Efficient Market Hypothesis (EMH)

Post on: 3 Май, 2015 No Comment

In The Only Guide To A Winning Investment Strategy Youll Ever Need . Larry Swedroe dedicated a major portion of the book to the discussion of the Efficient Market Hypothesis (EMH). specifically to explain why investing in passively managed funds is a winning investment strategy .

What is Efficient Market Hypothesis?

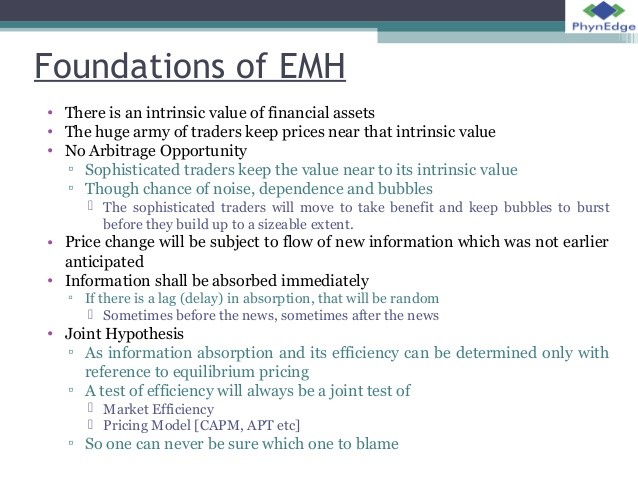

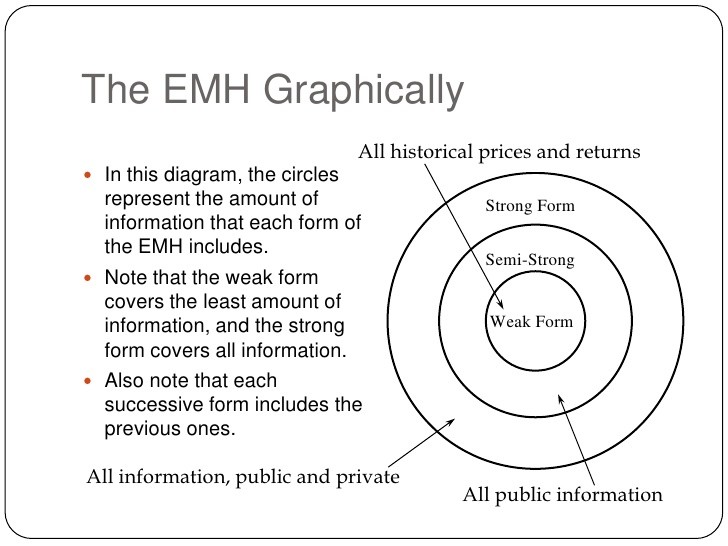

The Efficient Market Hypothesis asserts that the current market prices on traded assets, e.g. stocks, bonds, or properties, already reflect the total knowledge and expectation of all investors. It is unlikely that any one investor could use the information available to consistently produce above-market returns.

Larry also introduces two other efficiencies in his book i.e. cost and risk:

- Cost Efficient The market is cost efficient if the investors cost to enter into a market transaction is relative low The more cost inefficient the market (the greater the spread between the bid and offer), however, the greater are both the cost of trading and the barriers active managers must overcome in order to beat their benchmarks.

- Risk Efficient The market is risk efficient if investments that entail greater risk provide investors with greater expected returns as compensation for the greater risk assumed. For instance, stock has higher expected return than government treasury due to risks associated with investing in the stock market.

Why Does the Efficient Market Hypothesis Matters?

Efficient market hypothesis is important to understand because it explains why passively managed funds outperforms actively managed funds.

1. The costs of research and management

The main premise of active management is that superior performance can be achieved through research; specifically, by identifying mispriced investments and taking advantage of them. However, the cost of research and management is the first barrier that actively manage funds must overcome to beat their passively managed counterparts.

In other word, one reason why passively managed funds are superior to actively managed funds is their low costs (i.e. expense ratios, management fees, etc.) I demonstrated this concept, where a difference of 0.5% in expense ratio could result in a portfolio that under perform by nearly 15% over the course of 30 years .

2. The costs of trading

The second barrier that actively managed funds must overcome to beat passively managed funds is the costs of trading. The costs of trading include selling costs, buying costs, and the bid-offer spread .

Its interesting thing to note when information efficiency is lower i.e. lightly traded stocks, emerging markets, etc. the cost inefficiency takes over and wipe out any advantage of active management. For instance, information dissemination is slower for smaller stocks, but that advantage is wiped out by the higher bid-offer spread.

3. Taxes

Lastly, investors who hold actively managed funds in their taxable account have to contend with taxes. Specifically, there are two that these investors have to deal with:

- Depending on the level of turnover, or how much trading was done, the fund could accrue significant amount of capital gains. These capital gains result in capital gains distribution at the end of the year which is subject tax.

- Likewise, dividends result in distribution which is subject to tax.

Summary

In short, actively managed funds are unlikely to outperform passively managed funds due to the costs associated with actively managed funds. Moreover, its unlikely that active managers can consistently identify and take advantage of mispriced stocks to outperform the indices due to the Efficient Market Hypothesis.

For more information about Efficient Market Hypothesis, and passive investing as a winning investment strategy, I recommend The Only Guide to a Winning Investment Strategy Youll Ever Need by Larry Swedroe

What others are saying about Efficient Market Hypothesis: