Dual ExchangeRate Regime For China An Historical View China Real Time Report

Post on: 16 Март, 2015 No Comment

Hong Kong

Agence France-Presse/Getty Images

Is China going back to a dual exchange-rate system?

Thats the way its been looking of late with the renminbi trading at a discount in Hong Kong to the mainland rate.

The Hong Kong rate, of course, is the more market-driven one. Lately, investors have been selling off the yuan as part of a broad scramble into the relative safety of dollar assets.

Advertisement

The rate in Beijing is set by policy makers, not the market. Even as Chinese export growth tails off, the Peoples Bank of China continues to nudge the yuan higher, sending a message of support to the teetering global economy. A notable exception to the creeping appreciation came after the U.S. Senate last month advanced a bill to penalize countries that manipulate their currencies. China was ticked offand the yuan duly ticked down.

The gap between the two rates is hardly insignificant. On one day last month the yuan in Hong Kong traded at a discount of close to 3%. The differential is smaller at the moment: Late Thursday, the dollar traded at 6.3459 yuan onshore and 6.3685 yuan in Hong Kong.

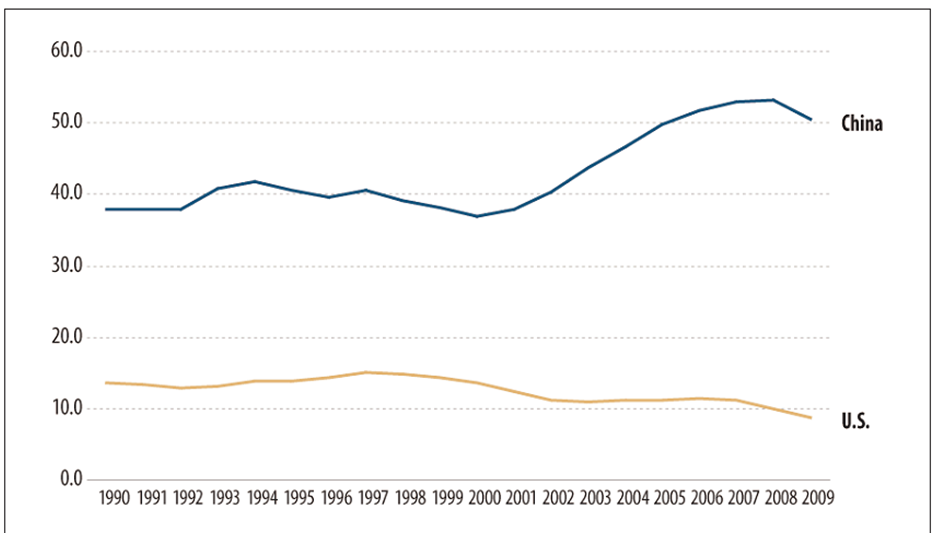

All this recalls the currency confusion of the 1980s and early 90s when China operated two distinctand highly divergentexchange rates.

There was an overvalued official rate and a market rate set by foreign and domestic businesses trading in currency swap centers. (There was also a black-market rate set by stall-holders in places where tourists congregated, like Beijings Bar Street in Sanlitun.)

Back then, there were also two types of Chinese currency. Foreigners werent allowed to own renminbi, literally the peoples money. So travelers were supposed to exchange their hard currency for Foreign Exchange Certificates at the Bank of China, and use them at designated tourist hotels and the famous state-run Friendship Stores that sold hard-to-find imported goods like 555 cigarettes and Johnnie Walker whiskey.

But the system started to break down as Chinas economy opened and private enterprise flourished. In 1994, China unified its two rates at the swap-market rate of 8.7 to the dollarmuch weaker than the official rate of 5.8 to the dollar. At the same time, China abolished the Foreign Exchange Certificates.

More In Currency

China now had one currency and one exchange rate. (The black market faded quickly). It was the most significant currency reform since Deng Xiaoping launched his economic modernizations in 1979.

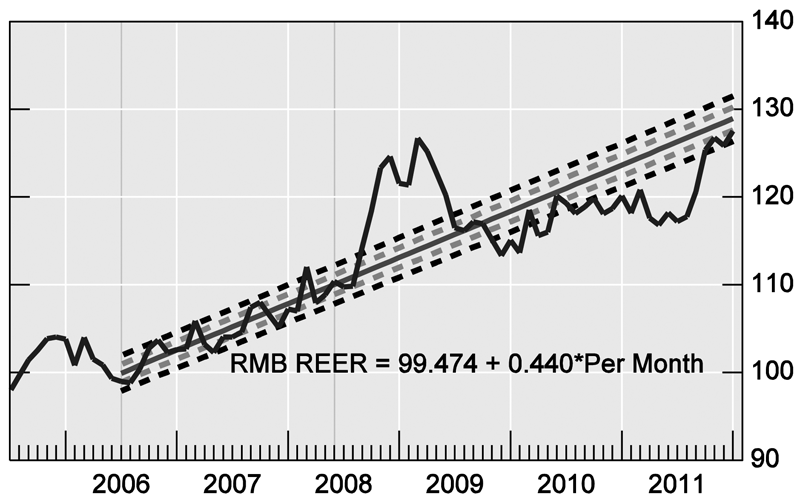

The decision to seek a role for the yuan as an international currency, taken at the height of the financial crisis in 2009, was similarly momentous. Some would argue its the most important reform to the exchange rate since the end of yuans dollar peg in 2005. It stands out for its boldness at a time when financial reform in China has largely stalled.

Among the newest generation of Chinese economic modernizers, many of them clustered around central bank Gov. Zhou Xiaochuan, the hope is that the internationalization of the Chinese currency will kick-start a broader reform process.

The reformers talk optimistically about a basically convertible currency by 2015, a move that implies market-driven interest rates, a truly commercial banking system, a deep bond market and a host of other innovations needed to underpin Chinas next stage of growth.

That is far from assured.

Indeed, the recent volatility of the offshore yuan might even be a reminder for Chinas leaders of the kind of problems they avoid by keeping the exchange rate for the onshore yuan under tight control.

As China prepares for a leadership transition next year, shifting currency policy will offer vital clues to how the reform effort plays out.

Reformists have no desire to see two exchange rates creating new confusion. For them the goal is clear: one currency; one exchange rate; full convertibility.

Andrew Browne

Sign up for CRT’s daily newsletter to get the latest headlines by email.