EDHECRisk Performance Measurement for Traditional Investment

Post on: 16 Март, 2015 No Comment

Performance — March 30, 2007

Performance Measurement for Traditional Investment

This paper presents the state of the art of performance measurement in the area of traditional investment, from a simple evaluation of portfolio return to the more sophisticated techniques including risk in its various acceptations. It also describes models that take a step away from modern portfolio theory and allow a consideration of cases beyond mean-variance theory.

The number of professionally managed funds in the financial markets is increasing. The mutual fund market is highly developed with a wide range of products proposed. The resulting competition between the different establishments has served to strengthen the need for clear and accurate portfolio performance analysis. Investors wish to avail of all the information necessary to carry out manager selection over comparable bases. They want to know if managers have succeeded in reaching their objectives, i.e. if their return was sufficiently high to reward the risks taken, how they compare to their peers and, finally, whether the portfolio management results were due to luck or because the manager has real skill that can be identified and repeated in the future. The portfolio return alone does not allow all these questions to be answered. This has led to the search for methods that would provide investors with information that meets their expectations and explains the increasing amount of academic and professional research devoted to performance measurement. The topic of performance analysis is still in expansion, meeting the needs of both investors and portfolio managers.

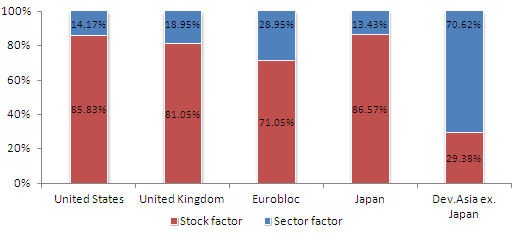

Performance measurement brings together a whole set of techniques, many of which originate in modern portfolio theory 1. Performance evaluation is closely linked to risk. Modern portfolio theory has established the quantitative link that exists between portfolio risk and return. The Capital Asset Pricing Model (CAPM) developed by Sharpe (1964) highlighted the notion of rewarding risk and produced the first performance indicators, be they risk-adjusted ratios (Sharpe ratio, information ratio) or differential returns compared to benchmarks (alphas). Portfolio alpha measurement is at the core of portfolio managers’ concerns. Sharpe’s model, which explains portfolio returns with the market index as the only risk factor, has quickly become restrictive. It now appears that one factor is not enough and that other factors have to be considered. Factor models were developed as an alternative to the CAPM, allowing a better description of portfolio risks and an accurate evaluation of managers’ performance, in particular a better evaluation of portfolio alpha.

Beside models issued from portfolio theory, research in the area of performance measurement has also concerned the consideration of real market conditions and has developed techniques to fit cases where the restrictive hypotheses of portfolio theory were not observed.

The choice of a performance measurement technique has to reconcile the ease of implementation and the accuracy and comprehensibility of the resulting information. In order to render this information accessible to a wide audience, rating agencies, by relying on different performance techniques, propose a ranking of funds within the various investment categories, whereby a certain number of stars is attributed to each fund. This aspect of performance measurement, which was the subject of a separate study 2. will not be presented here.

After a description of portfolio returns estimation, this article presents the state of the art of performance measurement in the area of traditional investment. As performance measurement not only serves to evaluate results previously obtained by portfolio managers, but also as a predictor for their future results, a review of studies concerning performance persistence will end this article.

Footnotes:

1 To replace the development of performance measurement techniques in the setting of portfolio theory, please refer to Amenc and Le Sourd (2003).

2 Cf. Amenc N. Le Sourd V. “Rating the Ratings”, EDHEC-Risk Institute, April 2005.

Attachments