ETF Managed Portfolio Landscape Sees Consolidation Of Assets

Post on: 16 Март, 2015 No Comment

Assets in ETF managed portfolios remained flat in the second quarter, according to a new report.

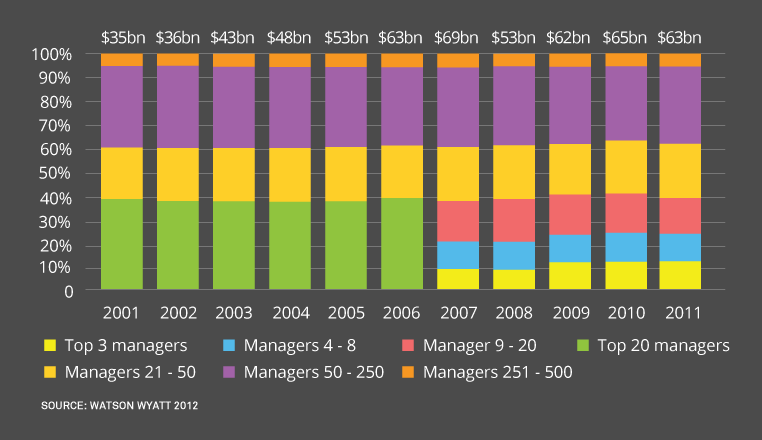

But a dive beneath that bland finding reveals a more interesting nugget about this fast-growing subindustry: Investor dollars are increasingly concentrated in the hands of a select few firms.

The 10 biggest asset managers in the ETF space hold roughly 75% of industry assets compared with 67% a year ago, says Morningstar’s second-quarter study on the ETF managed portfolio marketplace, released Friday. Overall, their portfolio strategies held $102 billion in assets, up 28% from $80 billion in the year-earlier quarter.

The landscape is continuing to become more top-heavy, said Ling-Wei Hew, an ETF-managed portfolio analyst with Morningstar. We’re seeing some of the smaller firms drop off.

The exit of some firms and strategies contributed to the flat asset picture in Q2. At the same time, existing managers expanded their product offerings to fill in gaps in their strategies.

Risk-based allocation continues to be a favored strategy. Since the 2008 financial crisis, ETF-managed portfolios have built on their success in addressing downside risk.

ETF-managed portfolios typically have more than 50% of assets invested in exchange traded funds. The professional money managers who put these packages together serve as a vital link between ETF providers and investors, and between providers and the financial advisers who use managed portfolios for their clients.

Outsourcing Tool

The services of third-party portfolio managers free up financial advisers to focus on asset gathering, tax planning, estate planning and managing the client’s profile.

It’s a way for advisers to outsource portfolio management and get institutional-type diversification, Hew said.

In 2013, assets in ETF-managed portfolios grew 40% vs. the 27% growth for all U.S. ETF assets.

At the end of the 2014 second quarter, the 667 strategies from 145 firms tracked in the study held a total of $102 billion. More than a third $36 billion was in U.S. equities.

The $34 million Athena Global Tactical ETFs portfolio was the top-performing strategy over a three-year period, returning an annual average 23% to investors. Its shares were up 10% this year at June’s end.

While the $10 billion Windhaven Diversified Growth portfolio was the largest strategy in the report, Good Harbor Financial’s Tactical Core US strategy showed the most asset growth in dollar terms.

It picked up $4 billion in the trailing 12 months, hoisting total assets to $9.6 billion and claiming the second spot for size.

Fastest Growers

Tactical Core US’ 73% asset growth in that time frame lagged other managed portfolios. The MIS Income & Growth ETF and MIS Growth ETF strategies led the way in percentage growth, gaining 240% and 216% respectively.

F-Squared Investments, with $25.6 billion in assets, is the largest ETF managed portfolio firm, followed by Windhaven Investment Management and Good Harbor Financial.

The three companies accounted for eight of the top 10 largest ETF managed portfolio strategies.

Charles Schwab (NYSE:SCHW ) acquired Windhaven in 2010.