Etrade Review 2015

Post on: 3 Май, 2015 No Comment

Etrade Review: Commissions, Fees, and Minimum Deposit

Etrade New Account Setup

Etrade new account online registration is fast (around 10 minutes) and well-organized, though the forms are not as clean-looking as they can be. The company offers several Sweep Options (where your money is held until you invest it) and the default is the E*TRADE Financial Extended Insurance Sweep Deposit Account, which offers daily interest and FDIC insurance up to $1,250,000. Other Sweep Options do not specify what interest (if any) they provide.

The company gives customers access to free debit card and check writing, although a minimum balance of $1,000 is required for that. What we also like is that right away all documents are set to electronic delivery, and there is a $2 fee for each document the customer chooses to have delivered through regular mail — let’s not forget about environment.

After we finished the application, we were given four options for funding an account: wire (1 business day), ACH (3 business days), check (5 business days) and account transfer (8 business days). We chose ACH, completed the bank information, and clicked the submit button. A message appeared saying You have requested access to a customer-only feature. This is apparently an error and it is definitely confusing to users. But when we logged in into our new account, everything was fine — all the information has been saved.

Funds deposited through ACH will appear to be available almost immediately; the Net Account Value on the main Etrade screen will show the transferred amount. But in reality it will become available for trading three business days later. A customer service representative will call on that day and offer assistance.

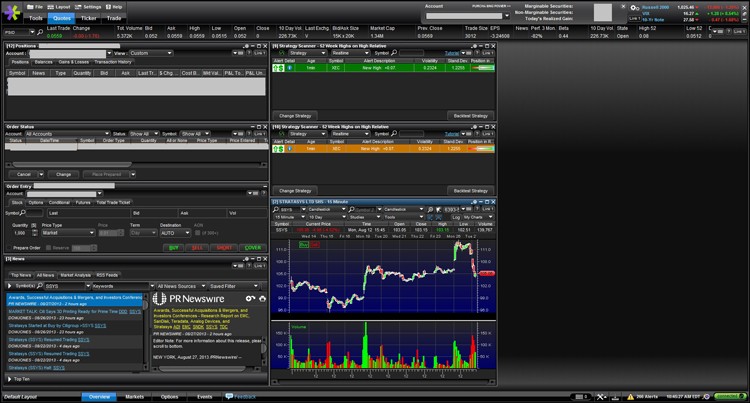

Etrade.com Website/Trading Platform/Tools Review

Etrade offers 18 powerful trading tools, including:

- Chart Patterns: up to twenty stocks ranked by how closely they meet your interests and spending limits.

- The Dragon: lets you scan the market for stocks and options that match your chosen criteria.

- StrategyScan: lets you find the strategy that aligns with your investing goals, trading experience and risk level.

- Chains: all-in-one screen for real-time quotes, intrinsic and time values, and complex spread construction.

Active traders (those who execute at least 30 stock or options trades during a calendar quarter) get free access to Etrade Pro — the firm’s direct-access desktop trading platform. Etrade Pro lets users find the top performing sectors, industries, and stocks in just three clicks. Customers can also watch fully integrated live-streaming CNBC right from their desktop.

The company has done a great job in making everything you see on your screen customizable. Just drag and drop anything to the desired place and you are done.

Etrade offers great mobile applications for investors wanting to trade or access their account from the smart-phone. Among other features, one can track the markets with streaming real-time quotes as well as securely buy, sell and place conditional orders with just a few taps.

Etrade Review: Company Pros

- No account maintenance or inactivity fees

- Large and well established company

- Powerful trading tools

- No IRA account fees, and no minimums with electronic statements and confirmations

- Low minimums to open accounts: $500 for cash account, $0 for retirement cash account, $2,000 for margin account

- Investing advice is available by phone or in person

- No surcharges on large orders or penny stocks

- Great research amenities from S&P, MorningStar, Thompson Reuters, Credit Suisse, and Smart Consensus

- Access to trading on 40 foreign exchanges

- Free streaming quotes

- Very broad selection of products: 8,000 mutual funds, every ETF sold, over 30,000 bonds, securities from 77 international markets, 1,300 no-load, no-transaction fee mutual funds, and 90+ commission-free ETFs

Etrade Review: Company Cons

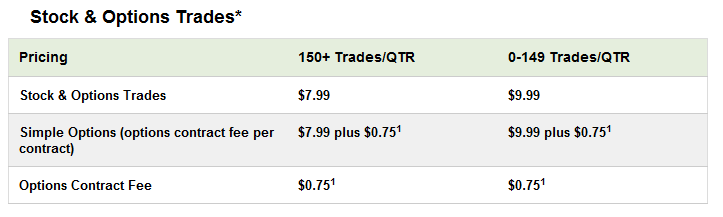

- High commissions on stocks and ETFs

- High margin rates

- $0.005 per share surcharge on extended hours trades (ECN fee) and on trades executed through E*TRADE Pro at an ECN during both regular market and extended hours sessions

- E*TRADE Pro platform is available at no charge only to customers who execute at least 30 stock or options trades during a calendar quarter

Etrade Review: Summary

Etrade is one of the best-known and largest online brokerage firms in the country, and it is a publicly traded company. When it was founded in 1992 as the first online discount brokerage, it revolutionized stock market trading. Since then, many other companies have followed the same business model. Based in New York, the company is winding down its mortgage-plagued bank activities to focus fully on its brokerage services.

Etrade’s stock and ETF commission is $9.99 per trade, options commission is $9.99 plus $0.75 per contract. Mutual funds are priced much more attractively at $19.99 per transaction. There are 1,300 no-load, no-transaction fee mutual funds available through the company.

Etrade offers some banking services to its customers — two checking accounts and mortgages. One of the things we like best about an Etrade account is the variety of options for accessing funds when needed. There are several methods available: transfer funds to another bank account, use a debit card to make a purchase or withdraw cash, or even simply write a check. One of the benefits of using Etrade debit card is that they do not charge a fee for withdrawing money from any ATM (unlike a traditional bank that charges for using an ATM outside of their network). Similar to traditional banks Etrade is a member of the Plus and Interlink networks meaning that you can use an ATM with those symbols and avoid being charged any fees. Etrade promotes unlimited ATM fee refunds when using an ATM that charges a fee.

Etrade customers have access to more than 30,000 bond issues. Clients can invest in Agency, Corporate, and Municipal bonds, Brokered CDs, Pass-thrus, CMOs, and Asset Backed Securities. The pricing for investing in bonds is very good: $1 per bond with $10 minimum and $250 maximum. We named the firm the Best Bond Brokerage in 2015.

The company offers access to trading on 40 foreign exchanges from Austria to South Africa — more than the typical 20 or so at other online brokers. Etrade also lets you trade 92 exchange-traded funds (ETFs) without paying a commission.

In summary, Etrade offers a lot of valuable services to the clients but its commissions on stocks and ETFs are higher than average. If you rarely trade securities or invest mostly in mutual funds or bonds than the company is a great option for both regular brokerage and IRA accounts.