Emerging Market Bonds

Post on: 2 Август, 2015 No Comment

by Doug Cronk on March 26, 2012

Traditional Mom & Pop, Apple Pie Pension Plan thinking is that the purpose of bonds in the institutional investment portfolio is to provide an offset against future pensions to be paid to pensioners. The stream of interest payments that the bond pays out look a lot like the pensions that have to be paid out. The future liability is calculated based on bond yields so both the assets (bonds) and future pensions (the liabilities) move in tandem. When bond yields move up, bond prices move down but pension plan liabilities move down too. So interest rate risk is somewhat negated. That’s why pension plans have a large strategic allocation to domestic (Canadian) bonds .

Non-Canadian bonds have interest rate risk AND currency risk which has made them more of a tactical play. But Emerging Market Bonds (EMB’s) might be an opportunity to significant to ignore.

__________________________________________________________________________________

The case for emerging markets (EM) is well documented (and marketed). According to Haver Analytics and RBC Asset Management, emerging markets contribute 47% to world GDP growth. Favourable Government debt-to-GDP ratios, stronger fiscal positions, increasing per-capita income, reduced variability in economic performance as well as significant human capital development and rapid productivity increases are some of the EM characteristics that describe a sustainable growth story. Further, EM debt is being put to productive use like building infrastructure. (European debt, in contrast, is being used to finance consumption).

The opportunity in EMB’s is in the Trillions (JP Morgan EMBi, CEMBi and GBi-EM indexes combined ) and growing fast. (see table). This compares to the Canadian (DEX Universe ) bond market size of $1.1 Trillion.

EMB yields and credit ratings

EMB yields are

4.5% above US Treasury yields (currently about 2% + 4.5% = 6.5%). (EM Corporate bonds yield another 0.50%-0.75%).

EMB credit ratings have steadily improved and hover around the investment grade cut-off of BBB.

Correlation of the JP Morgan EMBi to the S&P/TSX stock index is -0.10%. Negative correlation is tough to find. Even the Canadian (DEX Universe) bond index correlation to the S&P/TSX is only 0%. Source PHN .

Emerging market debt overall has roughly one-half the volatility of emerging market equities. (source PHN).

“Emerging markets are those from which one cannot emerge in an emergency! ” – James Cross, Deputy Governor, South Africa Central Bank, 1998.

Individual investors should consider a safety first approach.

Emerging stock and bond markets are growing and evolving (emerging?) so fast that using historical data to look forward and make predictions with requires a leap of faith.

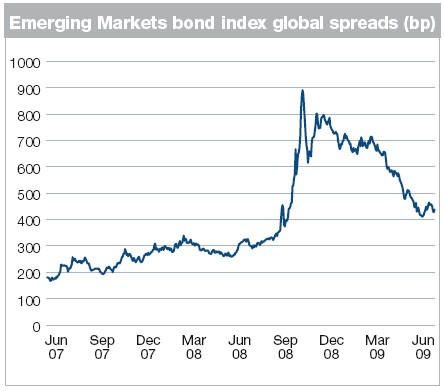

Seasoned investors will recall the early 1980’s and mid 1990’s EM currency crisis’s that hit foreign bond valuations (and allocations) severely.

Individual investors today need to be reminded of the risk and return relationship. EMB’s yield more than domestic bond yields because … they are riskier.