Eco 340 Chapter 7 lecture notes

Post on: 20 Апрель, 2015 No Comment

MONEY & BANKING (Eco 340)

Lecture notes to accompany Cecchetti’s Chapter 7 (The Risk and Term Structure of Interest Rates)

Last revised 11-April-2008.

In these notes:

I. Introduction

II. Risk structure of interest rates

III. After-tax interest rates

IV. Term structure of interest rates

— A. Introduction

— B. The expectations hypothesis

— C. The term-premium, or liquidity premium, theory

I. INTRODUCTION

We’ve already learned, in the Theory of Asset Demand and elsewhere, that riskier and less liquid assets are less desirable and therefore must offer a higher return to induce people to hold them. Just how much higher? We can file that question under Risk structure of interest rates. Likewise, we’ve learned about short-term debt like Treasury bills and commercial paper, and also about long-term debt like Treasury and corporate bonds. The longer-term debt tends to pay higher interest rates — why, and how much higher? File that question under Term structure of interest rates.

These concepts are of great importance to anyone thinking of buying bonds — How much risk am I willing to take on in order to get a higher return? Are short-term, long-term, or medium-term bonds my best bet? — and they’re also of great interest to economic policymakers and market analysts. The risk and term structures of interest rates are part of the tea leaves that policymakers and analysts consult to understand the economy and predict where it’s headed.

Two examples:

* October 1998: New York Fed Bank President William McDonough said the world economy faced its most serious crisis since the Second World War, and cited the high and rising risk spread as a major reason why.

* March 2006: Many financial analysts noted that short-, medium-, and long-term bond rates had an unusual flat yield curve pattern in which they were all about the same, and said that normally when this happens it means a recession is just around the corner. In a speech that month, Fed Chairman Ben Bernanke disagreed, saying that a flat yield curve (or an even more unusual inverted yield curve, in which short-term rates are higher than longer-term rates) was not necessarily bad news and could even reflect positive expectations of the future.

—- The rest of these notes should help to make sense of these examples.

II. RISK STRUCTURE OF INTEREST RATES

Once again: a risky asset will be in low demand, relative to less risky assets. The only way to induce people to hold a risky bond is to offer a higher interest rate than other bonds pay.

Treasury bonds are viewed as riskless assets, because the Treasury has never defaulted on its obligations to its bondholders. All corporate bonds, by contrast, carry at least some risk of default.

—> Corporate bond returns include a risk premium . defined as the extra interest that a risky asset must pay. relative to a riskless asset (Treasury bond).

—- RISK PREMIUM = i risky asset — i Treasury bond

—— The risk premium is also known as the risk spread.

—— (To be precise, since Treasury bonds are taxed differently than corporate bonds and municipal bonds, the risk premium on a bond is really the after-tax interest rate on that bond minus the after-tax interest rate on a Treasury bond of the same maturity.)

—— Ex. If T-bonds are paying 5% interest (after taxes) and high-grade corporate bonds are paying 8% interest (after taxes), then the risk premium on corporate bonds is 3% (=8%-5%).

Back to the opening example of why the high and rising risk spread of October 1998 was such a big deal to the New York Fed President: Such a high risk spread suggested that bond buyers had lost a lot of confidence in the creditworthiness of corporations and governments (other than the U.S. government). The high risk spread was due in large part to the Russian government’s default several weeks earlier on some of its debt, which had a ripple effect on the bond market and caused many people to be more leery of other bonds as well. This was bad news because if it continued, it could lead to a financial panic, with plunging demand for bonds and skyrocketing interest rates in many countries and for new corporate bonds. Higher interest rates on corporate bonds would cause fewer of them to be issued, thereby stunting corporate investment in new plant and equipment — if the interest-rate shock were severe enough, it could cause recessions in the USA and in much of the world.

