Emerging Market Bond ETF Research

Post on: 2 Август, 2015 No Comment

When investors think of Emerging Markets. the first countries that come to mind are the powerhouse economies in Asia like China, Singapore and South Korea or BRICs. There are many more Emerging Markets in other regions which are not commonly written about including Mexico (Latin America), Poland and Hungry in Eastern Europe. Nigeria which just became the largest economy in Africa and South East Asia (Philippines). Emerging Market Bond ETF invest in government bonds of economies classified as emerging markets.

Up until recently portfolio exposure to Emerging Market is one of the must haves for investors looking to outperform the staid US equity market. In the last 2 years however emerging market equity has underperformed due to increasing risks of capital outflow driven by concerns on governance, domestic and external debt levels, limited progress in economic reforms and increasing hawkish Fed policy expectations by 2016.

The Federal Reserve has kept interest low since the financial crises which has pressured US yield downwards in the most recent periods. US fixed income returns which in our eyes is not sustainable has been driven by increase in bond prices from the QE programs (which has now been pulled back through tapering).

Investors could improve overall portfolio yield and diversification through reallocating portion of fixed income portfolio to Emerging Market Bond ETFs. With any investment, the risk have to be balanced against returns. Risks of investing in Emerging Maket bond can be achieved by focusing on the debt of economies with strong economic fundamentals, stability, balance sheets and strong financial sectors. Short term hedging to volatile environment can be hedged using inverse ETF .

This research note focuses on the 4 largest Emerging Markets Bond ETFs listed in the US and highlights the major differentiating factors between the Emerging Market ETFs so investors can select the right exchange traded fund to track the direction that will perform the best or know to avoid exposure to those that are at most risk.

All 4 Emerging Market ETFs brings different aspects of emerging market exposure to the investor. Each with its own strength and weakness. Matrix of the Emerging Market ETF holdings broken down by regional exposure shows the different regional emphasis each ETF focuses on.

For example investors looking for exposure or want to avoid Latin America emerging market debt would avoid PCY as the EM bond vehicle.

The table also reinforces the finding from the research below that EMLC has the most evenly distributed holding with mix exposure across a number of emerging market at similar weights.

Main advantages of including Emerging Market Bond ETFs in the portfolios

- Capturing higher managed interest rate risk while limiting potential volatilities seen in the equity markets.

- Improvement in portfolio diversification by increasing exposure to number fixed interest rate markets outside the US.

- As the cost of hedging is relatively low, currency risks can be limited in emerging markets bonds ETF through from focusing on ETFs that hedges volatility in FX rate changes.

The Emerging market bond ETFs which investing across the globe would include a wider exposure at a more cost effective means than what investors achieve by themselves. Investor worrying about fees of the Emerging Market Bond ETFs should know the typical ETF fees are below 0.70% of asset under management.

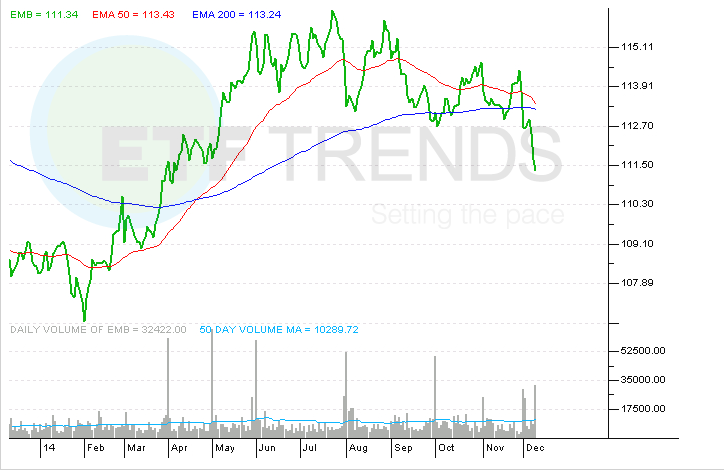

iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB) The Largest Emerging Market Bond ETF

EMB have one of the longest track records investing in emerging markets debt. EMB mandate is to invest in USD dollar denominated sovereign bonds of the emerging economies across the globe. EMB limit concentration risk through holding a wide range of sovereign bonds across countries and regions.

