ETF picks for your RRSP portfolio The Globe and Mail

Post on: 22 Июнь, 2015 No Comment

As the March 1 deadline looms for contributions to registered retirement savings plans, we asked four fund watchers to suggest ETFs that could be core holdings or fit inside a diversified portfolio.

Dan Hallett director, asset management, HighView Financial Group:

Vanguard Dividend Appreciation ETF

This U.S.-listed ETF tracks an index of U.S. stocks with a history of raising their dividends over time, he said. Academic research is increasingly identifying dividend growth, not just the raw yield, as a major contributor to total returns over time. When things get tough, this shouldn’t lose as much as broader indices. He suggests this ETF as a good as a core holding, and is not concerned with currency matters, because the Canadian dollar is still close to par with the U.S. greenback.

Claymore International Fundamental Index ETF

This ETF mimics the FTSE RAFI Developed Ex-U.S. 1000 index, which weights stocks by fundamental statistics instead of market value, and is a good core holding, he said. Stocks are weighted by cash dividends, cash flow, sales and book value, taken as an average over the previous five years. Market-cap weightings can get disconnected from fundamentals, particularly at market extremes, he said.

Vikash Jain, president, ArcherETF Portfolio Management:

iShares Canadian Dividend ETF

The ETF holds 30 Canadian blue chips and pays a dividend yield of nearly 4 per cent versus 2.5 per cent for the iShares S&P/TSX 60 ETF (XIU-T), he says. Compared to most places, Canada is in a pretty strong position, economically. Markets are shaky at the moment, but long-term, a good dose of Canadian equities are great for any RRSP.

SPDR S&P Emerging Asia Pacific ETF

East Asia ex-Japan is another rock, he suggested. Even after the Great Recession, most countries in the region have small budget deficits, healthy trade surpluses and positive [gross domestic product] growth. Inflation is mild, except in India. This ETF holds over 200 companies concentrated in China, Taiwan and India. The downside is that the region relies heavily on the worn-out U.S. consumer, but to counter that, about 60 per cent of the ETF is in companies serving local consumers.

Investor Education:

- All about ETFs

- How to make ETFs part of your RRSP

- Related content The bad boys of the ETF world

- Are ETFs your cup of tea?

- How do ETFs fit my investment strategy at this stage in life?

- Related content How do Exchange-Traded Funds (ETFs) work?

Tyler Mordy, director, research, Hahn Investment Stewards & Co. Inc.:

Market Vectors Global Agribusiness ETF

This ETF tracks an index of global companies in the agriculture business. Agriculture-related investments have a high probability of untethering from a slower-growth scenario expected in consumption-driven Western countries, he said. Food-price inflation is heating up, particularly in emerging parts of the world, while ongoing urbanization and improvement in dietary trends in developing parts of the world ensure this trend continues.

iShares U.S. Investment Grade Corporate Bond CAD-Hedged Index Fund

This ETF holds U.S. investment-grade corporate bonds. Aggressive policy responses among governments to stimulate their economies increase the probability that creditors will lose confidence in sovereign debt, he said. Eventually, government bonds in the most indebted nations risk losing their traditional safe-haven status. In this new environment, corporate bonds will do better than their sovereign counterparts.

Ioulia Tretiakova, director, quantitative strategies, PUR Investing Inc.:

BMO High Yield U.S. Corporate Bond Hedged to CAD ETF

A high-yield bond ETF provides a good diversifier to equities, she said. Nobody would call high-yield bonds a low-risk investment, but generally this asset class has lower volatility than equities. The higher yield from its shorter-duration bond investments — about five years — would compensate for the risk from a looming rise in interest rates if the ETF is held over a longer term, she added.

PowerShares DB Commodity ETF

This ETF is based on the Deutsche Bank Commodity Index, composed of futures contacts on 14 physical commodities. This investment can improve diversification beyond broad-based Canadian or U.S. stock and bond ETFs, she said. Commodities also have the added benefit of inflation protection. Currency hedging is generally desirable, but there are no broadly diversified Canadian-listed commodity ETFs, she said.

***

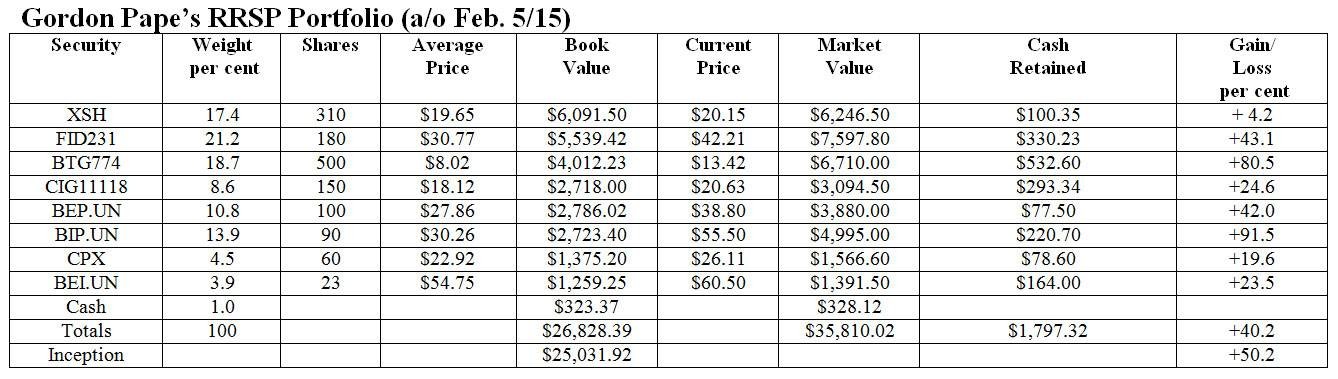

ETF Picks for an RRSP Portfolio