Emerging Market Corporate Bonds How To Invest

Post on: 8 Июнь, 2015 No Comment

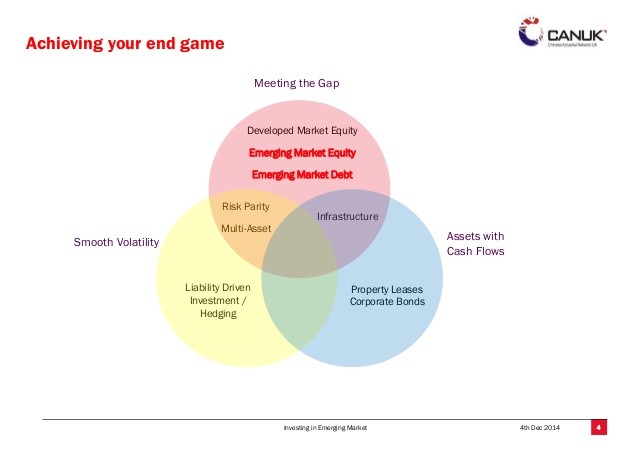

Emerging market corporate bonds carry a high degree of risk, one of the highest of the global bond market, but offer the potential for very high yield. They are excellent for investors looking for assets that are based in fast-growing emerging market economies. “Emerging market bonds” is a term that no longer only refers to simple government debt. It has evolved to cover everything from corporate bonds to inflation-linked bonds and from so-called “dim sum” bonds (bonds issued in Hong Kong in Chinese yuan) to other bonds denominated in local currencies. Specifically, emerging market corporate bonds have become popular for investors. They have high yield premiums when compared with US domestic bonds, and they are a unique way to bring diversification to an investment portfolio.

Investors who are interested in the increasing creditworthiness of companies in developing countries are ideal investors for emerging market corporate bonds. Due to the positive and continually improving state of international business and governments, long-term prospects of this particular bond class are high.

The emerging market corporate bond class has also seen an improvement in liquidity. Increased investor attention has led to an increase in securities trading without a significant price impact. The market’s value at the end of 2012 was comparable to the U.S. high yield market —valued at over a trillion dollars. Although in the past most of the emerging market corporate bond class assets have been based in Latin America, issuers from Asia, Africa, and Europe are becoming much more common and offering further diversity to investors.

During the 1990s, emerging markets were seen as an extraordinarily volatile investments. Due to lower debt and improved government in emerging markets over the last twenty years, the investments are much more stable than the used to be. However, emerging markets are often one of the first areas to be cut when investors are looking to reduce the overall risk of their portfolios, and are thus still quite prone to underperformance when investors become skittish. Corporate bonds, particularly high yield corporate bonds, are seen as far higher-risk than government-issue bonds. This vulnerability should be taken into account by investors when considering emerging market corporate bonds.

Many emerging market mutual funds have, rather than remaining based exclusively on government issued bonds, chosen to diversify their into corporate bonds. In order to see the specific details of a fund’s holdings, investors can request data from the fund company directly or use a third-party source like Yahoo! Finance to research the specific details of allocations.

A number of exchange traded funds (also known as ETFs) are available to investors. These include:

- iShares Emerging Markets Corporate Bond Fund (CEMB)

- iShares Emerging Markets High Yield Bond Fund (EMHY)

- Market Vectors Emerging Markets High Yield ETF (HYEM)

- SPDR BofA Merrill Lynch Emerging Markets Corporate Bond ETF (EMCD)

And finally,

- WisdomTree Emerging Markets Corporate Bond Fund (EMCB)

Although the emerging market corporate bond market is a rapidly-growing, high-yield option for investors who are interested in a newer class of assets to provide increased diversification to their portfolio, it is essential that investors keep in mind the extremely high risk levels of this asset class.

About Lawrence Meyers

Larry is regarded as one of the nation’s experts on alternative consumer finance. He consults for hedge funds and private equity via his Council Member status at Gerson Lehman Group, and as a member of Coleman Research Group’s Executive Forum. He also consults for Credit Access Businesses and Credit Services Organizations in Texas. His Op-Eds and Letters to the Editor have appeared in over two dozen major newspapers. He also brokers financing, strategic investments, and distressed asset purchases between private equity firms and businesses of all stripes. You can reach him at pdlcapital66@gmail.com.

Learn how to generate more income from your portfolio.