Equity Risk Premium What is It How to Use It

Post on: 20 Апрель, 2015 No Comment

Introduction to the Equity Risk Premium

You can opt-out at any time.

Please refer to our privacy policy for contact information.

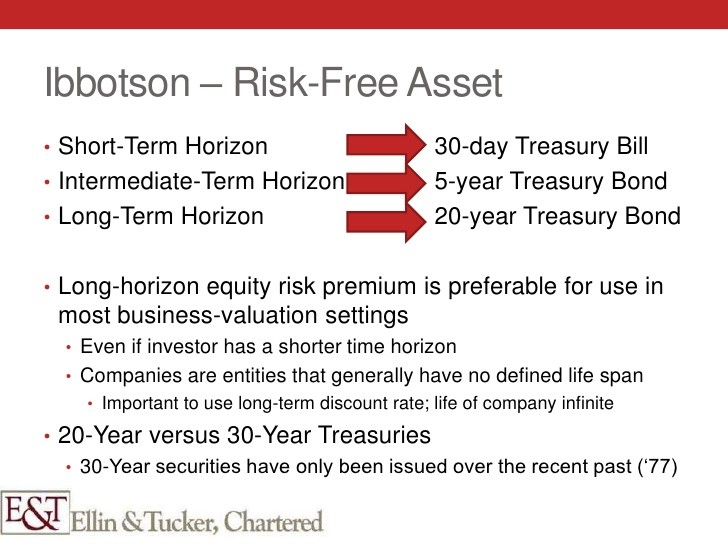

Equity risk premium is the excess return above and beyond the risk-free rate of return that you would expect to earn from investing in stocks. The risk-free rate is measured by T-bills, or long-term government bonds, as this type of investment is considered by academics to be risk-free (in that the U.S. Government is not expected to default on its loans).

Where do you see equity risk premium?

In any type of equity, whether it is an individual stock or a mutual fund.

How is the equity risk premium measured?

Simply put, if a long-term government bond (or risk free investment) has a return of 3% and a stock is expected to have a return of 11%, the equity risk premium is 8%. When looking at an equity return, capital gains, dividends and interest yield are included.

Only historical premiums can be calculated precisely since future returns are only anticipated. You can estimate an expected equity risk premium going forward and these estimates are used by many investment managers in an attempt to model out and project future returns. The CFA Institute has a research paper called The Equity Risk Premium that dives into additional detail on methods of calculation.

How do you avoid the equity risk premium?

You avoid the equity risk premium by avoiding stock investments all together. However if you invest only in safe investments. you take the risk that inflation will outpace the returns you earn.

How do you use the equity risk premium to your advantage?

Use the equity risk premium to gauge how ‘risky’ an investment is relative to the risk free rate. When buying an equity with a higher risk premium, expect that the return would be higher. On the flip side, when you have the opportunity for higher returns in the long term, you also have the chance of seeing much lower returns in the near term. This series of graphs titled Best and Worst Rolling Index Returns gives you a good visual representation of the equity risk premium in action.

For Retirees:

Equity risk premium is more of a concern for those in retirement (or near retirement) because of the time horizon you have. If the equity markets go down 50% in value the year before you retire, and you have a large portion of your investments in equities, this will affect the amount of portfolio withdrawals you will be able to take going forward.

As you take withdrawals from your portfolio, the effects of the equity risk premium can be even more drastic. If you don’t plan ahead and have enough cash on hand, then need to sell equities when the market is down (volatility goes hand in hand with equity risk premium), then you may be forced to sell at market lows. Equity risk must be carefully managed through proper asset allocation as you near retirement, and once you are retired.

My Experience with the Equity Risk Premium

Back in 1999, before I was a financial advisor, with all the money I had saved (which wasn’t a lot, but all I had), and without knowing anything about markets, I went to a broker and told them I wanted to invest. Given my age, the broker said, 100% equities would be my “ideal” portfolio, but didn’t explain that I needed to actually stay invested for the long term (more than 10 years). Needless to say, over the next three years the equity markets did not do so well. This is when I decided to sell everything, a natural reaction, but not a very good one. Lessons learned:

- Depending on the time you start and end your investment, you may not be compensated for the equity risk you take…know your time frame and stick to it, and

- Selling at the bottom means you have no chance to recover the losses you have already suffered

I wish I had done a bit more research before I started my investing endeavor and stayed invested over my anticipated investment time horizon (which would have been much longer than three years).

Instead of viewing this as a total loss, I viewed this as a challenge to figure out and learn as much as I could about how investing really works. This eventually led to my career as a fee only financial advisor .