form, or a unit of account, such as the European Currency Unit (ECU ). An important capital source for multinational companies, Eurobonds are cleared and settled through Euroclear and Cedel, two bank-owned clearing houses.

Certificates of Deposit (CDS), eurobonds. deposits, or any capital market instrument issued outside of the national boundaries of the currency in which the instrument is denominated (for example, Euro -Swiss francs, Euro -Deutsche mark s, eurodollars. eurodollar bonds, or eurodollar CDS).

For example, an Italian automobile company might sell eurobonds issued in US dollars to investors living in European countries. Multinational companies and national governments, including governments of developing countries. use eurobonds to raise capital in international market s.

Dual Currency Issues definition :

Eurobonds that pay coupon interest in one currency but pay the principal in a different currency.

FTSE 100, S&P 500 All In One

Expert analysis by professional trader, daily signals. high success rate, register for your FREE trial.

Eurodollar Bonds Bonds falling within the category of Eurobonds. that come with U.S. dollar denomination. [Read more. ]

Author: Skip Stamous Filed Under: e Tagged With: E Glossary, Eurodollar Bonds

Euroequity Issues.

A Eurobond is a bond issued by a borrower in a eurocurrency in a country that is not their own. Eurobonds are not subject to withholding tax. though an investor is obliged to declare the revenue obtained. Not to be confused with euro -denominated bonds, which are bonds issued in euros.

Ivory Coast missed a Dec. 31 coupon payment on its 2.5 percent dollar-denominated Eurobonds. Thierry Desjardins, who helped negotiate two debt restructuring s in the past 12 years on behalf of the London Club of creditors, said by phone from Paris.

International Bonds

Definition: A collective term that refers to global bonds. Eurobonds. and foreign bond s.

Source.

Dual-currency issues

Eurobonds that pay coupon interest in one currency but pay the principal in a different currency.

Other ways to look at the return generated by credit spread s is to measure the yield of each security against an industry sector curve, or (in the case of Eurobonds ) to measure the spread between bonds of the same credit rating and currency but differing by country of issue.

The sector includes domestic bonds. but foreign investors primarily buy bonds issued as Eurobonds or global bonds. Credit risk is a significant issue, and many outstanding bonds are restructured bank loans or restructured defaulted bonds.

Convertible Bonds. Pros And Cons For Companies And Investors

13 Pre-Issue Corporate Bond Questions For Businesses

The Ins And Outs Of Corporate Eurobonds

Debt Reckoning.

The bonds are usually issued by large underwriting groups from many countries. The entity issuing the bonds does not have to be from the country whose currency is being used. Eurobonds provide an important capital source for multinational companies and foreign governments.

Morgan Emerging Markets Bond Index Global (EMBI Global) tracks total returns for traded external debt instruments in the emerging markets. and is an expanded version of the EMBI+. As with the EMBI+, the EMBI Global includes US dollar-denominated Brady bonds. loans, and Eurobonds with an.

Gray market Purchases and sales of eurobonds that occur before the issue price is finally set. Greenmail Situation in which a large block of stock is held by an unfriendly company, forcing the target company to repurchase the stock at a substantial premium to prevent a takeover.