ETF Spotlight MortgageBacked Real Estate Investment Trust

Post on: 11 Август, 2015 No Comment

ETF Spotlight News:

ETF spotlight on the Market Vectors Mortgage REIT Income ETF (NYSEArca: MORT ). part of an ongoing series.

Assets. $51.6 million

Objective. The Market Vectors Mortgage REIT Income ETF tries to reflect the performance of the Market Vectors Global REITs Index, which follows publicly traded mortgage real estate investment trusts.

Holdings. Top holdings include: Annaly Capital Management (NYSE: NLY) 20.6%, American Capital Agency Corp (NasdaqGS: AGNC) 15.9%, MFA Financial (NYSE: MFA) 5.1%, Hatteras Financial (NYSE: HTS) 4.9% and Invesco Mortgage Capital (NYSE: IVR) 4.8%.

What You Should Know :

- Van Eck Globals Market Vectors sponsors the fund.

- MORT has an expense ratio of 0.40%.

- The fund has 25 holdings and the top 10 make up 73.4% of the overall portfolio.

- Market capitalization allocations include: large-cap 35.1%, mid-cap 39.9% and small-cap 25.0%.

- The ETF has 12.09% 30-day SEC yield.

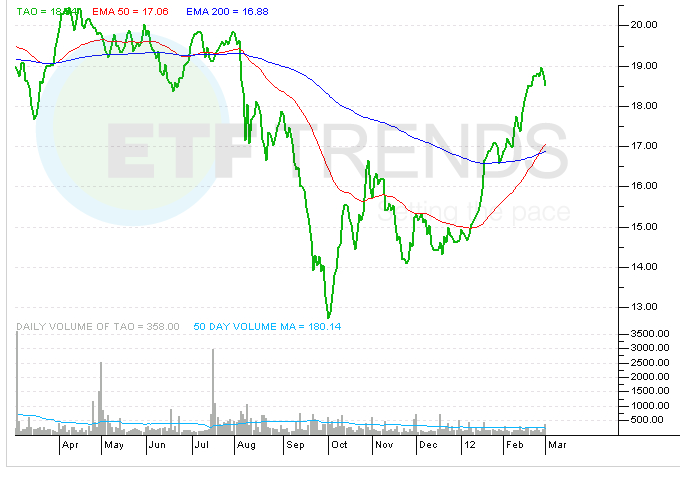

- The fund is up 5.5% over the last month, up 8.4% over the past three months and up 22.3% year-to-date.

- MORT is 6.7% above its 200-day exponential moving average.

- Real estate investment trusts are exempt from corporate taxes if they distribute at least 90% of income to share holders.

- Distributions are not qualified ad are taxed as ordinary income.

- This ETFs portfolio is composed of mortgage REITs, which are firms that seek to benefit from the spread between short-term and long-term rates by using very short-term debt such as repurchase agreements to fund purchases of residential and commercial mortgage-backed securities, according to Morningstar analyst Patricia Oey.

- At this time, mortgage REITs are benefiting from historically low short-term rates, Oey added. Given that the underlying investments in this ETF are mortgage-backed securities, investors in this ETF are exposed to credit risk and prepayment risk.

The Latest News :

- Mortgage-backed REITs are benefiting from the low, stable interest rate environment, at least through 2014.

- The spread between the 2-year Treasury and 10-year Treasury bonds of around 125 basis points and 200 basis points help make REITs an attractive option.

- The 30-year fixed-rate average hit a historic low 3.49%, compared to the average 4.55% last year.

- “Market concerns over the strength of the economic recovery brought long-term Treasury yields to new lows this week allowing fixed mortgage rates to reach record levels,” Frank Nothaft, Freddie Mac vice president and chief economist, said in a Washington Post article.

Market Vectors Mortgage REIT Income ETF

For past stories in this series, visit our ETF Spotlight category .

Max Chen contributed to this article .

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.