ETFs How Much Do They Really Cost

Post on: 6 Май, 2015 No Comment

Key Points

- When investing in ETFs, consider these four potential costs: commissions, operating expenses, bid/ask spreads, and changes in discounts and premiums to net asset value. The total cost of owning an ETF can vary significantly depending on the asset class the fund invests in, as well as your portfolio strategy. Essential reading for investors needing to understand ETF expenses.

Exchange-traded funds (ETFs) are similar to mutual funds except that they trade intraday like stocks. They’ve become extremely popular because they’re considered to be a less expensive way for investors to gain exposure to a diverse array of asset classes, including domestic and international stocks, bonds and commodities.

Even though ETFs can be relatively inexpensive, investing in them does include certain costs. The most obvious are commissions to trade ETFs (though some may be available commission-free) and operating expenses incurred while holding them. Trading costs can also include two misunderstood and sometimes overlooked items: bid/ask spreads. and changes in discounts and premiums to an ETF’s net asset value (NAV).

What’s more, both the nature of the asset class (broad category of investment) an ETF invests in as well as your portfolio strategy can affect the total cost of owning ETFs.

Let’s look at each of these factors in turn.

Trading commissions

In general, brokerage firms charge an online commission typically ranging anywhere from $8.95 to $19.95 when you individually trade an ETF without the assistance of a broker, in much the same way they charge to execute stock trades. The fee level can vary even more depending on your brokerage firm, account type, how often you trade, and whether you transact online, in person or over the phone. Many brokerage firms are now waiving commissions on certain ETF trades. For example, you can trade ETFs in Schwab ETF OneSource™ commission-free online in your Schwab account. 1

In cases where you pay commissions to trade ETFs, keep these two points in mind:

- The more frequently you trade, the more you’ll pay in total commissions.

- Because commissions are typically a flat fee no matter how large or small the trade, the percentage cost per trade will be larger for smaller trades and smaller for larger trades. For example, a $9 commission on a $900 trade represents a somewhat large 1% fee, whereas the same commission paid on a $9,000 trade represents a 0.1% fee.

The main takeaway is that commissions can play a more significant role in your total cost of ownership if you trade frequently or in small dollar amounts. This means that active traders should pay more attention to commission costs than long-term, buy-and-hold investors.

It also means that ETFs may not be the best choice if you frequently invest small amounts of money over long periods of time, unless you’re choosing ETFs that can be traded commission-free.

Operating expenses

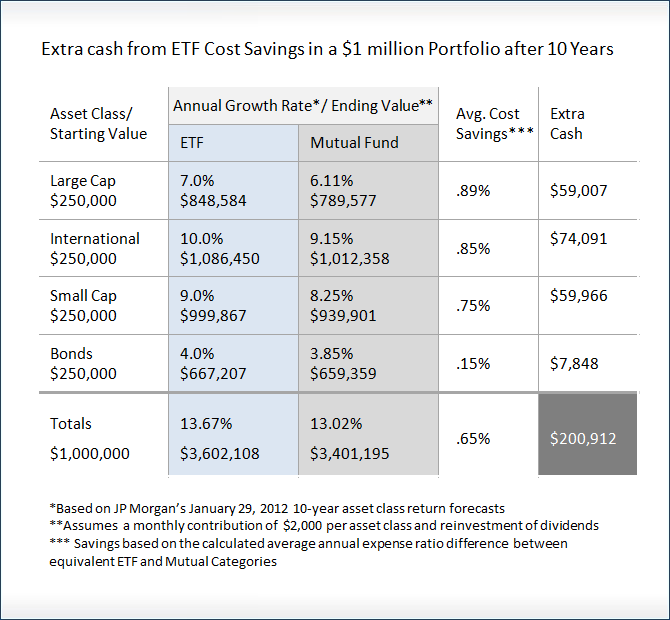

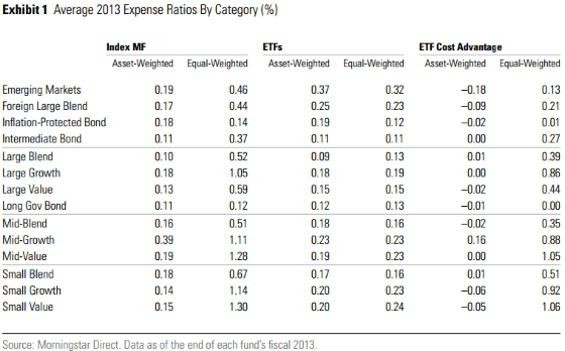

Most ETFs have attractively low operating expenses compared with actively managed mutual funds, and to a lesser extent, passively managed index mutual funds.

ETF expenses are usually stated in terms of a fund’s operating expense ratio (sometimes abbreviated as OER). The expense ratio is an annual rate the fund (not your broker) charges on the total assets it holds to pay for portfolio management, administration and other costs.

Since the expense ratio represents recurring fees that you’ll incur for as long as you own an ETF, it’s relevant for all investors, but particularly for long-term, buy-and-hold investors.

In cases where two or more ETFs track the same market index (or similar indexes), be sure to compare their expense ratios. A little homework might pay off, though of course you should focus on more than just expenses when choosing an ETF.

Bid/ask spreads

Commissions and expense ratios are fairly easy to understand, but ETF investors often overlook a third cost: the bid/ask spread .

The ask (or offer) is the market price at which an ETF can be bought, and the bid is the market price at which the same ETF can be sold.

The difference between these two prices is commonly known as the bid/ask spread. You can think of it as a transaction cost similar to commissions except that the spread is built into the market price and is paid on each roundtrip purchase and sale. So, the larger the spread and the more frequently you trade, the more relevant this cost becomes.

Many complicated factors drive bid/ask spreads, but three stand out:

- The extent of market maker competition.

- Market maker inventory management costs.

- The liquidity of the ETF itself.

Let’s explore these in more detail.

Each ETF has at least one market maker whose role is to set a bid and offer price in the absence of public buy and sell orders. Market makers help ensure that transactions in an ETF are as smooth and continuous as possible by facilitating orderly trading and helping to provide liquidity when buying and selling imbalances exist.

The more market makers that participate in the trading of a particular ETF, the narrower the bid/ask spread tends to become. This is because investors’ trades will be executed at the best bid and offer prices available, so the market makers have to compete with one another to attract order flow.

Market makers’ inventory management costs are another factor that influences bid/ask spreads. For example, market makers might hold direct long or short positions in the ETFs they deal in, but in order to minimize their own risks, they’ll often hedge their positions using derivatives, or by buying or selling baskets of the securities that underlie the ETF. (They eventually unwind these baskets themselves or exchange them directly with the ETF itself.)

What’s important to understand is that the market maker will attempt to pass these costs along to investors in the form of larger bid/ask spreads. Remember, they also have to be competitive in their bid and ask prices, or they won’t be able to attract order flow.

A third factor influencing bid/ask spreads is the liquidity of the ETF itself. The liquidity of an ETF is linked to the number of investors interested in buying or selling a position in the ETF at any point in time. The notion that higher liquidity can shrink bid/ask spreads makes intuitive sense—the more investors interested in being party to a transaction, the closer the highest price offered to buy and the lowest price offered to sell are likely to be. Similarly, less-liquid ETFs tend to have larger bid/ask spreads.

Let’s bring some of these points together by comparing two hypothetical ETFs.