With total assets above $4 billion and average daily liquidity of 2% of assets, it provides ample liquidity for investors looking to add emerging market bonds to their portfolio.

Investors should note although EMB has liquidity at the fund level. During periods of market risk off, illiquidity risks still exist as the underlying investment of sovereign bonds can still suffer from illiquidity and price swings.

Top 10 country holdings consist 50% of the fund under management with heavy focus on BRIC nations (with the exception of no exposure to India sovereign debt)

Credit and Maturity Risk are two of the largest drivers of emerging market bond ETF returns.

EMB is currently yielding above 4%. Investors should note the credit quality and maturity of the fund to ensure the sustainability of the returns. Analysis of these factors highlighted in the chart above shows the yield is driven by holding majority of emerging market bond in the ETF at BBB and BB rating by S&P .

From the maturity perspective, only 13% of the bonds held in the fund expire within the next 5 years. Large portion of the ETF have a maturity above 5 years with almost 50% fund in 5 – 10 year bracket and remainder in 10 years and above. If any of the government debt in the fund is at risk of default in the near term it would pose limited risks to the fund.

3 major specific Emerging Markets bonds held investors should be aware of include:

Estimated Duration of the portfolio stretches 7.5 years with average maturity of the bonds spanning 12.5 years. EMB is the largest emerging market ETF using long maturity bond holdings as the core driver of portfolio returns. By highlighting significant holdings of the fund we can flag exposure to countries that are in the news on the daily basis that could pose a risk to the portfolio return in the future.

EMB have 6% of asset under management in Turkish bonds. Political turmoil in Turkey poses heightened risk of Turkish government bonds (especially with $35 million maturing in 2017).

Geopolitical risks in Eastern Europe led by Russian will raise questions on the Russian Federation debt which is also at almost 6% of the portfolio. ($22 million maturing in 2017 at the earliest with remaining bonds at long dated 15 years plus maturities)

EMB holds also have 4% of portfolio in Venezuela government bonds (with $56 million bonds maturing by 2019, November 2017 posing the greatest risk).

PowerShares Emerging Markets Sovereign Debt Portfolio (PCY) – MK 2 Balanced Approach

PCY is the 2nd largest emerging market debt ETF with $2 billion AUM. Similarly to EMB, PCY commenced in 2007 in the depth of the financial crises. PCY returns since then has tracked closely with EMB. Both emerging markets ETF have returned close to 30% in NAV basis with average annual yield of 4- 5%.

PCY tracks the DB Emerging Market Liquid Balanced Index which have a smaller number of bond hooldings compared to EMB.

- Liquid USD Emerging Market Bonds only.

- Holding 67 securities covering 22 countries.

- 9% of portfolio is turned over annually.

- The standout risk for PCY is the 4% AUM in Ukraine bonds.

Diversified Emerging Market Bond ETF

Looking at the bond maturity breakdown, the duration of the PCY is slightly higher than EMB at just over 8 years and average years to maturity of the portfolio at 14.29 years.

Fund holdings analysis identified one major difference to EMB. All country exposures are held at an almost equal basis. The largest exposure is Venezuela at 4.62% with the smallest exposure to Ukraine at 4.11%. The variance between the largest and smallest country exposure is only 0.50% of total asset under management.

PCY Portfolio Allocation Summary

Potential risk again are Venezuela and Ukraine and Russia debt. The top 10 country holdings shows heavy exposure to Eastern Europe and South America with Korea, Philippines and Indonesia the only Asian emerging market debt included in the fund.