The greater the risk, the higher the risk premium. The bonds with the highest risk premiums, and hence the highest interest rates, are JUNK BONDS. defined as bonds with a high risk of default. Two investment advisory firms, Moody’s and Standard & Poor’s, rate bonds according to their default risk .

— The highest ratings are Aaa (Moody’s) or AAA (Standard & Poor’s), for the bonds with the lowest default risk. They next-best rating is Aa or AA, then A, then Baa or BBB. Bonds with any of these ratings are called investment-grade bonds.

— Bonds with ratings below Baa or BBB are considered junk bonds. Even among junk bonds, there is some differentiation according to default risk.

—- Bonds in the next two ratings categories (Ba or BB, then B) are called noninvestment, or speculative grade, bonds.

—- Below those ratings are Caa or CCC, then Ca or C, then C. These are highly speculative bonds .

—- A rating of D refers to a bond that is already in default.

Bonus question (‘Come on and show me,’ say the bonds of old Bowie):

Q: From 1970-2004, risk premiums on bonds varied somewhat but averaged 100 basis points (1.0 percentage points) for corporate Aaa bonds and 200 basis points (2.0 percentage points) for corporate Baa bonds. Referring back to the David Bowie bonds example in the chapter 5 notes, what was the apparent Moody’s rating of the Bowie bonds?

A: Aaa, because the risk premium on the Bowie bonds was only 50 basis points.

III. AFTER-TAX INTEREST RATES

Most investment income is taxable, so taxes end up lowering your personal return on most assets. But not all investment income is taxed the same — for example, capital-gains income is taxed at a lower rate than interest income. In assessing the economically relevant return on any interest-bearing asset, we must consider how much of that interest gets taxed. Not all interest-bearing assets are taxed the same. Because the tax treatment of income from different assets affect the expected returns on those assets, the demand for a given asset is partly a function of how heavily (or lightly) the income from that asset is taxed.

The interest rate that matters most to personal investors is the REAL, AFTER-TAX INTEREST RATE. The notation:

i = interest rate

p e = inflation rate

t = marginal tax rate (proportion of an extra dollar of income that gets taxed)

real, after-tax interest rate = (i )(1-t ) — p e

The nominal after-tax interest rate = (i )(1-t ), and is also useful when comparing your return on alternative assets, especially since the expected inflation rate is the same regardless of what kind of assets you hold.

Current federal tax brackets are 0, 10, 15, 25, and 35% and rise as your income rises. Current state income tax brackets vary from 0% in some states to about 7% in New York to a bit more in some other states. (Local taxes are generally negligible or are built into the state tax rates.) Those marginal tax rates are considerably lower than they were, say, 25 or 50 years ago, but they’re still high enough to influence a lot of economic decision-making. In the case of bonds, the existence of certain loopholes in the tax code that exempt certain types of bonds from taxation does a lot to affect the demand for different types of bonds. In particular:

* The interest on municipal bonds (state and local bonds) is not taxed at all within their home state. They are exempt from federal tax, and exempt from the state tax in their home state.

* Interest on Treasury bonds is exempt from state and local taxes, though not from federal taxes. The same goes for other bond obligations of the federal government, such as GNMA (Government National Mortgage Association) bonds.

* Interest on corporate bonds and other private assets is taxable at Federal and state/local levels

The middle-class tax brackets (covering every dollar of income between about $25,000-$85,000 per year) are 25% for federal tax and 7% for New York tax, or 32% altogether. Thus, the tax rates (t) on different types of interest are:

* corporate-bond / bank-account interest: tcorporate = 32%

* Treasury-bond interest: tTreasury = 25%

* municipal-bond interest (in same state): tmunicipal = 0%

Ex. Imagine choosing between a corporate bond (i=6.3%), a Treasury bond (i=5.0%), and a New York bond (i=4.2%). Say

you’re in the 25% federal tax bracket and the 7% NY tax bracket. The after-tax interest rates are:

corporate: iafter-tax = (icorporate )(1-tcorporate ) = (6.3%)(1-.32) = (6.3%)(.68) = 4.28%

