Equity markets Back to the Shiller p

Post on: 21 Август, 2015 No Comment

Back to the Shiller p/e

Add this article to your reading list by clicking this button

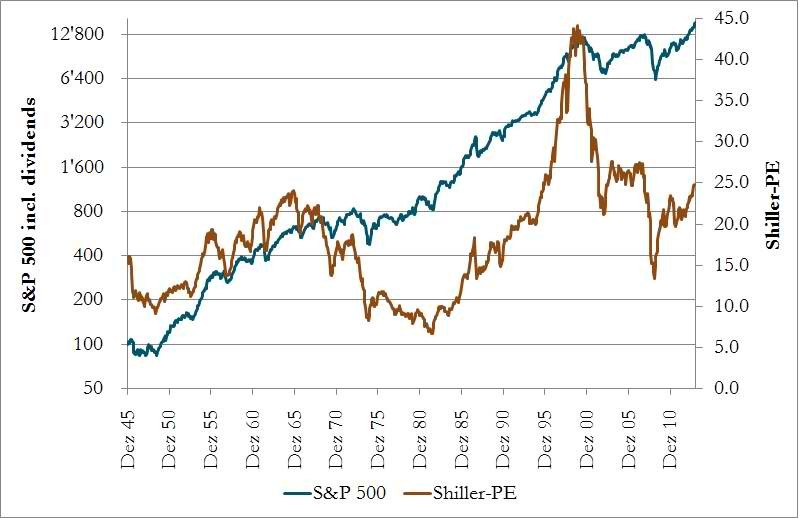

ONE key reason why I have been pessimistic about the outlook for the US stockmarket is based on the use of the Shiller price-earnings ratio. Ben Graham, the doyen of securities analysis, devised a version of this measure, but it has become associated with Robert Shiller, the Yale professor who can claim credit for calling both the dotcom and housing bubbles in his book Irrational Exuberance. He maintains the data on his own website .

The Shiller version tries to eliminate the effect of the economic cycle on valuations; without it, stock markets look expensive when earnings collapse in recessions and look cheap when earnings are high in booms. So it averages earnings over 10 years, and adjust them for inflation; at the moment, the p/e is 21.5, well above the historical mean.

So what? The noted quant, Cliff Asness, head of fund management group AQR, published a third quarter commentary in which he looked at future equity returns when the Shiller p/e was at current levels. The average 10 year real return was just 0.9%. Indeed, if you rank years by Shiller p/es, then you get an almost perfect relationship between valuations and future returns; real returns when the Shiller p/e was at its lowest ranged between 10.3 and 10.4%.

Now Mr Asness points out that there is a danger of small-sample bias and that the standard deviation of results is quite high. Nor is the Shiller p/e much use as a market timing signal; it was already high in the late 1990s and got even higher by the spring of 2000.

Shiller sceptics argue that the ratio is a particularly misleading indicator at the moment because of the steep plunge in earnings in 2008; this, they say, artificially depresses the 10 year earnings average. But the big fall in earnings in 2008 came in the finance sector which had enjoyed an artificial boom in previous years. Mr Asness suggests that

the earnings destruction post-2008 was making up for some earnings that, for several years prior, were too high, essentially borrowing from the future. Rather than invalidate the Shiller method, the 2008 earnings destruction is precisely why the (Shiller p/e) was created.

In any case, Mr Asness calculates cyclically-adjusted p/es based on the median earnings level of the previous 10 years, to eliminate outliers; and a version based on the maximum earnings over the past 10 years. In both cases, the p/e is significantly above the historical average. That is a big contrast with the one-year p/e which most investment bank analysts use and which shows the market fairly valued.

What this means, according to Mr Asness, is that future real returns are likely to be poor, especially as bond yields are so low. On a standard 60/40 equity/bond institutional portfolio, real returns are likely to be 3%.

That is extremely important for pension funds, particularly those in the US which assume a ludicrously high (nominal) return of 8% going forward. As I have pointed out in the past, this is way too high but allows them to stint on their contributions (not to mention this is wrong in theory, as well as practice. Liabilities are a debt, and should be discounted by bond yields).

Some people argue that the 30-year returns pension funds have achieved justify an 8% assumption. But this is fundamentally misguided. Back in 1982, Treasury bonds yielded 10.5% and US equities 6.2%. Investors benefited from the high level of running yield as well as capital gains as valuations improved to current levels. That simply cannot happen again. Treasury bonds now yield 1.7% and the dividend yield is 2.2%. Absent some unexpected surge in profits (which are already vlose to an all-time high as a proportion of GDP), the most likely outcome from here is low real returns. Whether you are an employee in a 401(k) plan or an employer running a final salary scheme, you need to put more money aside to generate a given pension.

Previous

New York conference: Buttonwood gathering

Next

Election aftermath: A small triumph for markets and maths