EmergingMarkets Bond ETF Breakdown

Post on: 3 Август, 2015 No Comment

By Timothy Strauts

With more than $9 billion in total exchange-traded fund assets, emerging-markets bond ETFs have grown quite popular with investors in the past few years. Seeking to capitalize on investor demand, ETF providers have launched many new products over the past few years. The emerging-markets bond category has grown into a collection of strategies that offers very different exposures with unique risks. I’ll highlight each group and discuss the key differences.

Government bonds of emerging-markets countries denominated in U.S. dollars are the oldest type of emerging-markets debt. When emerging-markets countries first started issuing debt in the early 1990s, the only way to get investors interested was to issue the bonds in U.S. dollars. Over the years as investors have become more comfortable with emerging-markets bonds, issuers have lengthened the average maturity of their issues to 10-20 years. As interest rates have fallen, these bonds have done very well, but if interest rates rise substantially the long duration of these bonds will likely cause high volatility and negative returns.

The two ETFs in this group, iShares JPMorgan USD Emerging Markets Bond (NYSEARCA:EMB ) and PowerShares Emerging Markets Sovereign Debt (NYSEARCA:PCY ). are the oldest and largest emerging-markets bond ETFs. These two ETFs account for 71% of all emerging-markets category assets.

Government bonds of emerging-markets countries denominated in their own local currency started appearing in the early 2000s. As emerging markets continued to develop, they began issuing bonds in their own currency so they were not exposed to the volatile currency markets. Because investors in these bonds are accepting currency volatility, the average maturity of the issues is only five to 10 years. The lower interest-rate risk helps to counteract the high currency risk. Countries that issue local-currency bonds typically have above-average credit ratings. For example, the largest ETF in this strategy, WisdomTree Emerging Markets Local Debt (NYSEARCA:ELD ). has 83% of its assets invested in investment-grade countries. This is substantially higher than EMB’s 54% in investment grade.

Low maturity length and good credit quality make local-currency sovereign bonds an interesting option for an investor looking for above-average yields with below-average interest-rate risk. A word of caution: If the U.S. dollar rises dramatically because of a future financial panic, local-currency bonds will experience negative returns and high volatility. A patient long-term investor could ignore these currency fluctuations as long as the currency movement is related to an external factor like the European debt crisis. Over time, the currencies would likely revert to their long-term trend so foreign-currency losses would be temporary.

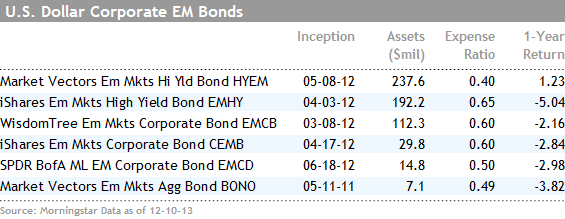

Emerging-markets corporate bonds are predominately issued in U.S. dollars. The market for local-currency corporate bonds is very small and illiquid so all of these ETFs invest solely in U.S. dollar issues. The largest ETF in the group, WisdomTree Emerging Markets Corporate Bond ETF (NASDAQ:EMCB ). has 76% of its assets in investment-grade companies so credit quality is good. Issuance is dominated by large multinational firms like Petrobras and Vale. Bonds are typically issued in the five- to 10-year range. If you exclude the high-yield ETFs, this group has similar yields to the U.S. dollar sovereign ETFs discussed earlier. Corporate bonds could be a good option for investors desiring a good yield, lower interest-rate risk, and U.S. dollar exposure.

The high-yield ETFs are for investors willing to accept much higher volatility for the hope of enhanced returns. Market Vectors Emerging Markets High Yield Bond ETF (NYSEARCA:HYEM ) focuses exclusively on corporate bonds, and the iShares Emerging Markets High Yield Bond (BATS:EMHY ) holds a combination of sovereigns and corporates. (Disclosure: EMHY tracks an index created by Morningstar.)

Dim sum bonds are denominated in offshore Chinese yuan, known as CNH, and not onshore Chinese yuan, known as CNY. While the CNH and CNY generally trade in line with each other, given the non-convertibility of the CNY, the two currencies effectively trade in different markets and therefore are subject to different supply and demand trends. This is a very specialized market and is probably not appropriate for the average investor at this point.

Disclosure: Morningstar licenses its indexes to certain ETF and ETN providers, including BlackRock, Invesco, Merrill Lynch, Northern Trust, and Scottrade for use in exchange-traded funds and notes. These ETFs and ETNs are not sponsored, issued, or sold by Morningstar. Morningstar does not make any representation regarding the advisability of investing in ETFs or ETNs that are based on Morningstar indexes.