Elliott Wave theory spells doom and gloom for the US market

Post on: 18 Май, 2015 No Comment

Trading & Technical Analysis question

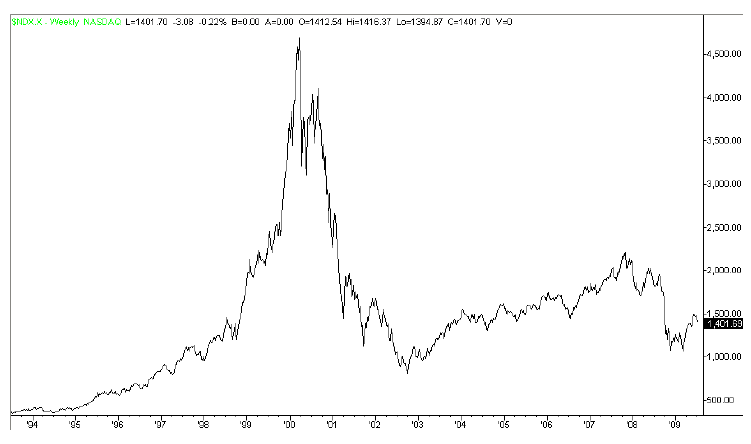

Elliott Wave theory spells doom and gloom for the US market

Famous forecaster Elliott Wave predicts a tsunami is coming for global sharemarkets.

Dinner party chatter around the country has swung from property prices, auctions and renovations to resources stocks and the sharemarket. Sometime in the future, the theme might be investing internationally, or art, but one thing is for sure — a common topic will be found because society moves in waves. Elliott Wave theory, a variety of technical analysis, analyses these waves to forecast the future direction of individual shares and the overall sharemarket.

The Elliott Wave principle is the brainchild of professional accountant Ralph Nelson Elliott, who wrote a series of papers in the 1930s and 1940s on his findings. Elliott noted that sharemarket movements were largely driven by investor psychology greed and fear, optimism and pessimism that created price patterns or waves over time. The wave traces the behaviour the buying and selling decisions — of the investment crowd as it swings from extreme pessimism at the trough of the cycle to extreme optimism at its peak. The theory asserts that this rhythmic pattern tends to occur irrespective of the news or events that arise during the waves formation.

The aim of the Elliottician is to use these wave patterns to anticipate what the market will do next — as a guide, more or less, for making investing decisions.

Today, most trading software packages offer a form of Elliott Wave analysis. Some traders learn to read the waves as a guide to future market direction.

www.elliottwave.com/) which publishes analyses of global stock, bond, metal and energy markets was introduced to the theory while working as a technical market specialist at Merrill Lynch in New York. Prechter, who holds a degree in psychology, was clearly taken with a theory with psychology at its axis.

Prechters fame as a forecaster just like the Wave principles it postulates has had its high and low points over the years. Prechter has been credited with accurately forecasting the market crash of 1987, the beginning of the long-term super bull market in stocks in October 1982, and was also lauded as the winner of the US Trading Championship in 1984. However, more recently, Prechters forecasting talents using the Elliott Wave principles have hit a low point.

Prechters forecasting efforts in his book At the Crest of the Tidal Wave (1996) was almost five years off the mark, similar to his ill-timed prediction of a large-scale bear market documented in his 2002 book: Conquer the Crash: You can survive a deflationary Depression. Had investors followed his advice, exiting stocks in 2002 in anticipation of a large-scale correction theyd have missed riding the wave of the stellar bull run over the past five years.

Nevertheless, Prechters insights resonate with some home truths today as we sit, as he purports, at the precarious fifth wave of the economic super cycle. The fifth wave denotes the final leg of a bull market, where roaring optimism encourages an unprecedented number of investors into the sharemarket and prices are bid up. Its here where novice investors finally step up to the plate and buy in at the top. The next step, according to Wave analysis, is a steep drop over the edge.

Prechters projections for the coming stage of the sharemarket are alarming to say the least. Based on the Wave principles, Prechter forecasts a correction on the scale of 1720-1784, 1835-1842 and 1929-1932 where asset values for real estate, stocks and bonds will crash to low levels. In alarming rhetoric Pretcher states: The size of todays credit bubble is so huge that it dwarfs, by many multiples, all previous bubbles in history. The developing deflation will be commensurate with the preceding expansion, so it will also be the biggest ever. Staying in traditional investments stocks, real estate, commodities and most corporate and municipal bonds will surely prove to be a deadly decision. Its not the Goldilocks 1950s. Its not the inflationary 1970s. And its not a business as usual extension of the 1980s 1990s bull market. Its 1929 times ten. Those who cant see the difference will suffer the consequences. Those who see it this means you will survive and prosper. So if we were to take a ride on the Prechter wave, wed probably be moving money out of inflated assets and into cash.

According to Elliott Wave theory, the market consists of five waves that move in the primary direction of the market called impulse waves, and three waves, called corrective waves that move counter to the underlying market trend. Both impulse and corrective waves consist of many smaller individual waves, which can be analysed in time periods of decades to weeks, hours or even minutes. This means, according to practitioners, that the theory is equally applicable to the long-term buy and hold approach as short-term trading.

The goal of any investing theory is to determine when to buy and when to sell; the greater the distance between these two points involves a meatier profit.

Interestingly, Elliott Wave patterns are founded in mathematics, or probability, and have applications for other sciences. In Elliotts final work with its grandiose title, Natures Laws The Secret of the Universe (1946), he suggested that human thought and action just like the ocean currents or galaxy is bound by a similar order: Because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable, he wrote. Prechter has since used the wave theory for predicting social trends.

The biggest reported problem of using Elliott Wave theory to make investing decisions is the challenge of correctly interpreting the wave patterns to discern where we currently sit on the wave, and what the wave is likely to do next. Its often said that a room full of Elliott Wave practitioners would struggle to agree on a common interpretation; that the theory is too vague, too subjective and too easily revised in hindsight. This uncertainty can make traders and investors slow to act or just downright confused. Of course, like most things in life, a theory alone doesn’t make you successful in the market. You do.