ETF replicatephysical and synthetic

Post on: 16 Март, 2015 No Comment

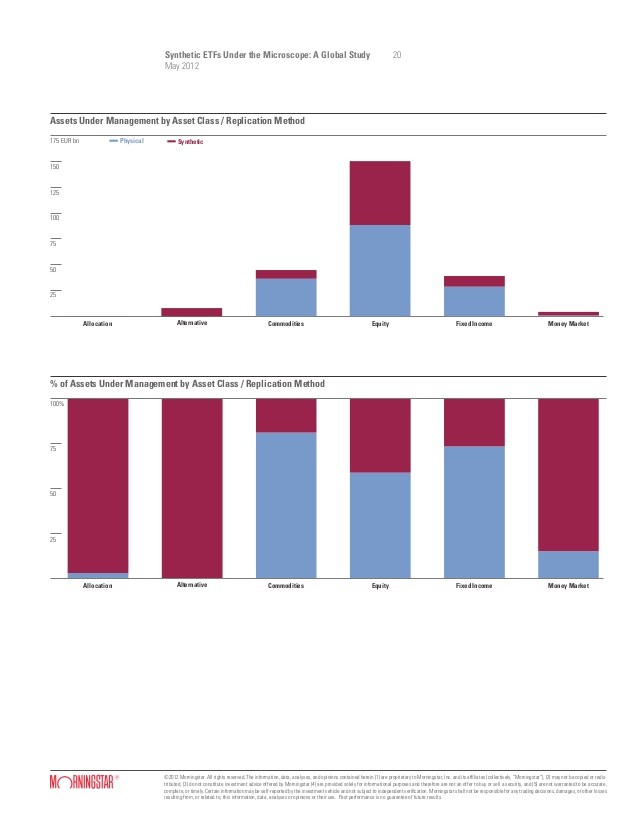

ETF can use physical or synthetic replication. The first method is by far the most used and means that an index funds a representative part or all of the components of an index in the portfolio continues to be as true to nature to mimic an index.

This is a highly transparent investment with a low tracking error. That is the difference between the yield of the index fund and that of the index that mimics it.

Physical replication:

- Simple and transparent investment;

- Low tracking error;

- No counterparty risk as long as effects not be lent.

Swap Agreement

For some indices is physical replication tricky to achieve. A provider of a physical ETF that the MSCI Emerging Markets Index one-on-one follows, gets more than 1,500 funds on costs because it hunted from 21 countries must go purchases and sales. In addition, some scholarships also inaccessible to investors, such as those of India. In these cases is synthetic replication more meaningfully.

In case of synthetic replication connect a fund provider a swap agreement with one, but often several investment banks. The swap counterparties receives the money that investors have put in the index fund and delivers in return a basket effects: the lean or so-called reference basket . It can just as well effects that no relationship with the index. The intention is that the reference basket the same yield as the index, but many concerns about the ETF provider not to worry because with the counterparty (s) the return of the collateral is agreed that he trades against that of the index.

Synthetic replication

- Relatively cheap and reliable;

- Index can be very accurately imitated;

- Access to closed and/or less liquid markets.

ETF History

The first ETF to use physical replication with the S&P 500 index as benchmark saw the light of day in 1993. A.D. 2013 the largest share of the ETF s use physical replication. Market leader Plus500 CFD Service (your capital may be at risk) has a strong preference for physically choose to replicate and also other distributors of ETF currently massively for physical replication. After a fierce debate about replication methods, the European Securities and Markets Authority (ESMA) in late July 2012, however, that both methods may be used.