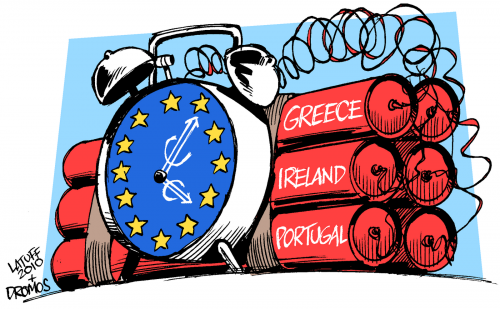

Euro zone crisis

Post on: 10 Апрель, 2015 No Comment

ajay kumar

Published on Mar 02, 2011

more>

the euro zone introduction and the reason for the crisis and its impact on the european countries and on the world

Transcript

Present condition.

Solution.

Conclusion.

It is an economic and monetary union (EMU) of 16 European Union (EU) member states

They have adopted the euro as their sole trading currency.

Euro became a reality on Jan 1, 1998. but came for the European consumers on Jan 1 2002.

It currently consists of Austria, Belgium, Cyprus, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain.

6. Introduction to Euro Zone crisis

It is the biggest challenge Europe has faced since 1990.

Due to global financial crisis that began in 2007-08 the euro zone entered its first official recession in third quarter of 2008.

The official figures were released in 2009 Jan.

On 11 Oct 2008, a summit was held in Paris by the Euro group heads of state and Govt. to define a joint action plan for euro zone and central banks of Europe to stabilize the economy.

7. Beginning of Crisis

Started in – Oct 2009 in Greece

Its immediate causes lie with the US crisis of 2007-09.

The result in Euro Zone was Sovereign debt crisis.

PIIGS: Portugal, Italy, Ireland, Greece, Spain.

8. What Happened and Why?

Greece: Sharp Budget Deficit

Large government and External Debts in PIIGS.

Greece credit rating downgraded.

Interest rates surged on government bonds.

Need for external aid from EU and IMF

The high debts and rising rate of interests was a matter of concern.

9. Reasons for rise in External Debts

High household indebtness.

Large current account deficit:

- Excessive growth in domestic demand. 10. Increase in wage rates. 11. Lower exchange rate risk.

Weakening export competitiveness.

Reasons for rise in Internal Debts:

Rising Unemployment: Lower tax returns, higher budget deficits.

12. PRESENT SITUATION

In the first quarter of 2010, the national debt of Greece was put at €300 billion ($413.6 billion), which is bigger than the countrys economy.

Greece has the worst combination of high debt level, large budget deficit and large external debt

20. GDP — $360 billion

Debt-GDP ratio – 113% of GDP

Budget Deficit – 12.9% of GDP

Current Account Deficit- 11.0% of GDP

Net Foreign Debt – 70% of GDP

Total Outstanding Public Debt- 290 billion euro

21. 22. Countries Affected By Greek Crisis

South-eastern Europe

Neighboring Serbia, Albania, Macedonia, Romania, Bulgaria and Turkey

Contagion Effect

Greek crisis has made investors nervous about lending money to governments through buying government bonds.

Reduced wealth:

Take-home pay is likely to fall as it is eroded by rising taxes.

Impact on private individuals

European governments and the International Monetary Fund (IMF) have stunned global stock markets with a 750bn-euro.

France agrees to pitch in with 17 billion euro.

27. Situation of other countries

Spain is experiencing the highest unemployment rate of 20%.

Italy- has already taken austerity measures. The lower house of parliament has voted for 25 billion Euros of cuts to reduce the country’s deficit. The govt. aims to reduce budget deficits down from 5.3% of GDP to 2.7% by 2012.

28. Effect on India

India’s exports to Europe could witness a slump close to 10%.

Export driven sectors such as textiles and software are likely to bear the brunt.

About 22-28 percent of revenues of India’s top tech majors come from Europe whose revenues will definitely be affected.

Government’s overall target of $200 billion for the fiscal could be at stake.

29. FUTURE PREDICTED

Either the euro zone should go for integrating their economic policies.

It collapses, and the Greeks and other profligate countries devalue and the banks (German, French, British and American) lose hundreds of billions.