ETFs Needed In 401k Plans

Post on: 25 Июль, 2015 No Comment

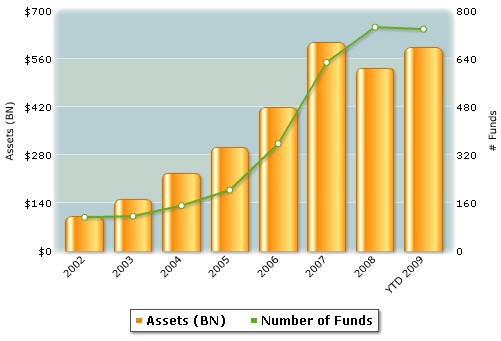

There has been a lot of discussion concerning the use of exchange traded funds as the primary investment vehicle within 401k plans. The barriers that once stood in the way are being removed by innovative record keeping and the growing use of ETFs in private and institutional accounts. There are some compelling reasons as to why ETFs can force the door open into 401k plans across America.

PASSIVE vs. ACTIVE

We all believe, or want to believe, that we are winners. This mindset can take us far in life, but it is not necessarily how we should approach portfolio management. Of course we want to win in investing, but investors should focus long term, not on the hot stock, sector or asset class of the year. There is a growing realization that actively trading stocks and bonds for short-term gain is a losing bet. We see this in a University of Maryland Study that shows, adjusted for risk, only 0.06% of fund managers beat their index from 1975 to 2007. 1975 is an important year as this is the conception of the Vanguard S&P 500 Index fund.

The buy and hold indexing approach is being fueled by two things: disenchantment with high-cost, under-performing active mutual fund managers; and the migration of brokers from commission firms to fee-only platforms where a fiduciary responsibility forces a better look at active mutual fund management. These issues have increased the use of index funds, specifically exchange traded funds. As plan participants want their 401k accounts to look like their private accounts, ETFs are building momentum to fill this void, especially in small to mid size 401k plans. Plan fiduciaries also realize that adding indexing to active management plan options reduces their liability.

LOW COST INVESTING

If a plan participant can save 1% a year in investment costs on a $20,000 portfolio, over a 20 year period that participant would have 17% more money, not accounting for any performance differences. The benefit of cost savings are more apparent over the last market decade where portfolio rates of return have been nearly flat after the 2000 tech crash, September 11th and the 2008 financial crisis. The average mutual fund costs 1.15%, where the average iShares ETF costs 0.45%. Core ETFs would be much less.

DIVERSIFICATION

Index funds offer great diversification. IVV or SPY hold all 500 stocks within the S&P 500, whereas a similarly styled actively managed mutual fund may hold only 40 — 60 equities, some not even listed on the S&P 500.

ETFs can also provide plan participants access to harder-to-reach asset classes such as emerging market bonds, frontier markets, international bonds or commodities. All of these asset classes can be held at a cost of less than 0.50%.

TRANSPARENCY

Ask any plan participant, or in some cases the plan sponsor, how much their plan costs. This includes the administration and investment fees. Very few will be able to tell you. In 2012 there is new regulation that will help change this, but up until this point transparency has been about as clear as a muddy river. Exchange traded funds provide a daily look into what is held within the portfolio, and management fees are fully disclosed. Add a report showing the participant plan administration fee and you will have a very transparent 401k.

WHO NEEDS ETFs TODAY?

One can argue that large plans have the negotiation power to lower plan participant investment costs. This is true to a certain extent. In some cases a Vanguard Index Tier may be more beneficial to plan participants versus exchange traded funds. The Vanguard Index Tier can drop investments costs below 0.05% if the plan is large enough. Indexing as an option if desired in these plans, whether it is an index mutual fund or exchange traded fund.

The real benefit for ETFs falls in plans with less than $100 million in assets. These 401k plans are currently being serviced by industry leaches such as the Hartford, VALIC, and other annuity-based 401k/403b plans. Participants in these plans can pay nearly 3% annually in fees. Lowering their costs by 2% would be huge.

For some plans that do not offer any form of indexing, often the plan sponsor has allowed the plan provider to offer a brokerage link account. This is where a participant is allowed to move all or a portion of their 401k balance into a brokerage account under the 401k umbrella. Within this account a plan participant can purchase most equities and bonds including index mutual funds and Exchange Traded Funds.

THE BARRIER

An exchange traded fund trades just like a stock, which means that they can be traded intraday with a bid and an ask spread. A net asset value (NAV) is also calculated; NAV is the value of the underlying securities. Mutual funds, on the other hand, trade at day end on NAV. There is a good probability that an intraday purchase of an ETF could be made at a value greater than the NAV, which is not a good thing for 401k plans. This issue has been solved by not allowing intraday trading of ETFs inside a 401k. Transactions will take place at the end of the day, just as mutual funds are currently traded. There has been noise that mutual funds have the same NAV issue but at a different level. There is debate that ETFs could, in the end, be traded more efficiently than mutual funds. This is actually good news for proponents of ETFs within 401ks, as just a short time ago this was a case-closed win for mutual funds.

Another barrier for ETFs has been record keeping. Up until recently, accounting systems would only handle mutual funds. Participants can hold fractional shares of a mutual fund. ETFs trade in whole shares. This has changed; through new techniques fractional ETF ownership is possible.

THE PLAYERS

Several companies are offering ETFs within 401k plans. The larger players are ING’s Sharebuilder 401k, Charles Schwab, Invest N Retire, WisdomTree, iShares and TD Ameritrade. All of these companies have invested into architecture that allows for the efficient use of ETFs within a 401k plan.

USERS

Plan sponsors that use ETFs within their plans are innovators, and the organizations understand investing at a level higher than the average sponsor. Case in point: Apple uses all ETFs within its 401k plans. This technology leader is now demonstrating its core value of innovation in its 401k plans as well. As other CFOs and HR directors learn about indexing and the use of exchange traded funds, the ultimate winners will be plan participants.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.