Treasury: iafter-tax = (iTreasury )(1-tTreasury ) = (5%)(1-.25) = (5%)(.75) = 3.75%

New York: iafter-tax = (iNY bond )(1-tNY bond ) = (4.2%)(1-0) = 4.20%

Note: The T-bond can get away with paying by far the lowest after-tax interest rate because (1) it has no default risk and (2) T-bonds are the most liquid, or resellable, bonds in the world. The corporate bond pays a slightly higher after-tax interest rate than the NY bond because it is a bit riskier.

Since bonds and other interest-bearing assets tend to be held by wealthy people in the top tax brackets, we should pay some attention to the top marginal tax rates as well. At the federal level, the top marginal tax rate is (in the process of being lowered to) 35%, for households earning over $300,000. At the state level, in New York, the middle- and upper-class marginal tax rate is the same, 7%. So, for people in the top tax bracket — any interest that is taxed at both levels (namely corporate bond interest and bank account interest) faces a 42% (35% + 7%) marginal tax rate; Treasury bond interest, which is taxed at the federal level only, is taxed at 35%; and, again, municipal bond interest is not taxed at all in the state in which the bond was issued. As a result, municipal bonds are even more attractive to very wealthy investors than to ordinary investors.

IV. TERM STRUCTURE OF INTEREST RATES

A. INTRODUCTION

The term structure of interest rates refers to the relation between the interest rates on short-term bonds versus those on medium- and long-term bonds.

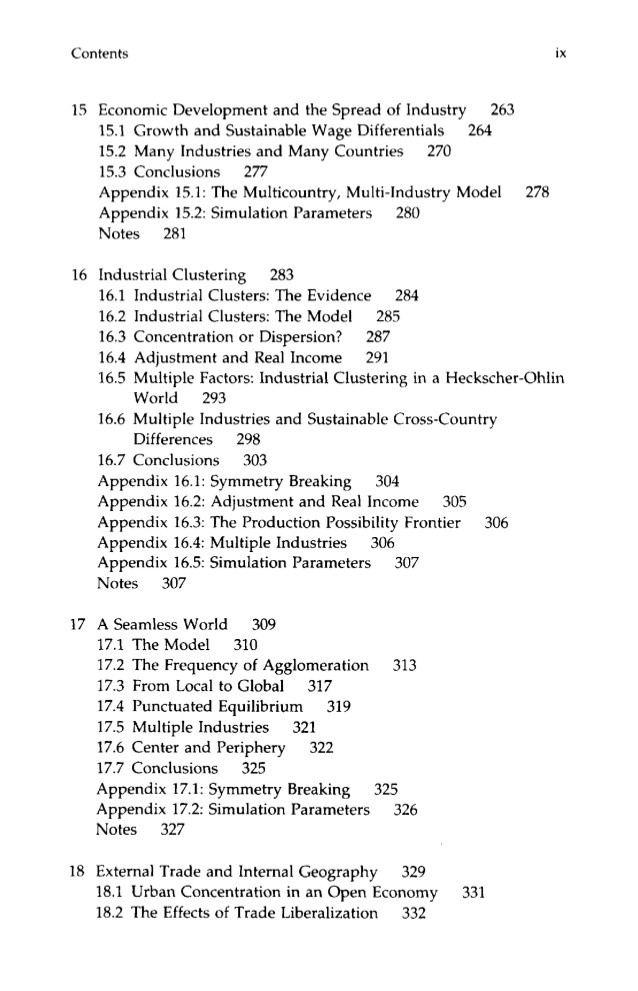

— [Refer to Figure 7.5 in Cecchetti’s textbook, page 161, The Term Structure of Treasury Interest Rates.]

