Earn Dividends From Preferred StocksKiplinger

Post on: 1 Июль, 2015 No Comment

Yields are superb, but these investments are riskier and more complex than you may think.

By Jennifer Schonberger, April 2011

Does a 7.3% yield whet your income-starved appetite? That’s what the average preferred stock currently pays. Tempting, for sure. But don’t jump into these quirky securities before you understand their ins and outs.

Preferreds pay fixed dividends. That makes them similar to bonds, which usually pay a set amount of interest. When it comes to paying dividends, preferred investors get preference over holders of common stock. A firm must ax common-stock dividends before it tampers with preferred payouts. Preferred holders also get preference over common holders in the event a company liquidates, though bondholders get first dibs on the firm’s assets.

Preferreds generally yield more than a company’s common stock and sometimes yield more than the firm’s bonds. In addition, dividends from some preferred stocks are qualified, meaning that they are taxed at a top federal tax rate of 15%. (Nonqualified dividends are taxed at a maximum federal rate of 35%. It’s best to use nonqualified preferreds inside of tax-deferred accounts, such as IRAs.)

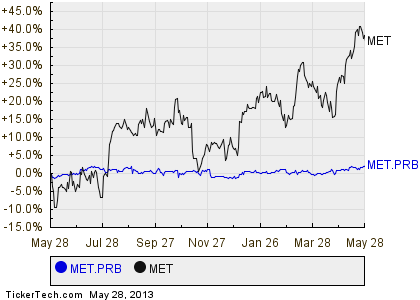

Preferreds are less risky than common stocks but offer less opportunity for appreciation. Ignore preferreds’ spectacular climb from March 2009 through March 2010. During that period, iShares S&P U.S. Preferred Stock Index (symbol PFF ), an exchange-traded fund that tracks an index of more than 220 issues, soared 181%. The surge followed an equally stunning flameout during the financial crisis.

Advertisement

A replay of the 2008-09 cataclysm isn’t likely anytime soon. The bigger risk to preferred values today is rising inflation and interest rates. Because preferreds pay fixed dividends, higher rates could force down preferred share prices. Preferreds really start to fall apart when inflation hits, says Ken Winans, president of Winans International, a Novato, Cal. investment firm.

Preferreds don’t have fixed maturity dates, but most may be redeemed by their issuers. Before buying a preferred, find out when it can be called and at what price. If the call price is below the current price, you could lose principal if the stock is redeemed. Note, too, that most preferred issuers are in the financial sector; more than 80% of the iShares ETF’s assets are in preferreds issued by financial firms.

Of the six preferreds listed in the table below, only one is issued by a financial company. Don’t be surprised by the so-so Standard & Poor’s quality ratings, which are at the low end of investment grade for five of the issues and in junk territory for Ford. The preferred rating is usually a level or two below a company’s bond rating.

In the end, the iShares ETF may be the best choice for most investors, even though it distributes a mix of qualified and nonqualified dividends. From its launch in March 2007 through February 11, it returned an annualized 1.9%, a figure that includes a 23.8% loss in 2008. Over the past year, the ETF gained 13.8%. The fund, which charges annual fees of 0.48%, yields 6.5%.