ETF opens up mortgagebacked securities market

Post on: 20 Июль, 2015 No Comment

JohnSpence

BOSTON (MarketWatch) — Most specialized exchange-traded funds are launched on a market segment when it’s hot, but considering the subprime-lending market’s well-publicized woes, that’s certainly not the case with a new ETF that provides exposure to mortgage-backed securities.

Although the timing of the listing of iShares Lehman MBS Fixed-Rate Bond Fund MBB, -0.05% Friday on the American Stock Exchange raised eyebrows given concerns swirling around the mortgage market, analysts said the ETF will likely serve a need in long-term investors’ portfolios.

These are not subprime mortgages and I wouldn’t classify this ETF as a risky security, said Greg McBride, senior financial analyst at BankRate.com.

It’s important to note that the new ETF does not hold riskier subprime loans, which are designed for lower-income homebuyers with weaker credit scores who don’t meet banks’ strictest lending standards.

Major subprime lenders such as New Century Financial Corp. NEWC, +10.00% and Accredited Home Lenders Holding Co. LEND have come under intense pressure in recent weeks after their own lenders hit them with margin calls. Mortgage lenders are tightening their standards or simply exiting the subprime business, and some worry the pain could spread into the broader mortgage market and slow the economy.

Conversely, the new ETF, which has an expense ratio of 0.25%, tracks an index of investment grade fixed-rate mortgage-backed securities of government-sponsored mortgage issuers Ginnie Mae, Freddie Mac FRE, +1.43% and Fannie Mae FNM, +1.02% The mortgage-backed securities are pass-through, meaning all principal and interest payments from the mortgage pool are passed directly to investors. The securities must be non-convertible.

The index includes 30-, 20-, 15-year and balloon securities that have a remaining maturity of at least one year and have more than $250 million of outstanding face value, according Barclays Global Investors, the ETF’s sponsor.

In the beginning of February, there were 387 issues in the Lehman index but BGI says it plans to sample the benchmark rather than necessarily holding every security.

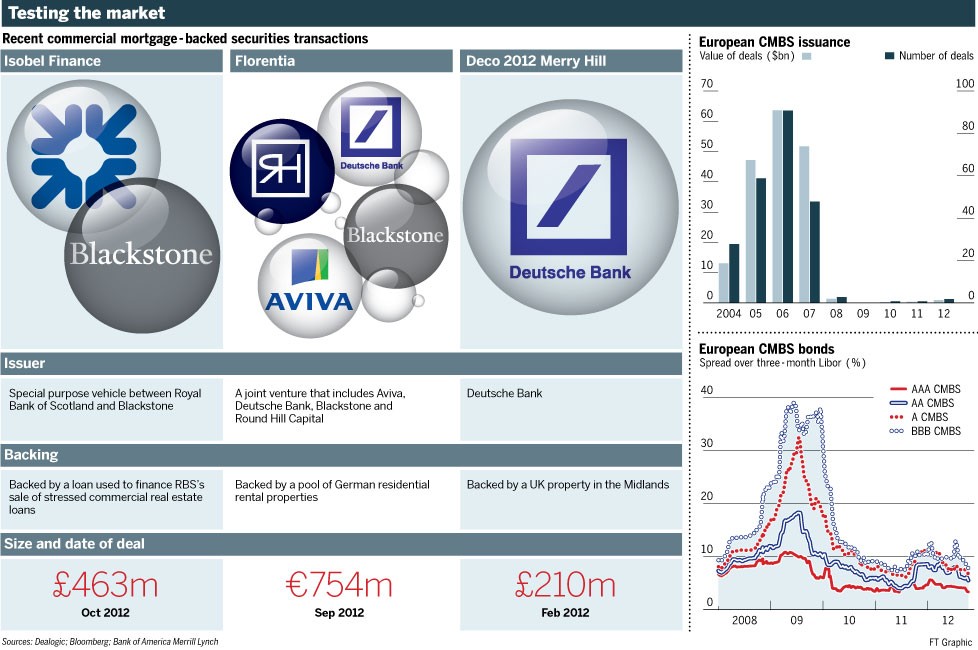

The issuance of agency mortgage-backed securities from Ginnie Mae, Freddie Mac, and Fannie Mae combined has grown from $23.1 billion in 1980 to a peak of about $2.13 trillion in 2003, according to the Securities Industry and Financial Markets Association.

The mortgage market underwent a sea change in the 1980s when banks rather than holding the loans on their own balance sheets started selling mortgages to other institutions, which then pooled them and sold off slices to investors, a process called securitization.

Mortgage-backed securities are bonds that represent a claim on the principal and interest from the loans, and tend to pay out a higher yield than comparable quality government or corporate bonds.

Questions of timing, risk

One reason mortgage-backed securities have higher yields is to compensate investors for so-called prepayment risk. When interest rates decline, home owners often pay off their loans early, refinance their mortgages or buy a bigger house, so holders of mortgage-backed securities have some uncertainty about the timing and amount of their payments.

According to the ETF’s prospectus, prepayment risk is the risk that during periods of falling interest rates, an issuer of mortgages and other securities may be able to repay principal prior to the security’s maturity causing the fund to have to reinvest in securities with a lower yield, resulting in a decline to the fund’s income.

Meanwhile, when interest rates rise, the value of the securities may fall as home owners pay off their mortgages at a slower pace.

Because of prepayment and extension risk, mortgage-backed securities react differently to changes in interest rates than other bonds, according to the prospectus. Small movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain mortgage-backed securities.