—- We see that the short-term interest rates tend to be lower than medium- and long-term rates, but that they aren’t always. We also see that the short-, medium-, and long-term rates tend to move together over time — very low in the 1950s, rising in the 1960s and 1970s, and generally falling in the 1980s and 1990s.

The term structure of interest rates is important to anyone who’s thinking about buying bonds — should you buy short-term, medium-term, or long-term bonds? The interest rates on them are likely to be different, and a prospective bondholder should have some understanding of why. The term structure is also important to monetary policymakers, because business investment depends mainly on long-term interest rates, whereas the Fed has its most direct control over extreme short-term interest rates like the federal funds rate, which is an overnight lending rate.

YIELD CURVE: a graph of the yields on bonds with different maturity lengths. Since bonds typically have only a few standard maturity lengths (3 and 6 months; 1, 2, 3, 5, 10, and 30 years), to draw a yield curve we must plot the yields for the available maturity lengths and then connect the dots.

— The typical yield curve slopes upward, reflecting the usual pattern of longer-term bonds’ paying higher interest rates.

— The Wall St. Journal and numerous other sources present a yield curve everyday for Treasury bonds.

— [In class we saw numerous real-life yield curves, from YieldCurve.com and StockCharts.com. which also gives you the option of viewing animated presentations of the changes in the yield curve during the past several years. Notably, in the last few years we’ve seen yield curves of all different kinds— steep, almost flat, U-shaped, upward sloping, downward sloping.]

Three key patterns in the term structure of interest rates

(three basic facts about yield curves):

1. Interest rates on bonds of different maturities tend to move together over time. When short-term interest rates are high, medium- and long-term interest rates are usually high, too.

— Another way of putting this is to note that yield curves from different dates typically do not intersect each other — either all interest rates are higher, or all interest rates are lower.

2. (a) When short-term rates are (very) low, yield curves tend to have a (steep) upward slope;

(b) when short-term rates are very high, yield curves are more likely to slope downward (be inverted ).

— A classic case of an inverted yield curve was in the early 1980s, when Federal Reserve Chairman Paul Volcker (Alan Greenspan’s predecessor, at the helm of the Fed from 1979-87 ) declared a severe War on Inflation so as to break the back of the double-digit inflation that was harassing the U.S. economy in 1979-80. The Fed hiked short-term interest rates up to record-high levels, thus choking off credit and inducing a severe recession, but people eventually came to see that the Fed was serious about stopping inflation and came to expect lower inflation and lower short-term interest rates in the future. As a result, long-term interest rates were lower than short-term interest rates, because people expected short-term interest rates to fall over the lifetime of a long-term bond (see the Expectations Hypothesis, below, for an understanding of how that expectation would cause long-term interest rates to be lower).

3. Yield curves almost always slope upward. For whatever reason, people typically require a higher interest rate to induce them to hold longer-term bonds.

There are two leading explanations of these basic facts about the term structure of interest rates. i.e. of the relationship between interest rates on bonds of different maturity lengths.

* (1) simplest explanation:

the EXPECTATIONS HYPOTHESIS : the interest rate on a long-term bond equals the average of the short-term rates that people expect to occur over the life of the long-term bond.

— In other words, long-term rates are just a simple average of current and expected future short-term rates.

* (2) the LIQUIDITY-PREMIUM HYPOTHESIS: just like the expectations hypothesis, except that it posits that there is a positive term premium (or liquidity premium) for longer-term bonds (the longer the bond’s maturity length, the larger the liquidity premium).

— The terminology for this one is a bit confusing. A premium on a bond typically refers to a higher interest rate on the bond, such as the risk premium that junk bonds must pay. But, shorter-term bonds are more liquid (and hence more desirable) than long-term bonds, so according to this hypothesis they pay a lower interest rate. So the higher interest rate on longer-term bonds is more accurately an il liquidity premium. because you don’t get your money back as quickly. In plain English, we should call that extra interest rate on longer-term bonds a waiting premium.

