Emerging Market Debt s Wild Ride Market Vectors Emerging Markets Local Currency Bond ETF

Post on: 29 Март, 2015 No Comment

An abridged version of this article appeared in the January issue of REP. magazine and online at WealthManagement.com .

I like bottoms. Double bottoms especially.

Im referring, of course, to market bottoms. Chartists like me constantly scan the alternative investment space for signs of rebounds following sector selloffs. There may, in fact, be just such a signal developing in emerging market debt (NYSE:EMD ).

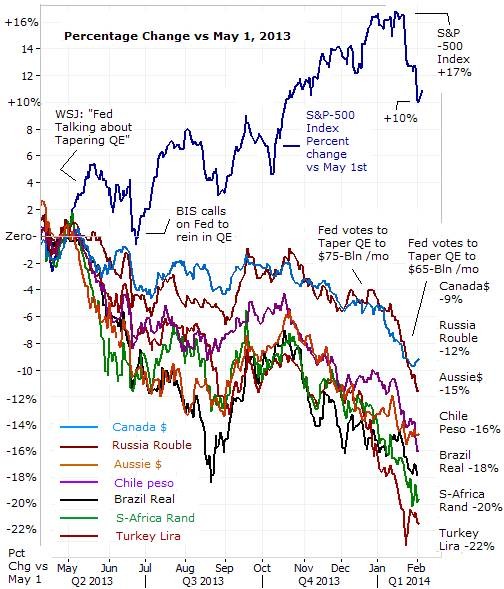

Take a look at Chart 1 which compares the performance of the Barclays Capital Emerging Market Local Currency Index (BarCap EMLC. in red) to the Barclays Capital U.S. Aggregate Bond Index (BarCap AGG. in black) over the past 12 months. EMLC is comprised of more than 120 sovereign debt instruments denominated in freely traded local currencies.

As you can see, EMLCs been a bit of a roller coaster over past year. A peak was reached in May as a number of currencies gained ground against the greenback and default fears eased.

Chart 1 — Emerging Market vs. U.S. Domestic Debt Prices

That, however, proved to be a precipice from which EMD tumbled. Hard. In barely more than a month, EMLC plunged 12 percent as the odds of Fed tapering shortened.

Its fair to ask why emerging markets would have been hit so hard by a prospective end to the Federal Reserves bond buying program. The answer is fairly simple. Much of the money that the Fed program pushed into the U.S. economy ended up looking for yield overseas. American investors became the worlds biggest investors in foreign debt as this hot money flooded into high yield markets such as Turkey, Brazil, Mexico and Indonesia.

Then, when the prospect of a crimp in U.S. liquidity was raised, bond domestic bond prices tumbled. Bids for emerging market paper virtually vanished as investors fretted about rate hikes by central banks to defend their currencies. The red roller coaster careened downward.

After hitting the skids in June, the coaster bumped along throughout the summer. Around Labor Day it dipped to retest the market nadir. It was then that the classic W pattern of a double bottom emerged on charts, tempting technicians to bid into a rally that continued through autumn. By Halloween, emerging market paper recovered two-thirds of its summer swoon.

The question facing investors now is whether this rally has wheels.

There are reasons, of course, for holding a permanent allocation to EMD in a portfolio. International debt adds diversification, generally providing higher expected returns, higher volatility and low correlations to other asset classes. The puzzlement lies in whether to over- or underweight the sector.

Overweighters include Pacific Investment Management Co. (PIMCO), the worlds biggest bond buyer. Ramin Toloui, co-head of emerging markets at the $2 trillion asset manager, remained sanguine about developing country debt in the midst of the summer selloff.

In a global environment characterized by continued concerns about growth — even amid firmer economic indicators — policy interest rates in both developed and emerging countries are poised to stay low, he declared.

Clive Dennis, head of currencies for London-based Schroders plc, takes a more nuts-and-bolts view. Dismissing Fed taper talk as a bit of a red herring, Dennis eyes the new-found transparency of central bank policymaking with suspicion. Its just not credible, he proclaims.

Instead, Dennis relies upon a model tallying hot money levels and competitiveness, among other factors, to throttle emerging market exposure. Developing countries with the ideal mix of cheap currencies and low economic risk presently include South Korea, Argentina, Egypt and Hungary, according to Dennis.

Emerging market bond funds

In the current low-yield environment, EMD funds have been exceedingly popular. Theyve been some of the top-performing investments in the fixed income sector over the past three and five years. The past year, however, has been a rough patch (see Chart 1 again). Still, there are standout portfolios that have wrested positive returns from this very volatile market over the past 12 months. Among those available for retail investors, the top five are:

HSBC RMB Fixed Income Fund (MUTF:HRMBX ) — The top risk-adjusted return was earned by a fund with RMB (literally) at its core. The acronym stands for renminbi, the official currency of the Peoples Republic of China.

