Elliott Wave Theory

Post on: 16 Март, 2015 No Comment

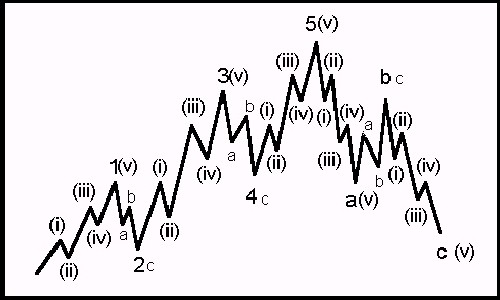

In this video introduce you to the Elliott Wave Theory. We will show you why it’s the preferred trading methodology to help set emotion aside, and formulate razor sharp entry levels with minimal risk. Using Elliott Wave, here’s what we see for the S&p 500.

Don’t take my word for it, here’s what notable industry experts say about Elliott Wave Principle:

- Robin Wilkin, Ex-Global Head of FX and Commodity Technical Strategy at JPMorgan Chase. ..The Elliott Wave principle. provides a probability framework as to when to enter a particular market and where to get out, whether for a profit or a loss.

- Jordan Kotick, Global Head of Technical Strategy at Barclays Capital said that R. N. Elliott’s discovery was well ahead of its time. In fact, over the last decade or two, many prominent academics have embraced Elliotts idea and have been aggressively advocating the existence of financial market fractals.

- Andrew Baptiste, Chief Technical Analyst at Morgan Stanley 1999-2011, CTA for Fixed Income at JP Morgan prior to 1999. In essence, The Wave Principle is a simple rule-based methodology (3 rules) that allows the practitioner to dissect the collective mindset of the markets participants, which allows for defined, attractive / positive Risk-Reward trading / investing parameters A Game Plan.

And my personal market hero, and probably the greatest living trader of all time.

- Paul Tudor Jones from the modern day trading classic Market Wizards

Are there any market advisors that you pay attention to?. Bob Prechter is the champion. Prechter is the best because he is the ultimate market opportunist.

What do you mean by opportunist? The reason he has been so successful is the Elliott Wave Theory allows one to create incredibly favorable risk/reward opportunities. That is the same reason I attribute a lot of my own success to the Elliott Wave approach.

Speaking of Paul Tudor Jones, take an hour to watch this lost video of PTJ back in the pre-’87 crash days.

To view the video — click here

In this video please disregard the old 1980’s footage and do not make the mistake of considering it obsolete. There is nothing new under the sun. In the video notice how PTJ approaches the market with a fierce competitive drive. He studies the crowd and price behavior, and uses Intermarket analysis through out. Notice how we uses correlations at around 12 minutes in. And best of all he is talking Elliott Wave with Zack at around 25:30 minutes in. There is no dispute that PTJ uses Elliott Wave because he simply came out and said it in the trading classic Market Wizards. Lastly, try and follow along at 16 minutes in when he’s dealing Deutschmarks from his house drinking a Budweiser. He’s trying to buy 60 million USD / DMark in Asia. I’ve seen roughly 1/3rd of that size push an Asia session around in the 2010 markets. Can you imagine the significantly less liquid markets of the 1980’s? He’s a beast. Watch this video and study what he says — it will make you a better trader.

Paul Tudor Jones, who in my opinion is the greatest living trader in the world. He has raised over 1.25 billion USD for his charitable organization the Robin Hood Foundation because. well. he can.