WisdomTree Emerging Markets Local Debt Fund (ELD) – A Distinct Local Flavor (and Risk)

The 2 largest Emerging Market Bond ETFs above focus on US dollar issued and most liquid emerging market bonds. Both are passive index tracker ETFs. ELD is an actively managed ETFs with $1 billion AUM. It differentiate itself by investing in locally denominated emerging markets bonds and can over or underweight countries that are more at risk. This opens up a greater number of opportunities for investors and provide a means for for those that are looking for options on the higher end of the risk curve in this asset class.

Locally denominated bonds could pose a higher risk as investors in event of a sovereign default. This is because most bonds denominated in local currency are issued under local laws which is at the mercy of the government at the time of restructure.

High inflation in the economy can erode purchasing power which would not favor bondholders and investors are also exposed to exchange rate risk .

ELD balance the higher risk of local currency debt by:

- Actively manage the portfolio ensure that it is rebalanced frequently to reflect changes in macro economic conditions.

- Holding shorter dated debt. Duration of emerging market debt in the ELD portfolio is under 5 and average maturity of the debt is closer to 7 years. (vs Duration and Average Maturity of EMB and PCY closer to 8 and 10 – 12 years respectively.)

- The use of partial FX rate hedges (ETF disclosed to use forwards only to hedge the FX risk), however this is only applies to minority portion (4.2%) of the portfolio.

Below ELD Credit and Maturity chart shows, 65% of the bond is held in A and BBB rated emerging market debt. 21% is invested in higher risk emerging markets debts are not rated by any rating agencies. This is balanced by 52% of the emerging markets debts maturing in 1-5 years and only 14% of the portfolio maturity in the 10+ years maturity horizon.

ELD portfolio at a first glance can also be viewed as being aggressive. Top 10 holdings consist of 80% of the portfolio. By digging into the details. The emerging markets bonds at higher risk spectrum Russia and Turkey comprises only 10% of the portfolio (with portion of Russian Ruble exchange rate hedged investors can hedge risk of Russia through shorting leveraged oil ETF ). The remaining names like Malaysia also at 10% provide exposures which the bigger USD denominated funds have limited exposure.

Market Vectors Emerging Markets Local Currency Bond ETF (ELMC) – Pure Local Index Tracker

ELMC is a pure local emerging market index tracker fund. The ETF tracks the JP Morgan GBI-EMG Core Index. Total AUM close $800m is the smallest major emerging market bond ETF included in the research.

- From diversification perspective, the fund spreads the investments in emerging market debt across 20 countries with 40 different local entities.

- ELMC is different to the above 3 ETFs by not only buying the emerging markets bonds issued by the governments. ELMC portfolio includes utilities, financials and industrial debt (these entities are backed by local governments). Government bonds comprise 85% of the portfolio.

Maturity profile shows that the duration and average maturity of the portfolio is below 5 and 6 years respectively. Only minor portion of the portfolio is in long end of the rate curve .

Credit rating profile of bonds included in the ETF matches closely ELD with the exception of no discretion in deviation from the index. For example ELMC downgraded and underweights Russia given current political risks independent of index weights, however ELD will not move any position until the index it self changes exposure to Russia.

Emerging Market Bond ETF Yield Comparison

From the profile on of the Emerging Market Bond ETFs the chart below shows the current annual dividend yields. ELMC maintains the highest yield ETF out of all 4 Emerging Market Bond ETFs analyzed.

The similarity in the EMB and PCY yields could be attributed to the USD denominated debt held in the portfolio. Although the issuer is an emerging market bond, the yield to an extent also is priced off the US dollar yield curve. The level of diversification difference between the fund means total yield have slight deviation from each other.

For ELD and EMLC It is interesting given the short maturity distribution of the underlying holding, investors can conclude the local yield curve is responsible for the higher than average yield.

The detailed analysis of the emerging market bond ETFs above hopefully gives the investors better understanding of which ETF would be best suited given their individual situation and primary differentiator of each products so risk can be managed effectively.