Duration and Convexity The Price

Post on: 16 Март, 2015 No Comment

searchfeed 20and%20convexity%201.gif /% Credit images Source Credit images Source

Related Post: Bond Convexity || Rate Of Return And Taxes Cost Of Capital Mcapm Cost || Falling Prices Of Downside Puts On The S P Shrinking Fund Size Of VIX || Yield Book Calculator || Personal Financial Advisor ||

admin 10 out of 10 based on 1000 ratings. 5 user reviews.

Duration and Convexity: The Price

An illustrated tutorial about how bond prices change with yield, using duration, convexity, and the price of a basis point. UVA-F-1238 -3- Exhibit 1 Macaulay Duration takes the present value of each payment and divides it by the total bond price, P. By doing this, one has a percentage, w Duration and Convexity: The Price/Yield Relationship. Investors who own fixed income securities should be aware of the relationship between interest rates and a bond. D is the bond’s duration; C is the periodic coupon payment; F is the face value at maturity (in dollars) T is the number of periods until maturity; r is the periodic. Bond Duration and Convexity Background If an investor is given a choice of two 10-year bonds to choose from, one with a 10 percent coupon rate and the other with a 5. This video illustrates how duration can be used to approximate the change in bond price given a change in interest rates. It also introduces and discusses. Convexity & Duration calculator for US Treasury Bills, Notes and Bonds. To demonstrate how Duration and Convexity are calculated for specific US Treasuries we select. §Calculation of convexity. Duration is a linear measure or 1st derivative of how the price of a bond changes in response to interest rate changes. One thought on “Duration & Convexity Calculation Example: Working with Convexity and Sensitivity” Pingback: ALM Posts Index | Learning Corporate Finance Gajek, Ostaszewski, and Zwiesler: Primer on Duration 61 2 Duration 2.1 Duration as Derivatives Durationisameasureofthesensitivityofafinancialassettochanges

Duration and Convexity: The Price

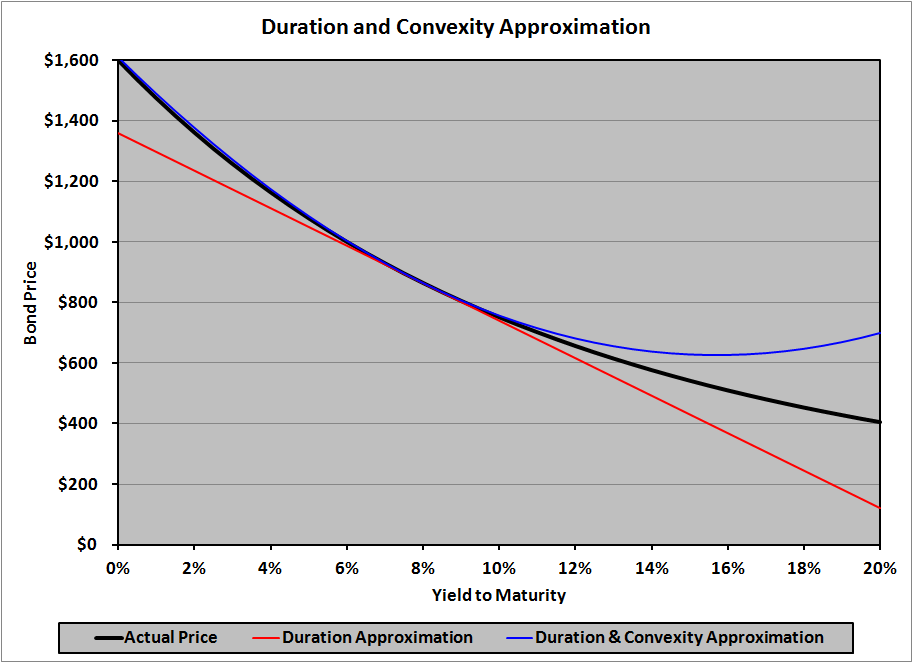

An illustrated tutorial about how bond prices change with yield, using duration, convexity, and the price of a basis point.

UVA-F-1238 -3- Exhibit 1 Macaulay Duration takes the present value of each payment and divides it by the total bond price, P. By doing this, one has a percentage, w

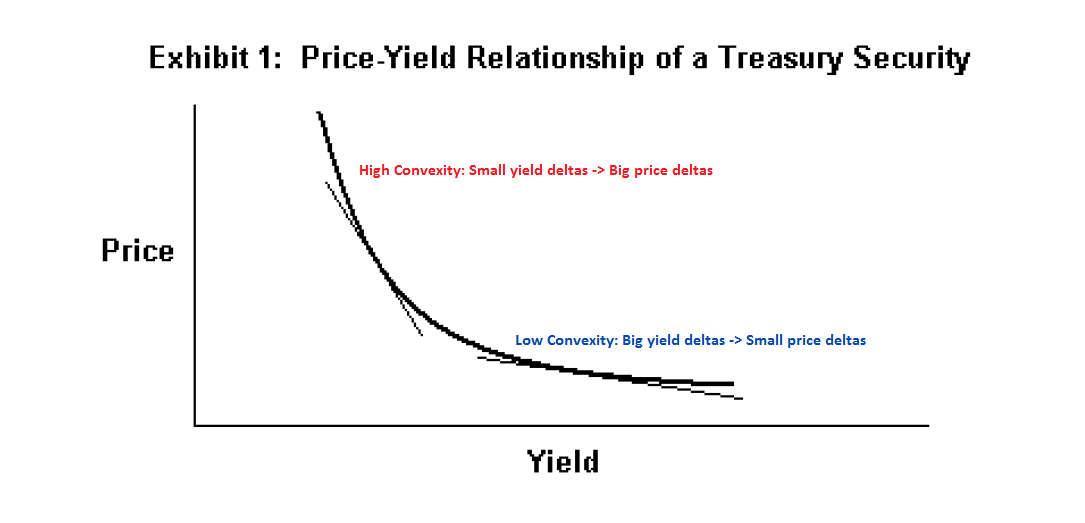

Duration and Convexity: The Price/Yield Relationship. Investors who own fixed income securities should be aware of the relationship between interest rates and a bond.

D is the bond’s duration; C is the periodic coupon payment; F is the face value at maturity (in dollars) T is the number of periods until maturity; r is the periodic.

Bond Duration and Convexity Background If an investor is given a choice of two 10-year bonds to choose from, one with a 10 percent coupon rate and the other with a 5.

This video illustrates how duration can be used to approximate the change in bond price given a change in interest rates. It also introduces and discusses.

Convexity & Duration calculator for US Treasury Bills, Notes and Bonds. To demonstrate how Duration and Convexity are calculated for specific US Treasuries we select.

§Calculation of convexity. Duration is a linear measure or 1st derivative of how the price of a bond changes in response to interest rate changes.

One thought on “Duration & Convexity Calculation Example: Working with Convexity and Sensitivity” Pingback: ALM Posts Index | Learning Corporate Finance

Gajek, Ostaszewski, and Zwiesler: Primer on Duration 61 2 Duration 2.1 Duration as Derivatives Durationisameasureofthesensitivityofafinancialassettochanges