B. THE EXPECTATIONS HYPOTHESIS (see above for definition)

Notation:

i n,t = interest rate on an n -year bond at time t (t = today; t+1 = a year from today)

i1,t + i e 1,t+1 + i e 1,t+2 +. + i e 1,t+(n-1)

Ex. If the interest rate on a brand-new one-year bond is 5% and people expect the one-year bond rate to rise to 6% next year, 7% the year after, 8% the year after that, and 9% the year after that, then:

* the interest rate on a 1-year bond sold today is already given; it’s 5%

* the interest rate on a 2-year bond sold today would be (5+6)%/ 2 = 5.5%

* the interest rate on a 3-year bond sold today would be (5+6+7)%/ 3 = 6%.

* the interest rate on a 4-year bond sold today would be (5+6+7+8)%/ 4 = 6.5%.

* the interest rate on a 5-year bond sold today would be (5+6+7+8+9)% / 5 = 7%

— [I drew the yield curve that would go along with these interest rates. Consult your notes for a copy. Note that the yield curve is less steep than a time plot of expected future short-term interest rates for each of the next five years would be.]

Ex. If the interest rate on a brand-new one-year bond is 5% and people expect the one-year bond rate to remain at 5% for all of the next five years, then the interest rates on two-, three-, four-, and five-year bonds will all be 5% as well. People will be indifferent between holding a five-year bond that pays 5% per year and holding a succession of five one-year bonds that pay 5% per year.

Strengths: Explains why —

(1) interest rates on bonds of different maturities tend to move together; and

(2) yield curves are steepest when the current short-term rate is exceptionally low, flattest or downward-sloping when the current short-term rate is exceptionally high.

Weakness: Since yield curves normally slope up, the expectations hypothesis implies that short-term interest rates are going up every year, which is not the case. In fact, the short-term interest rate is basically trendless, meaning that it may fluctuate over time, but has no long-term upward or downward trend. If you were to fit a line through a scatter plot of short-term interest rates over time, it would be flat, indicating no long-term trend.

So we need to look elsewhere for an explanation of empirical fact number (3), yield curves generally slope upward. Since short-term interest rates are not rising over time, then people’s willingness to hold short-term bonds that pay lower interest rates than longer-term bonds suggests that a majority of people simply prefer short-term bonds to long-term bonds. The likely reasons are greater liquidity (since you get your money back sooner) and lower interest-rate risk (since the resale price, or PDV, of a short-term bond is less affected by fluctuations in the market interest rate than is the resale price of a long-term bond).

C. THE LIQUIDITY-PREMIUM THEORY

The LIQUIDITY PREMIUM THEORY is just like the expectations hypothesis, except that it posits that there is a positive term premium (or liquidity premium) for longer-term bonds (the longer the bond’s maturity length, the less liquid it is and hence the larger the liquidity premium). The theory states that the interest rate on an n -term bond in year t will be:

i1,t + i e 1,t+1 + i e 1,t+2 +. + i e 1,t+(n-1)

(l n,t = term premium, or liquidity premium, for an n -year bond in year t (today);

i n,t = interest rate on an n -year bond issued in year t )

Ex. Suppose the current i on 1-year bonds is 4% and the expected interest rate on all one-year bonds to be issued in the next five years is also 4%. Suppose the liquidity premium is

l n,t = (0.1)(n -1) (%)

What will the interest rates on 1-, 2-, 3-, 4-, and 5-year bonds be, based on the liquidity-premium theory?

i1,t = 4% + (0.1)*(1-1) (%) = 4 + 0 (%) = 4%

i2,t = (4+4)/2 + (0.1)(2-1) (%) = 4 + 0.1 (%) = 4.1%

i3,t = (4+4+4)/3 + (0.1)(3-1) (%) = 4 + 0.2 (%) = 4.2%

i4,t =(4+4+4+4)/4 + (0.1)(4-1) (%) = 4 + 0.3 (%) = 4.3%

i5,t = (4+4+4+4+4)/5 + (0.1)(5-1) (%) = 4 + 0.4 (%) = 4.4%

Ex. (Same as the one in the previous section, but with a liquidity premium just like the one in the last problem.)