Since the funds June 2012 launch, its capitalized on the growth of offshore trading in RMB-denominated securities, the so-called Dim Sum bond market. The fund tries to capture total returns — capital appreciation and coupon income — from its investments as well as incremental gains from the appreciation in the RMB relative to the U.S. dollar. Fully two-thirds of HRMBXs assets are held in Chinese and Hong Kong paper.

Generally speaking, the RMB debt market offers an enticing yield spread over developed market bonds as well as shorter average duration.

While demand for RMB-denominated debt remains strong, cracks are now appearing. Every time Chinese authorities take steps to curb the influence of the shadow banking system or try to take of some of the heat out of a hyper-inflated housing market, Dim Sum bonds take a hit. Sometimes a big hit. HRMBX managers have mitigated some of this risk by steering the portfolio towards higher-quality credits.

Dim Sum bonds continue to be backstopped by the managed loosening of the Chinese currencys peg to the greenback. Over the past 12 months, RMB appreciated 2.2 percent against the U.S. dollar.

Overall, capital appreciation accounted for half of HRMBXs six percent total return over the past 12 months. The $14 million fund levies a 1.45 percent annual expense charge, making it the priciest of the top five. Available through 11 brokerage platforms, the minimum investment is $1,000.

Guinness Atkinson Renminbi Yuan & Bond Fund (MUTF:GARBX ) — A year older than the HSBC product, GARBX, too, concentrates on RMB-denominated debt (the yuan in GARBXs title is the specific unit of RMB currency; think pounds and sterling).

Given the narrow supply in the Dim Sum market, its not surprising that GARBX and HRMBX are stylistically quite similar.

GARBX, with $93 million in assets, is distributed over a much broader base than HRMBX. Dealer agreements with 22 financial intermediaries have been negotiated, though the $10,000 minimum investment is daunting to some individual investors. At 90 basis points (0.9 percent) GARBXs annual expense ratio is the lowest of the top five funds.

Schroders Absolute Return Emerging Market Debt and Currency Fund (MUTF:SARVX ) — RMB isnt the showpiece for the Schroders fund. Theres no slot in the SARVX portfolio, in fact, for Chinese currency or debt currently. RMB remains an option, but not a mandate. The fund is heavy with Singaporean, Greek, and Vietnamese sovereign paper instead, together with substantial positions in a broad mix of currencies. The funds largest exposure is actually a U.S. dollar position.

SARVX managers use cash investments strategically, building them up when attractive EMD prospects are sparse. Presently, the outsized Yankee exposure stems, in part, from managements belief in the continued recovery of the U.S. economy.

The diversity of the SARVX portfolio is reflected in its .23 r-squared (r2) correlation to the Barclays Capital Emerging Market Local Currency Index (see Table 2). This coefficient may not seem particularly strong on its face, but its a lot bigger that those of the RMB funds.

The $169 million portfolios objective is the capture of positive absolute returns in all market conditions, benchmarked against the three-month U.S. London Interbank Offered Rate (Libor). Accordingly, managers keep the fund on a short duration leash. The portfolios average effective maturity is just short of a year.

SARVX is available through 26 brokers, carries a 1.35 percent expense ratio and can be purchased for as little as $2,500.

Forward Emerging Market Corporate Debt Fund (MUTF:FFXRX ) — This fund invests in a diversified portfolio of fixed income securities of companies located in emerging market countries. While the fund purchases debt denominated in local currencies, its primary exposure is in U.S. dollar and euro paper.

The fund actively hedges foreign currency risk and limits exposure to any one country and any one issuer to no more than 35 percent and five percent of assets, respectively.

FFXRX commits more than a third of its assets to Asian companies, led by those in China and South Korea, and more than a quarter to Latin American issuers, most notably those in Colombia and Mexico. The funds single largest country allocation, at 16 percent, is Russia.

Over the past year, a small capital loss was more than offset by coupon income.

The $347 million Forward portfolio, dealt by 45 brokers, is the most widely distributed among the top funds. Expenses run 1.35 percent annually with a minimum buy-in of $4,000.

Franklin Templeton Emerging Market Debt Opportunities Fund (MUTF:FEMDX ) — With assets near $589 million, FEMDX is the largest fund among the top five and focuses on sovereign debt, though corporates are secondary targets.

The funds portfolio includes outsized investments in U.K. and Irish paper but leans most heavily on higher yield, i.e. lower-rated, securities. That slant is reflected in a 5.6 percent capital loss over the past 12 months. Luckily, that was more than overcome by coupon income, netting the fund a 2.7 percent total return.

The funds investment mandate is aggressive, permitting up to 15 percent of its net assets to be invested defaulted debt securities. Additionally, the funds use of currency derivatives could allow the fund to obtain net short exposures.

Thirty brokers offer the Franklin Templeton fund presently. The fund incurs 100 basis points (one percent) in annual expenses.

Table 1 — Top Performing EMD Funds (21-Nov-12 through 22-Nov-13)