Suppose the interest rate on a brand-new one-year bond is 5% and people expect the one-year bond rate to rise to 6% next year, 7% the year after, 8% the year after that, and 9% the year after that.

Suppose also that the liquidity premium is

l n,t = (0.1)(n -1) (%)

What will the interest rates on 2-, 3-, 4-, and 5-year bonds be, based on the liquidity-premium theory?

i1,t = 5% + (0.1)*(1-1) (%) = 5 + 0 (%) = 5%

i2,t = (5+6)%/ 2 + (0.1)(2-1) (%) = 5.5 + 0.1 (%) = 5.6%

i3,t = (5+6+7)%/ 3 + (0.1)(3-1) (%) = 6 + 0.2 (%) = 6.2%.

i4,t = (5+6+7+8)%/ 4 + (0.1)(4-1) (%) = 6.5 + 0.3 (%) = 6.8%.

i5,t = (5+6+7+8+9)% / 5 + (0.1)(5-1) (%) = 7 + 0.4 (%) = 7.4%

In class we plotted the yield curve for these interest rates, on the same graph as the one for the earlier exercise with the same numbers but no term premium (i.e. when we applied the expectations hypothesis). Note that this yield curve is steeper, because the term premium adds some extra interest for longer-term bonds. (To be precise, it adds an extra 0.1 %-point of interest for every additional year of a bond’s length after the first year.)

The liquidity-premium theory seems to do the best job of any of the theories that attempt to explain the term structure of interest rates. It offers plausible explanations of all three of the basic facts about the term structure of interest rates. Empirical research has shown that the bond market is very sensitive to expectations of inflation and future interest rates and also very sensitive to liquidity.

Applications to recent events

In early 2006, the yield curve was basically flat (and sometimes inverted), which worried some investors. Because a yield curve is thought to be based on current and expected future short-term interest rates, investors often study yield curves to see what is likely to happen to interest rates in the future. An inverted yield curve means interest rates are expected to be lower in the future; a flat yield curve generally does, too (because the liquidity premium on longer-term bonds means that we’d normally expect long-term rates to be higher than short-term rates). So if interest rates are expected to be lower in the future, the question is why:

— Those worried investors are likely thinking that lower interest rates in the future would be the result of a recession in the future. A recession would tend to have that effect, as interest rates are procyclical (recall from earlier unit on bonds) — in a recession, companies invest less and supply fewer bonds, causing bond prices to rise and the interest rate to fall. Also, in a recession, the Fed normally takes steps to lower interest rates, often repeatedly.

— Fed Chairman Bernanke pointed out that lower interest rates in the future could have other causes, such as expectations of lower inflation. Recall the Fisher effect: If people expect lower inflation in the future, then the nominal interest rate should fall, too.

In early spring 2008 (April 11), the yield curve was upward-sloping and fairly steep with short-term Treasury securities (3- and 6-month T-bills) paying about 1.5% interest and 30-year Treasury bonds paying about 4.5% interest. The 30-year rate is not far from the norm, but short-term rates of 1.5% are unusually low. Thus the April 2008 yield curve is in line with pattern 2(a), noted above: When short-term interest rates are unusually low, yield curves tend to be steep. The higher-but-basically-normal long-term rate seems to reflect an expectation that short-term rates will return to more normal levels in the future.

— Why are short-term rates so low in April 2008? Probably because the Federal Reserve has cut the federal funds rate to very low levels (2.25% is the Fed’s target rate), and also because of a widely reported credit crunch in which banks and other lenders are reluctant to make loans to households and businesses. In a credit crunch, instead of making loans banks are likely to purchase very safe assets like Treasury bills.